- South Korea

- /

- Food

- /

- KOSE:A006040

Exploring PSK HOLDINGS And Two Emerging Small Caps In South Korea

Reviewed by Simply Wall St

The South Korean market has shown a steady performance, remaining flat over the last week and rising by 4.1% over the past year, with earnings anticipated to grow significantly in the coming years. In this context, identifying promising stocks like PSK HOLDINGS and other emerging small caps can offer potential opportunities for investors seeking growth amidst stable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

Overview: PSK HOLDINGS Inc. is engaged in the global manufacturing and sale of semiconductor and flat panel display equipment, with a market cap of ₩1.14 trillion.

Operations: PSK HOLDINGS derives its revenue primarily from the sale of semiconductor manufacturing equipment, generating ₩132.98 billion.

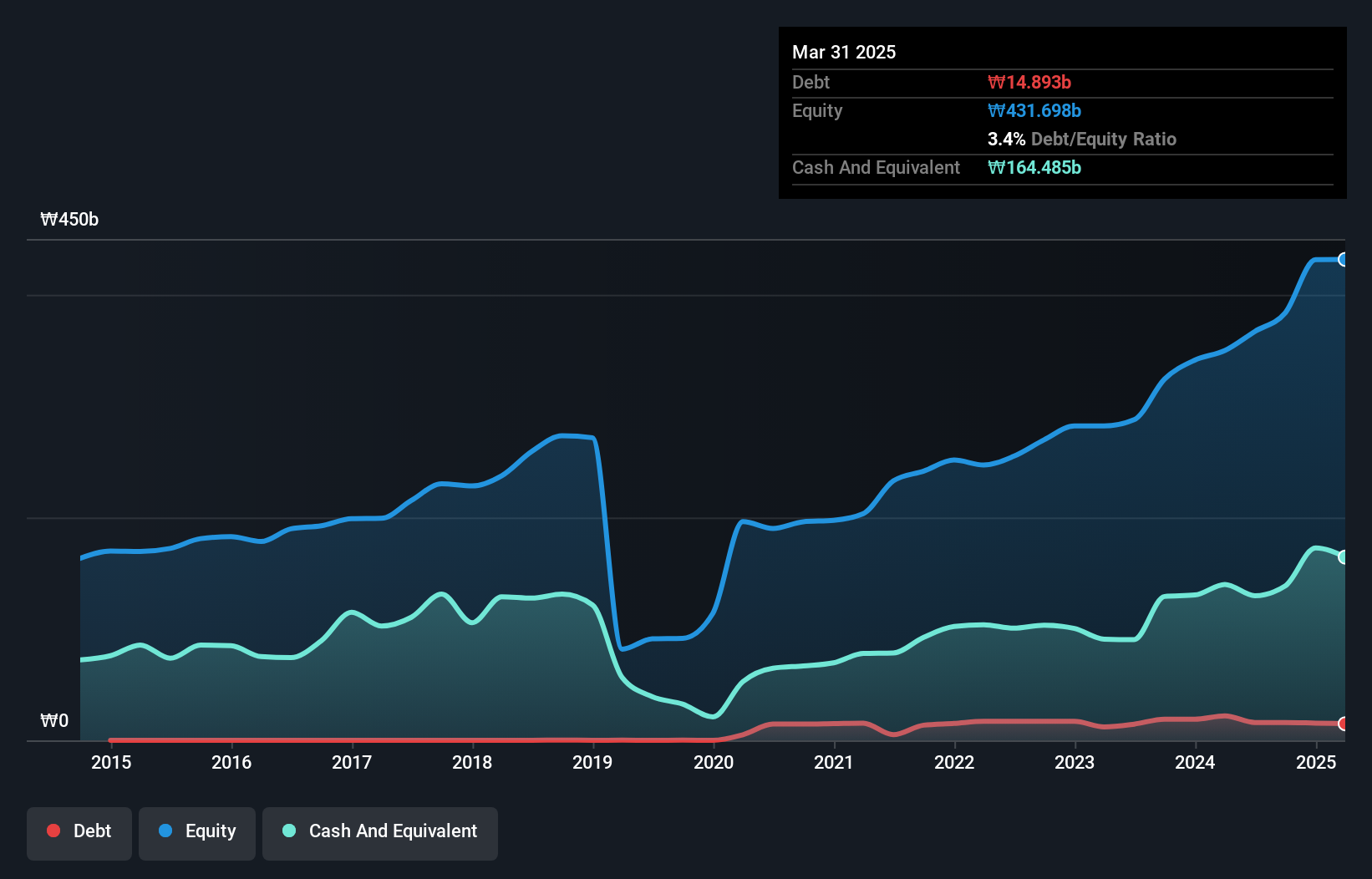

PSK Holdings, a small player in the semiconductor industry, has shown impressive earnings growth of 40.8% over the past year, outpacing the industry's -10%. The company is financially sound with a debt-to-equity ratio that increased to 4.4% over five years and more cash than total debt. Despite a volatile share price recently, its inclusion in the S&P Global BMI Index suggests growing recognition. A notable ₩26 billion one-off gain impacted recent financials, highlighting potential for future stability.

- Unlock comprehensive insights into our analysis of PSK HOLDINGS stock in this health report.

Understand PSK HOLDINGS' track record by examining our Past report.

Dongwon Industries (KOSE:A006040)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dongwon Industries Co., Ltd. operates in the marine and fisheries, distribution, and logistics sectors both within South Korea and internationally, with a market capitalization of ₩1.24 trillion.

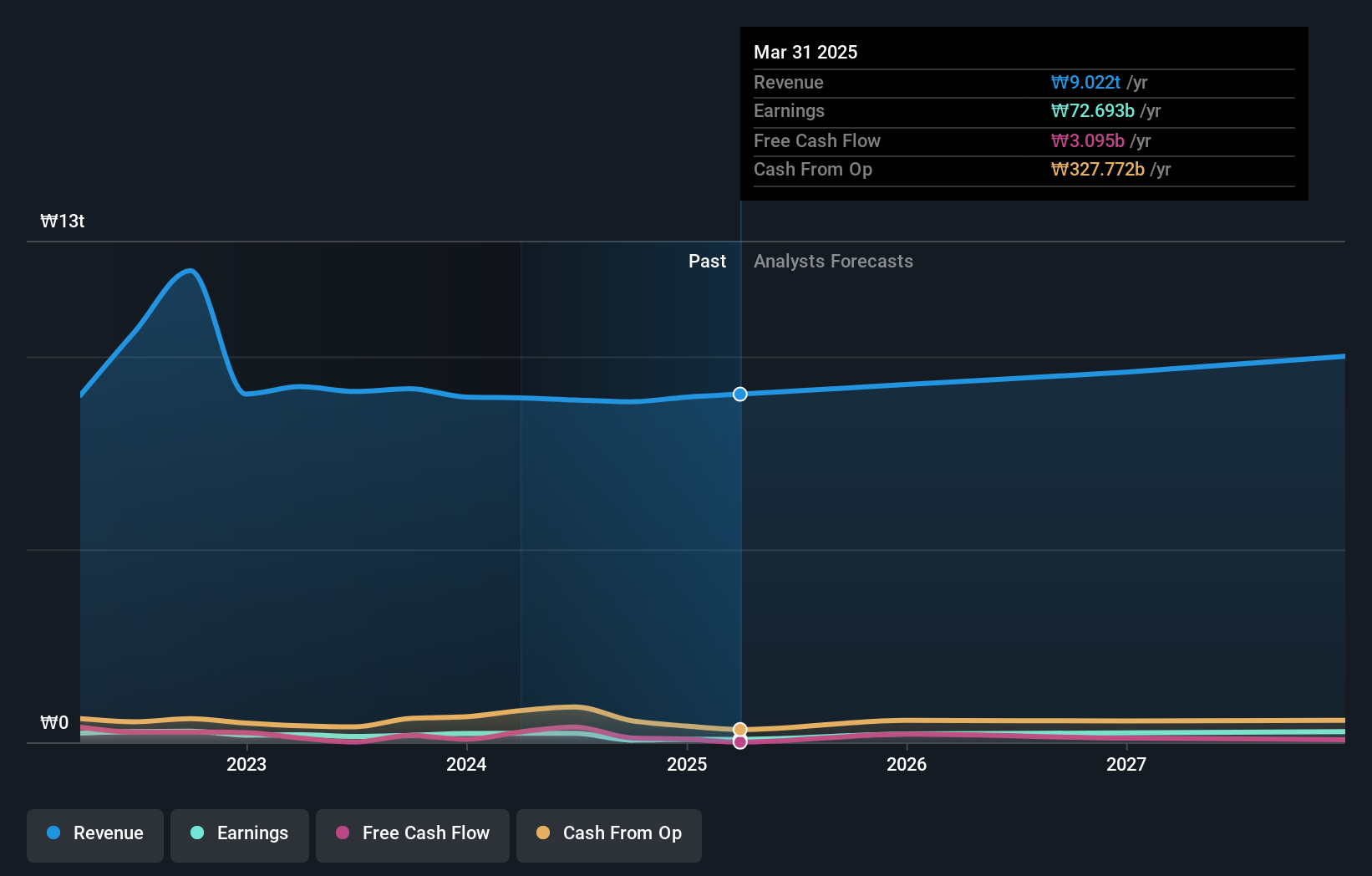

Operations: Dongwon Industries generates revenue primarily from its food processing and distribution sector, which accounts for ₩6.49 trillion, followed by the logistics business at ₩1.41 trillion. The company also has significant contributions from its packaging material sector with ₩1.31 trillion in revenue and the fisheries business sector at ₩690.42 billion.

Dongwon Industries, a promising player with a market cap under the radar, has seen its debt to equity ratio improve from 119.5% to 75.8% over five years, indicating better financial health. The company's earnings surged by 51.7% in the past year, outpacing the food industry average of 23.2%. Trading at a discount of 35.9% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in South Korea's dynamic market landscape.

- Click here to discover the nuances of Dongwon Industries with our detailed analytical health report.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. is a South Korean company specializing in the manufacturing and sale of machinery and heat combustion equipment, with a market capitalization of ₩1.28 trillion.

Operations: Kyung Dong Navien generates revenue primarily from the air conditioning manufacturing and sale segment, amounting to approximately ₩1.29 billion.

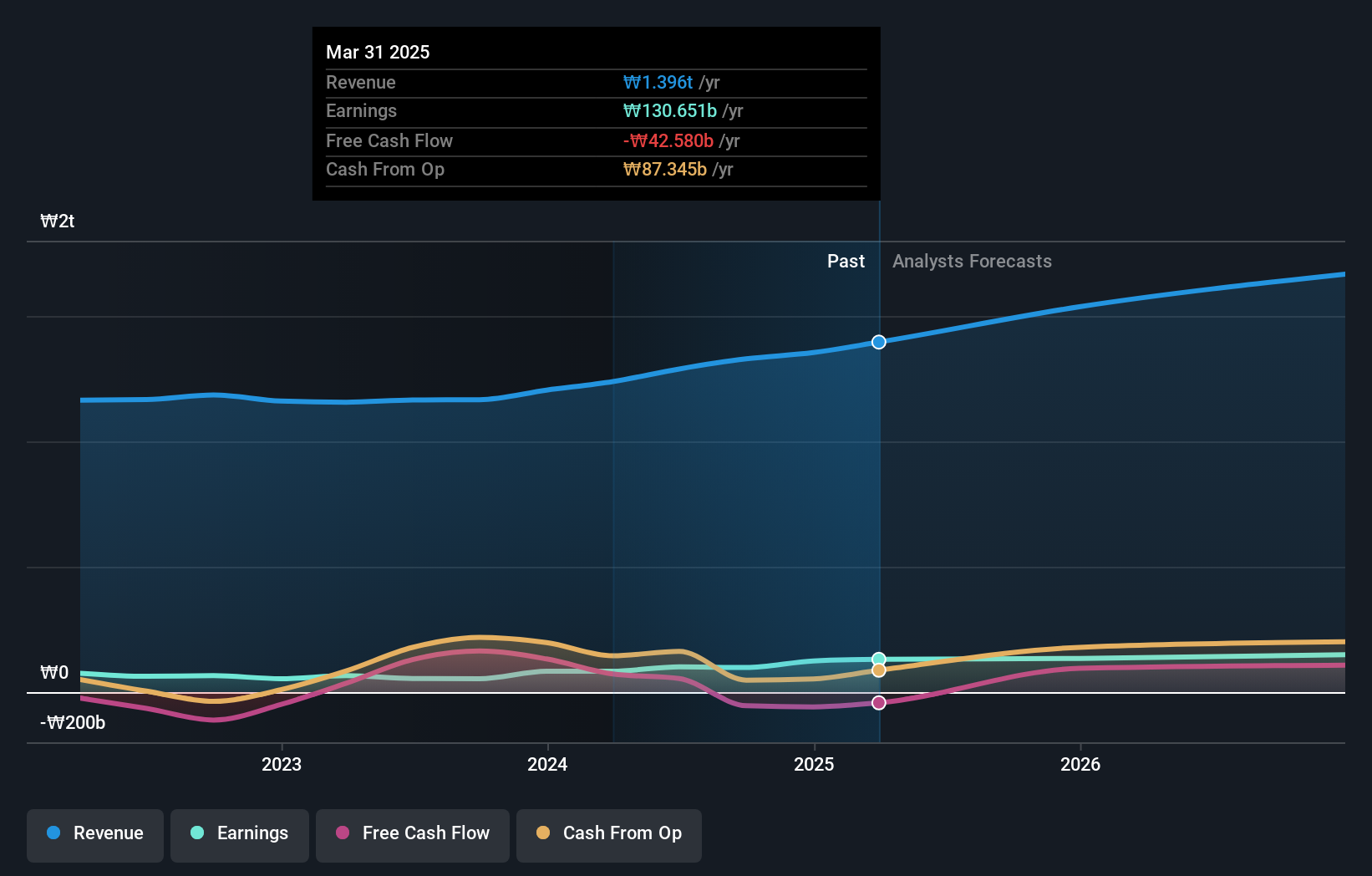

With its earnings surging 85.5% last year, Kyung Dong Navien is making waves in the building industry, outpacing the sector's 28.5% growth. This company boasts high-quality earnings and a positive free cash flow position, adding to its appeal. Over five years, it has slashed its debt-to-equity ratio from 46.4% to 22.4%, showing financial prudence. Interest payments are comfortably covered by EBIT at 27 times over, reflecting robust fiscal health and management efficiency in handling liabilities.

- Get an in-depth perspective on Kyung Dong Navien's performance by reading our health report here.

Examine Kyung Dong Navien's past performance report to understand how it has performed in the past.

Where To Now?

- Click this link to deep-dive into the 188 companies within our KRX Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A006040

Dongwon Industries

Engages in the marine and fisheries, distribution, and logistics businesses in South Korea and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives