- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A031980

PSK HOLDINGS And 2 Other Undiscovered Gems In South Korea

Reviewed by Simply Wall St

The South Korean market has shown positive momentum, rising 1.1% over the past week and achieving a 4.9% increase over the last year, with earnings projected to grow by 30% annually. In this promising environment, identifying stocks with strong growth potential and solid fundamentals can be key to uncovering hidden opportunities like PSK HOLDINGS and two other lesser-known gems in South Korea.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

Overview: PSK HOLDINGS Inc. specializes in the production and sale of semiconductor manufacturing and flat panel display equipment on a global scale, with a market cap of ₩1.12 trillion.

Operations: The primary revenue stream for PSK HOLDINGS Inc. is its semiconductor manufacturing equipment segment, generating ₩132.98 billion.

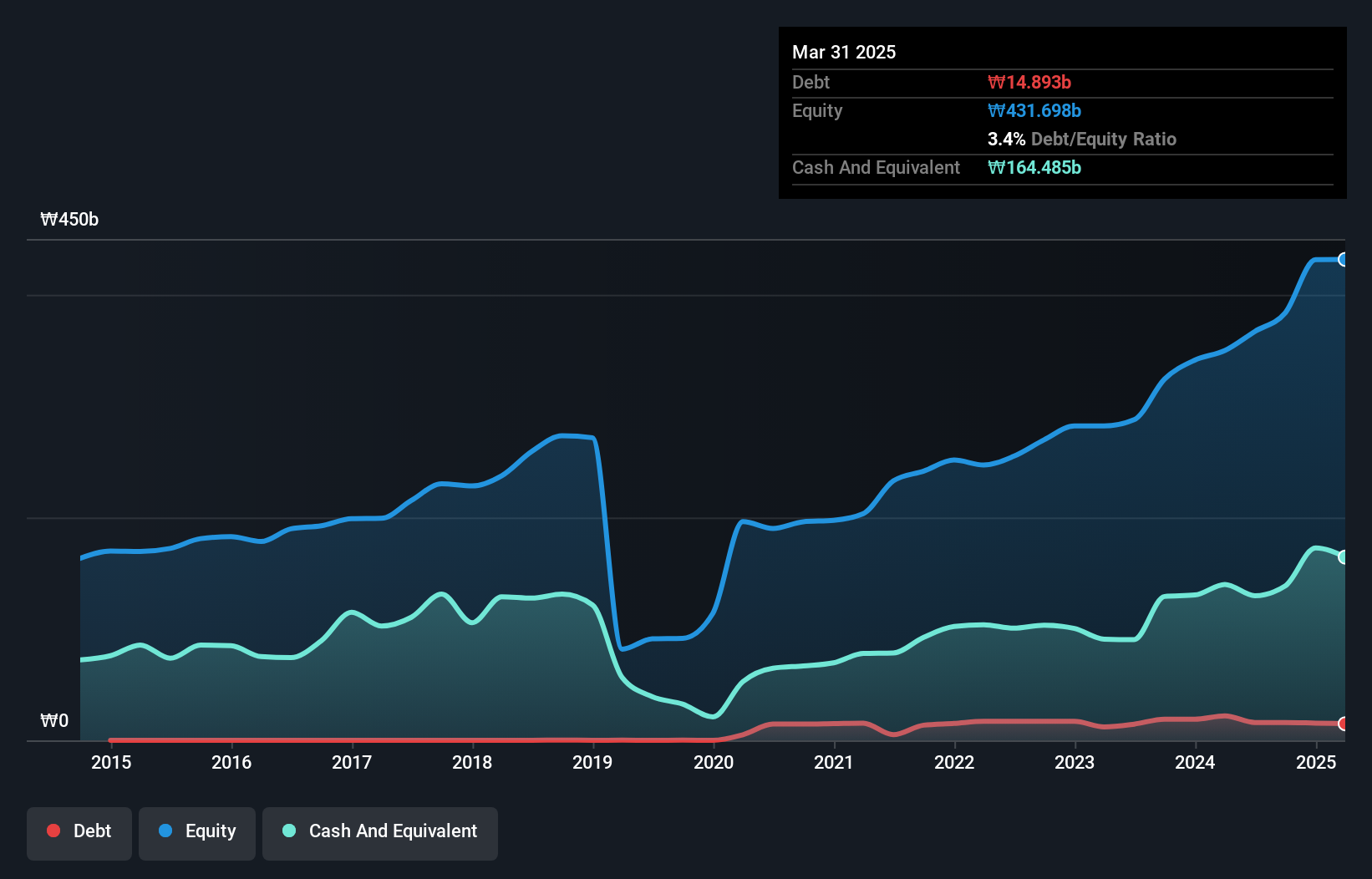

Despite its small size, PSK Holdings has shown impressive earnings growth of 40.8% over the past year, outpacing the semiconductor industry's -10%. The company has more cash than total debt, though its debt-to-equity ratio rose from 0% to 4.4% in five years. A notable one-off gain of ₩26.4 billion affected recent results. Recently added to the S&P Global BMI Index, it forecasts a steady annual earnings growth rate of 20.74%.

- Click here to discover the nuances of PSK HOLDINGS with our detailed analytical health report.

Gain insights into PSK HOLDINGS' past trends and performance with our Past report.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. is a South Korean company specializing in the manufacturing and sale of machinery and heat combustion equipment, with a market cap of ₩1.24 trillion.

Operations: Kyung Dong Navien generates revenue primarily from its air conditioning manufacturing and sale segment, which reported ₩1.29 billion.

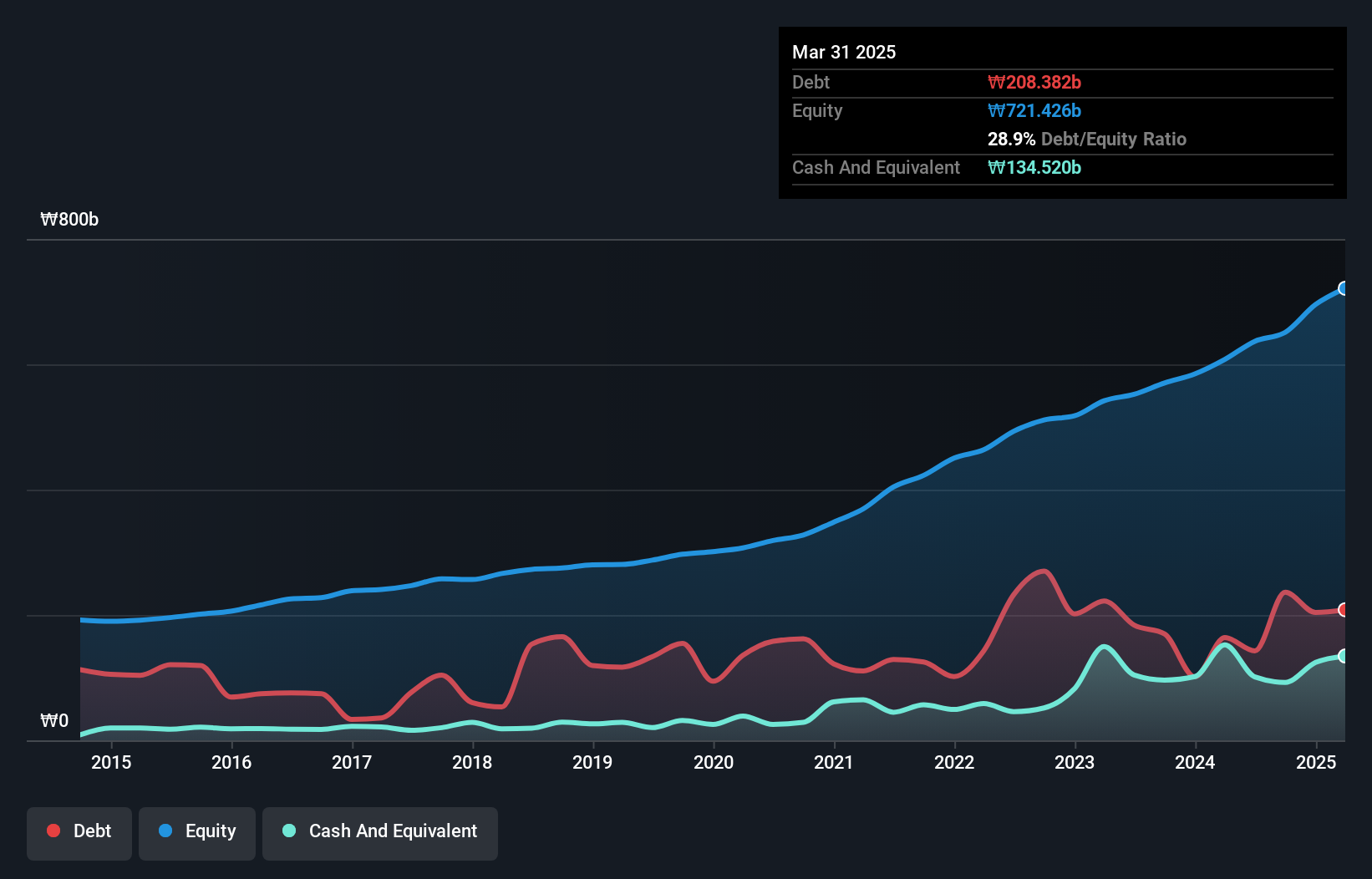

Kyung Dong Navien's performance paints a promising picture with earnings growth of 85.5% over the past year, outpacing the building industry average of 28.5%. The company's net debt to equity ratio stands at a satisfactory 6.5%, reflecting prudent financial management as it has decreased from 46.4% to 22.4% over five years. Additionally, its free cash flow is positive, and interest payments are well-covered by EBIT at a robust multiple of 27x, indicating strong operational efficiency and financial health in this small-cap space.

- Delve into the full analysis health report here for a deeper understanding of Kyung Dong Navien.

Assess Kyung Dong Navien's past performance with our detailed historical performance reports.

KCTech (KOSE:A281820)

Simply Wall St Value Rating: ★★★★★★

Overview: KCTech Co., Ltd. is a South Korean company that manufactures and distributes semiconductor systems, display systems, and electronic materials, with a market cap of ₩812.56 billion.

Operations: KCTech Co., Ltd. generates revenue primarily through its semiconductor systems, display systems, and electronic materials segments. The company has a market capitalization of approximately ₩812.56 billion.

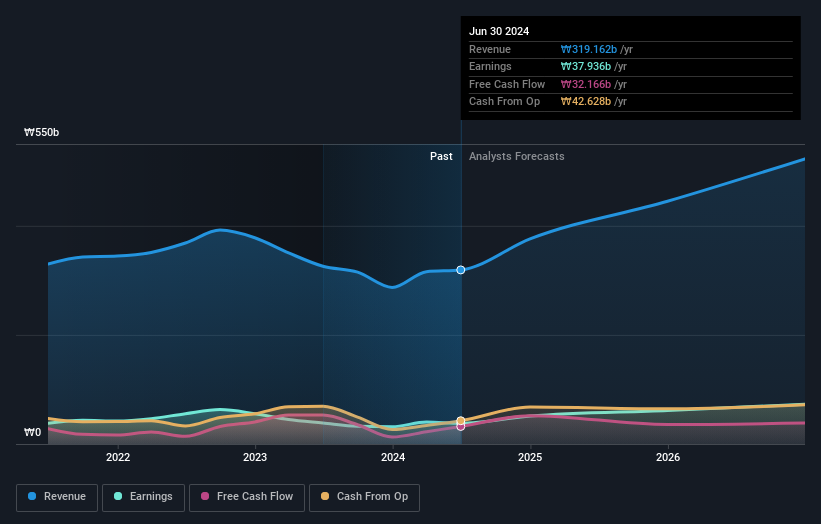

KCTech, a nimble player in the semiconductor sector, is debt-free and boasts high-quality earnings. Despite a recent negative earnings growth of 1.5%, it outpaces the industry average of 10%. The company has reported positive free cash flow over the past five years, with figures reaching KRW 32.17 million as of June 2024. Additionally, KCTech announced share repurchase programs totaling KRW 10 billion to enhance shareholder value and stabilize its volatile stock price.

- Get an in-depth perspective on KCTech's performance by reading our health report here.

Explore historical data to track KCTech's performance over time in our Past section.

Summing It All Up

- Take a closer look at our KRX Undiscovered Gems With Strong Fundamentals list of 188 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A031980

PSK HOLDINGS

Manufactures and sells semiconductor manufacturing and flat panel display equipment worldwide.

Excellent balance sheet with proven track record.