- South Korea

- /

- Specialty Stores

- /

- KOSE:A284740

Here's Why I Think CUCKOO Homesys (KRX:284740) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in CUCKOO Homesys (KRX:284740). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for CUCKOO Homesys

How Fast Is CUCKOO Homesys Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a wedge-tailed eagle on the wind, CUCKOO Homesys's EPS soared from ₩2,261 to ₩3,428, in just one year. That's a commendable gain of 52%.

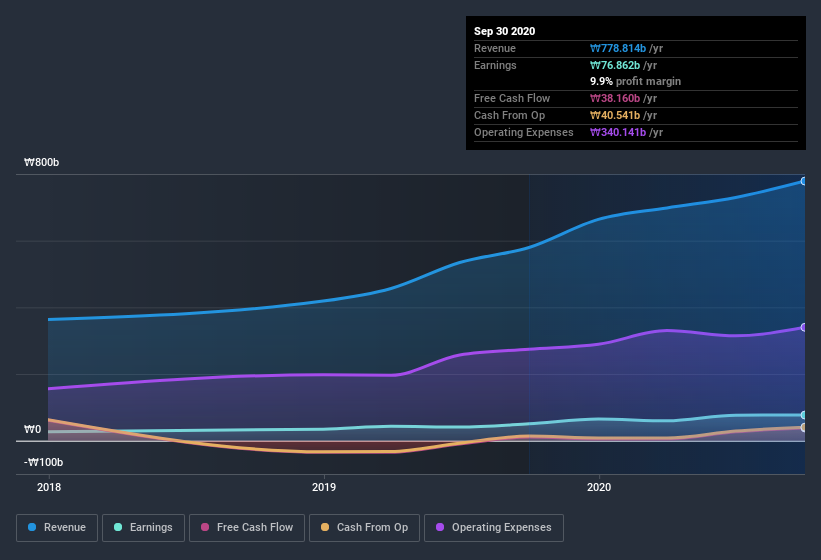

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note CUCKOO Homesys's EBIT margins were flat over the last year, revenue grew by a solid 34% to ₩779b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for CUCKOO Homesys.

Are CUCKOO Homesys Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that CUCKOO Homesys insiders have a significant amount of capital invested in the stock. Notably, they have an enormous stake in the company, worth ₩303b. Coming in at 33% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Should You Add CUCKOO Homesys To Your Watchlist?

You can't deny that CUCKOO Homesys has grown its earnings per share at a very impressive rate. That's attractive. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. What about risks? Every company has them, and we've spotted 1 warning sign for CUCKOO Homesys you should know about.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade CUCKOO Homesys, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A284740

CUCKOO Homesys

Engages in the manufacture, sale, and rental of home appliances.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026