- South Korea

- /

- Machinery

- /

- KOSDAQ:A137400

Exploring PSK HOLDINGS And 2 Other Undiscovered Gems In South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 3.8%, driven by gains of 6.0% in the Information Technology sector, and is up 5.8% over the last 12 months with earnings forecast to grow by 29% annually. In this promising environment, identifying strong stocks like PSK HOLDINGS and two other undiscovered gems could offer significant potential for investors looking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| SELVAS Healthcare | 13.50% | 9.36% | 71.59% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| THINKWARE | 36.75% | 21.25% | 22.92% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

Overview: PSK HOLDINGS Inc. manufactures and sells semiconductor manufacturing and flat panel display equipment worldwide, with a market cap of ₩984.32 billion.

Operations: PSK HOLDINGS Inc. generates revenue primarily from its semiconductor manufacturing equipment segment, which reported ₩132.98 billion in sales.

PSK Holdings, a semiconductor player, has seen earnings grow by 40.8% over the past year, outpacing the industry’s -10%. A notable one-off gain of ₩26.4B boosted recent financial results. The company's debt to equity ratio increased from 0% to 4.4% in five years, yet it holds more cash than total debt. Recently added to the S&P Global BMI Index, PSK seems poised for continued growth with earnings forecasted to rise by 20.74% annually.

- Get an in-depth perspective on PSK HOLDINGS' performance by reading our health report here.

Gain insights into PSK HOLDINGS' past trends and performance with our Past report.

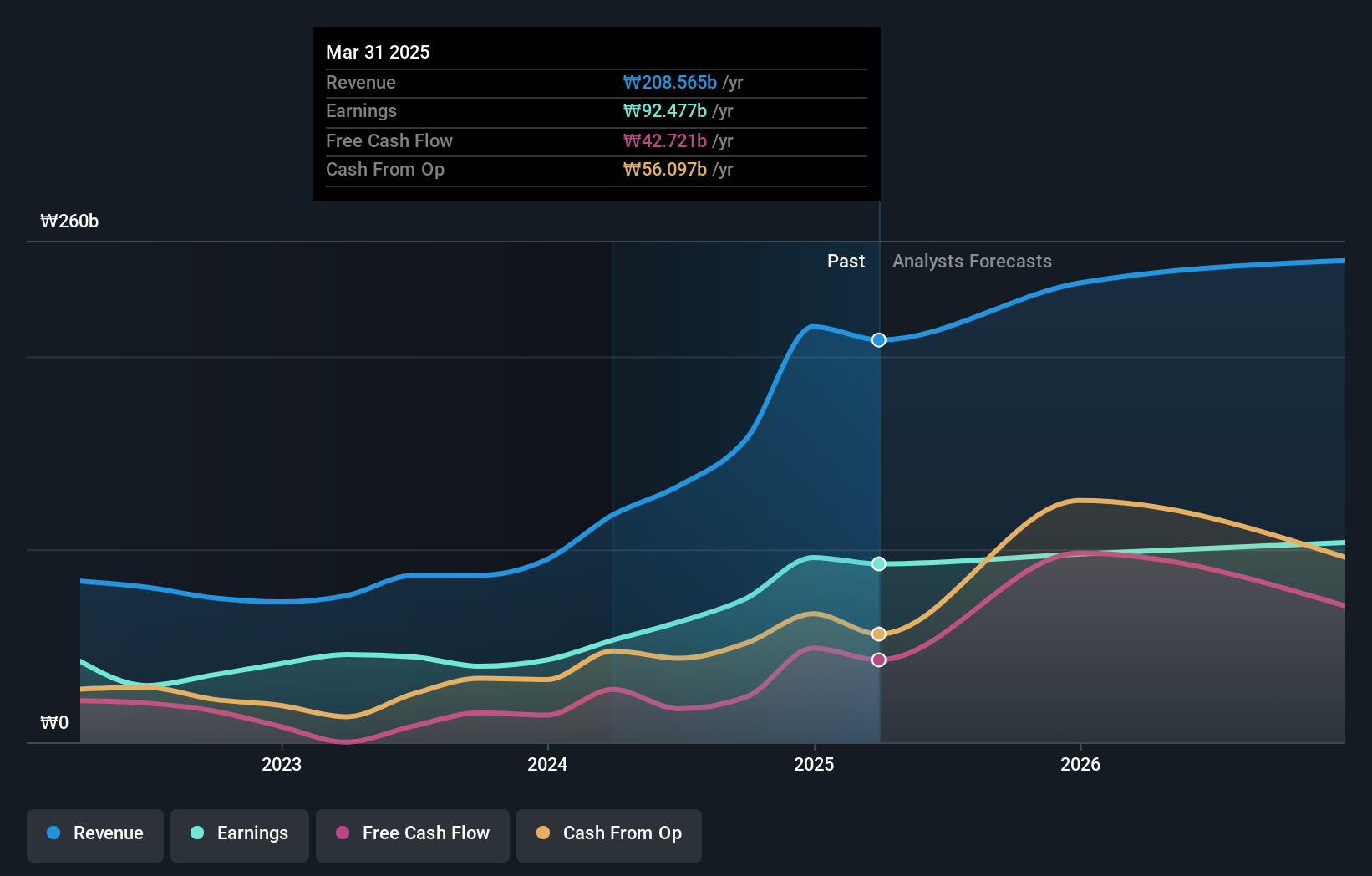

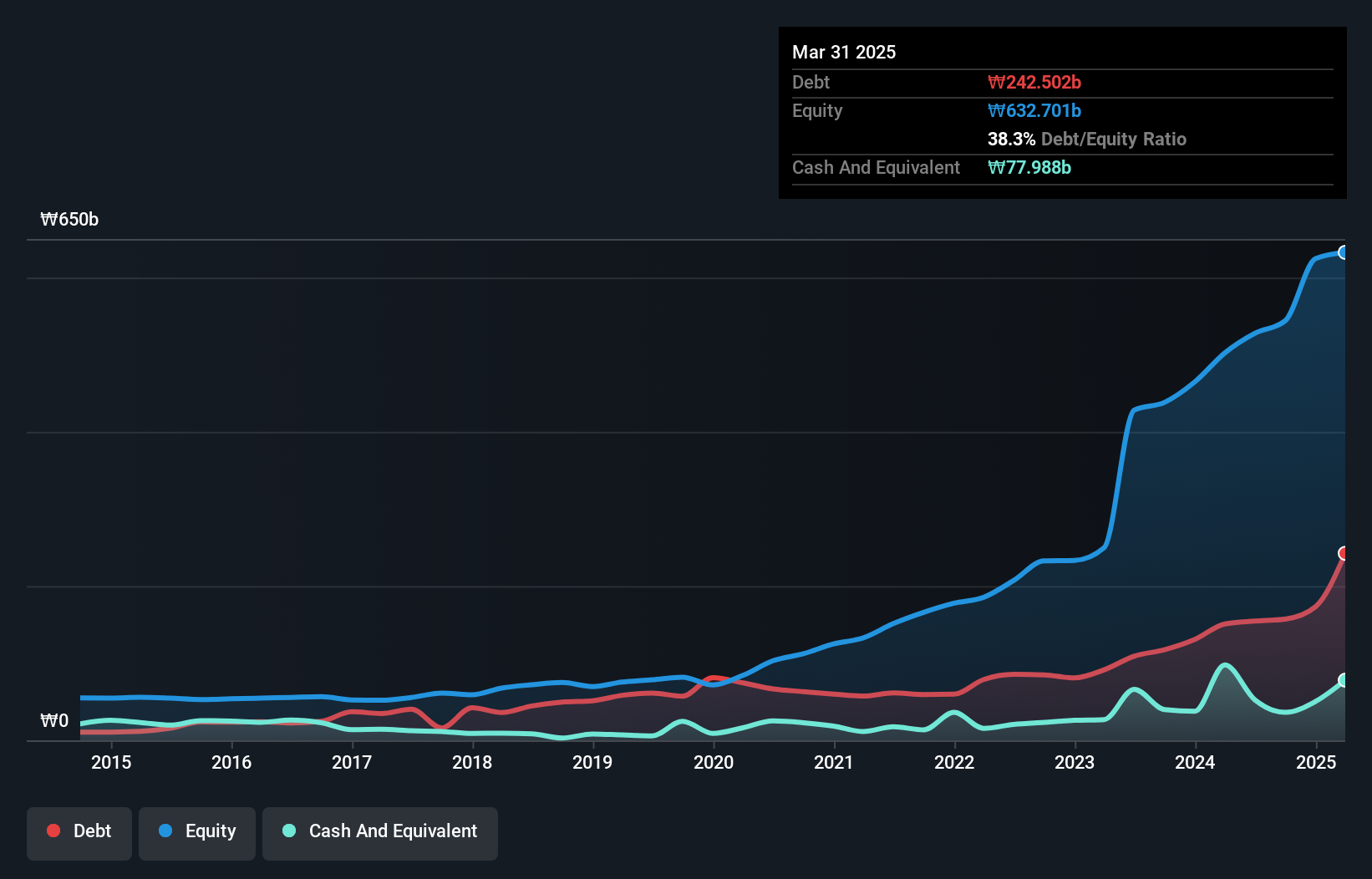

People & Technology (KOSDAQ:A137400)

Simply Wall St Value Rating: ★★★★★★

Overview: People & Technology Inc. specializes in providing coating, calendaring, slitting, automation, and other machineries with a market cap of ₩1.34 billion.

Operations: People & Technology Inc. generates revenue primarily from its Machinery & Industrial Equipment segment, amounting to ₩792.60 billion.

People & Technology, a small cap firm in South Korea, has shown impressive financial metrics. Its net debt to equity ratio stands at 19.4%, which is satisfactory and indicates prudent financial management. Over the past year, earnings growth hit 50.9%, outpacing the Machinery industry’s 5.4%. Notably, the company repurchased shares in 2024, signaling confidence from within. Trading at 55.5% below estimated fair value further underscores its potential as an undervalued investment opportunity.

- Delve into the full analysis health report here for a deeper understanding of People & Technology.

Understand People & Technology's track record by examining our Past report.

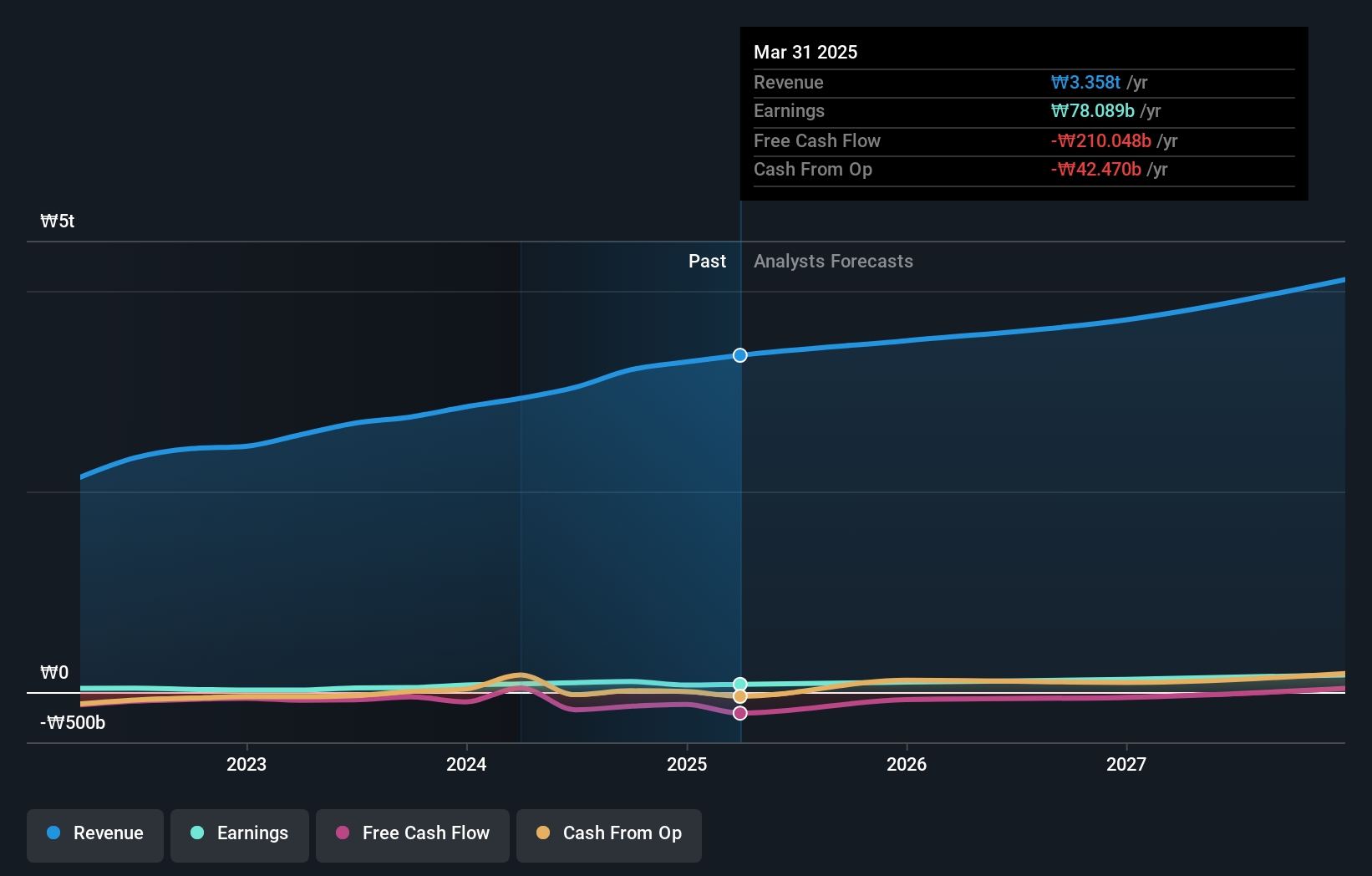

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taihan Cable & Solution Co., Ltd. manufactures, processes, and sells electric wires, cables, and related products worldwide with a market cap of ₩2.30 trillion.

Operations: Taihan Cable & Solution generates revenue primarily from its wire segment, amounting to ₩3.42 billion. The company also incurs sales between divisions, which subtracts ₩380.13 million from the total revenue.

Taihan Cable & Solution has shown impressive financial health, with its debt to equity ratio dropping from 203.6% to 30.2% over the past five years and earnings growth of 127% in the last year. The company reported a net income of ₩24.88 billion for Q2 2024, up from ₩12.82 billion a year ago, despite sales decreasing to ₩8.82 billion from ₩9.75 billion in the same period. Basic earnings per share also rose to ₩134 from ₩104 year-over-year, indicating robust profitability amidst fluctuating sales figures.

Make It Happen

- Explore the 194 names from our KRX Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A137400

People & Technology

Offers coating, calendaring, slitting, automation, and other machineries.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)