- South Korea

- /

- Entertainment

- /

- KOSDAQ:A041510

3 Stocks Estimated To Be Trading Below Their Intrinsic Value By Up To 48.7%

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with central banks adjusting rates and major indices showing varied performances, investors are increasingly on the lookout for opportunities. In such an environment, identifying stocks trading below their intrinsic value can be a strategic move, as these may offer potential upside once market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | US$26.67 | US$53.13 | 49.8% |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.59 | CN¥19.09 | 49.8% |

| technotrans (XTRA:TTR1) | €15.40 | €30.59 | 49.7% |

| Xiamen Bank (SHSE:601187) | CN¥5.70 | CN¥11.35 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| Hanwha Systems (KOSE:A272210) | ₩20900.00 | ₩41661.29 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP291.30 | CLP579.37 | 49.7% |

| Constellium (NYSE:CSTM) | US$10.91 | US$21.69 | 49.7% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.28 | 49.9% |

| FINEOS Corporation Holdings (ASX:FCL) | A$1.91 | A$3.82 | 49.9% |

Let's review some notable picks from our screened stocks.

Fiskars Oyj Abp (HLSE:FSKRS)

Overview: Fiskars Oyj Abp manufactures and markets consumer products for indoor and outdoor living across Europe, the Americas, and the Asia Pacific, with a market cap of €1.16 billion.

Operations: The company's revenue segments include Vita at €609.50 million and Fiskars at €551.50 million.

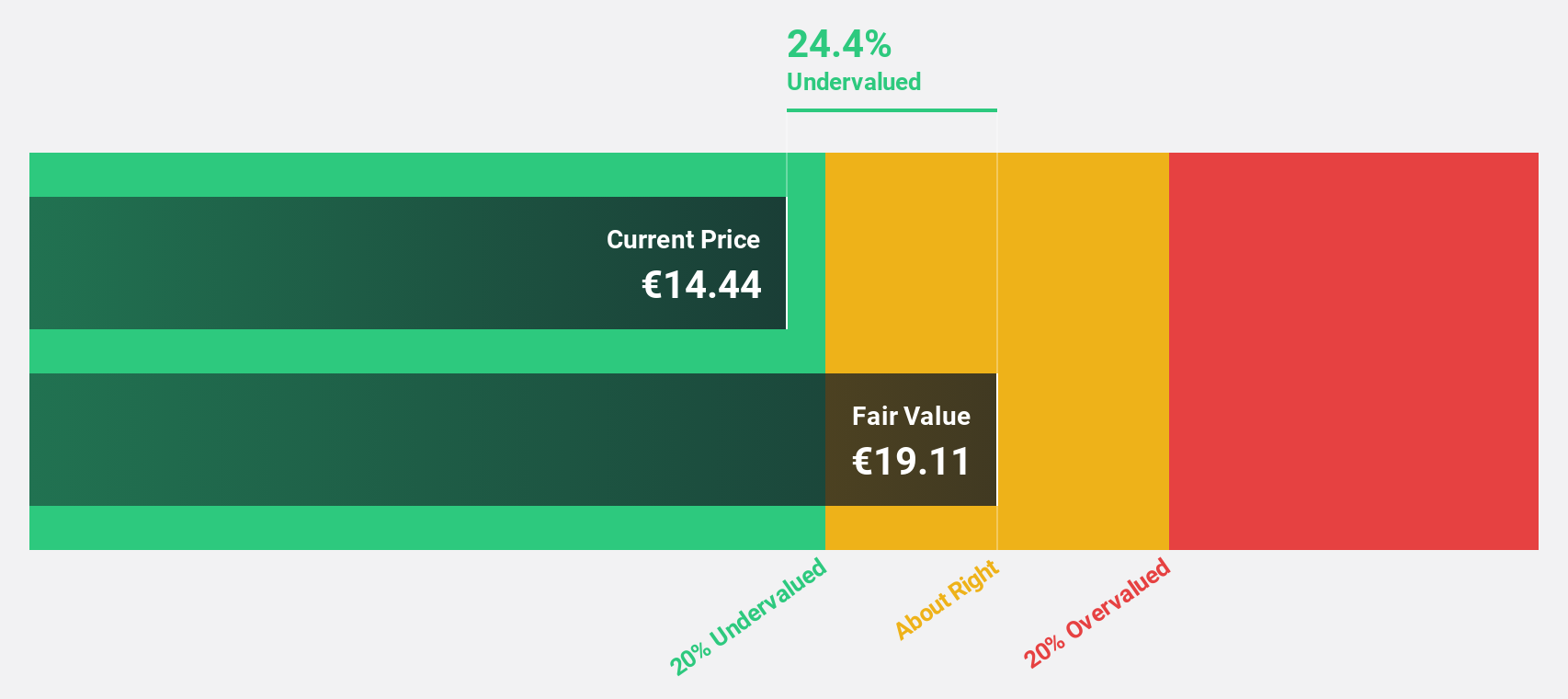

Estimated Discount To Fair Value: 22.4%

Fiskars Oyj Abp is trading at €14.32, significantly below its estimated fair value of €18.44, suggesting potential undervaluation based on cash flows. Despite a challenging financial position with interest payments not well covered by earnings and a dividend yield of 5.73% that is unsustainable, the company forecasts robust annual earnings growth of 82.7%. Recent strategic initiatives include share repurchases and restructuring into two independent entities to enhance operational efficiency.

- Upon reviewing our latest growth report, Fiskars Oyj Abp's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Fiskars Oyj Abp's balance sheet health report.

SM Entertainment (KOSDAQ:A041510)

Overview: SM Entertainment Co., Ltd. operates in music and sound production, talent management, and music/audio content publication both in South Korea and internationally, with a market cap of ₩1.74 trillion.

Operations: The company's revenue is primarily derived from its Entertainment segment, excluding advertising agency activities, which accounts for ₩871.42 billion, alongside an additional ₩80.94 million from its Advertising Agency segment.

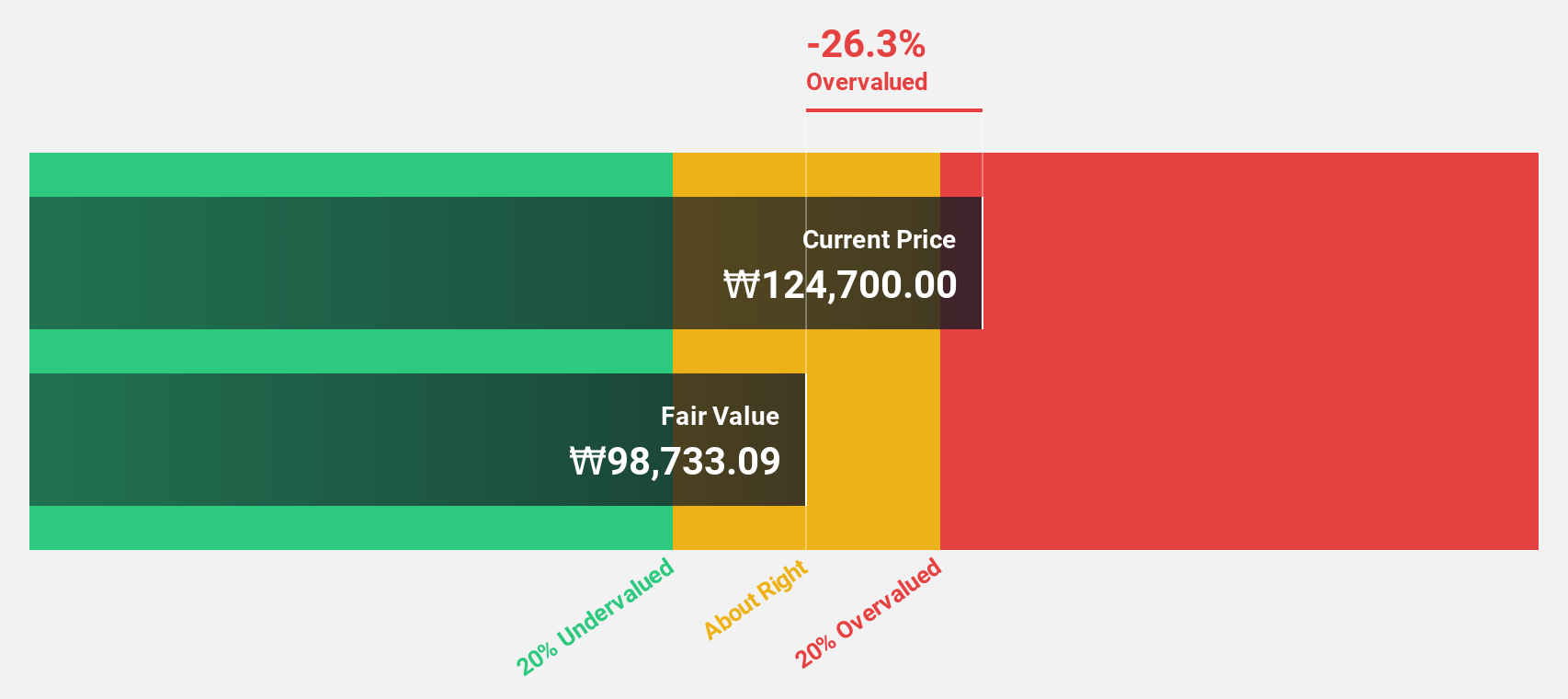

Estimated Discount To Fair Value: 16%

SM Entertainment is trading at ₩78,200, below its fair value estimate of ₩93,070.2, reflecting potential undervaluation based on cash flows. Earnings are projected to grow 78.4% annually over the next three years, with revenue growth expected at 11.7% per year—outpacing the Korean market average. However, a low forecasted return on equity and an unsustainable dividend yield of 1.53% present challenges despite analysts' consensus for a price increase of 25.8%.

- Our expertly prepared growth report on SM Entertainment implies its future financial outlook may be stronger than recent results.

- Take a closer look at SM Entertainment's balance sheet health here in our report.

Shinsegae International (KOSE:A031430)

Overview: Shinsegae International Co., Ltd. operates department stores and hypermarkets in South Korea, with a market cap of ₩375.38 billion.

Operations: The company's revenue segments consist of Domestic Cosmetics at ₩388.10 billion, Overseas Cosmetics at ₩13.35 billion, and Domestic Fashion and Lifestyle at ₩917.43 billion.

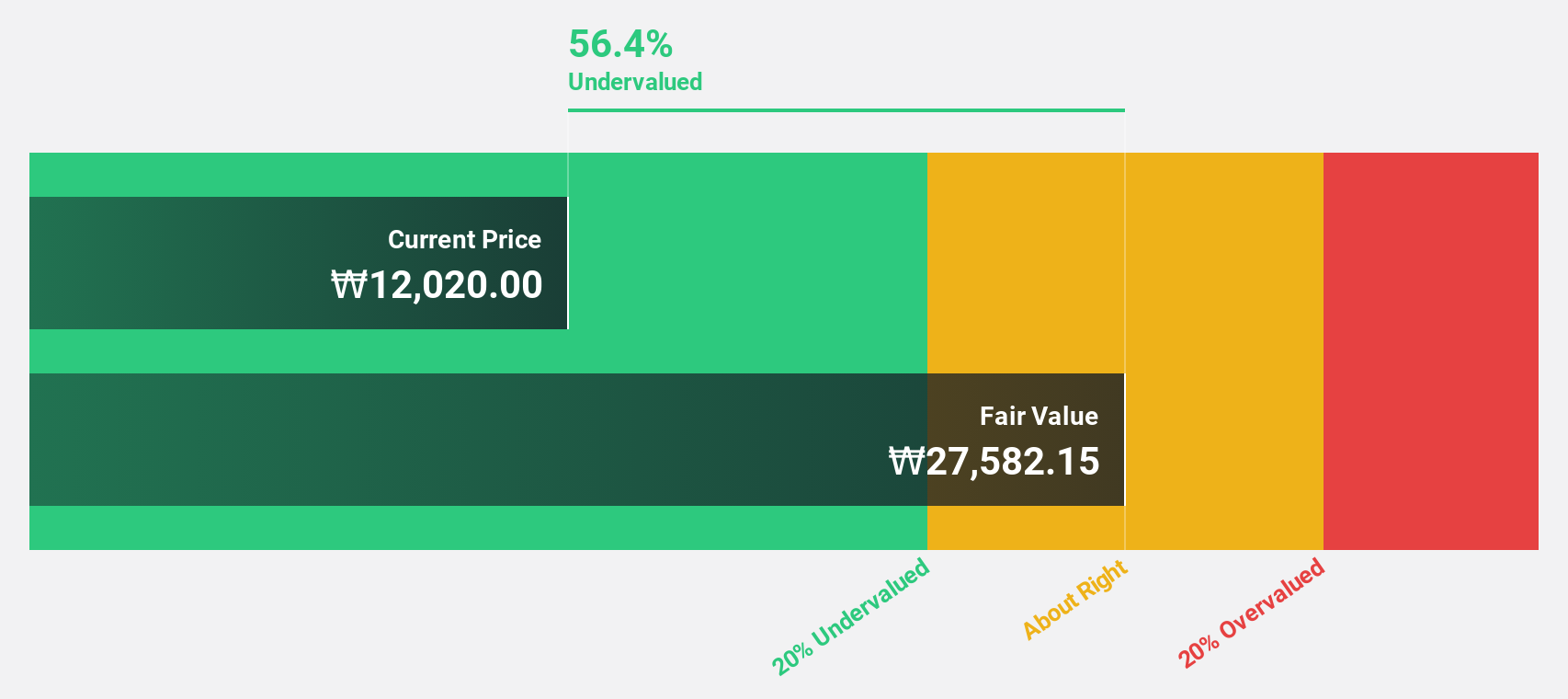

Estimated Discount To Fair Value: 48.7%

Shinsegae International's stock is trading at ₩10,950, significantly below its estimated fair value of ₩21,327.66, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 5.2% to 3.1%, earnings are forecasted to grow by 22% annually, surpassing the Korean market average of 12.6%. However, revenue growth is expected at a modest 5.9% per year with a low projected return on equity of 7.1%.

- In light of our recent growth report, it seems possible that Shinsegae International's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Shinsegae International.

Next Steps

- Investigate our full lineup of 875 Undervalued Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A041510

SM Entertainment

Engages in music/sound production, talent management, and music/audio content publication activities in South Korea and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives