- South Korea

- /

- General Merchandise and Department Stores

- /

- KOSE:A023530

Risks To Shareholder Returns Are Elevated At These Prices For Lotte Shopping Co., Ltd. (KRX:023530)

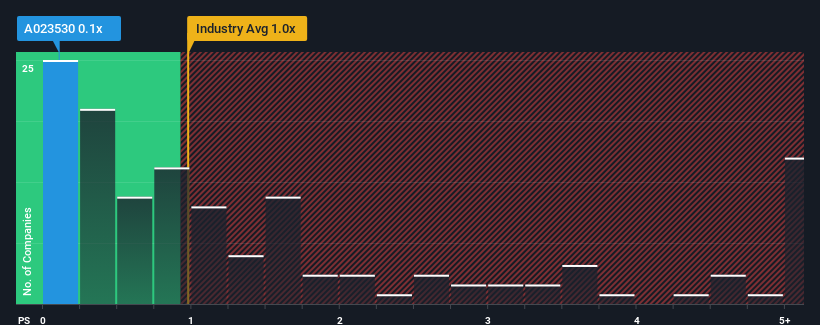

It's not a stretch to say that Lotte Shopping Co., Ltd.'s (KRX:023530) price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" for companies in the Multiline Retail industry in Korea, where the median P/S ratio is around 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Lotte Shopping

What Does Lotte Shopping's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Lotte Shopping's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Lotte Shopping will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Lotte Shopping?

In order to justify its P/S ratio, Lotte Shopping would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.9%. This means it has also seen a slide in revenue over the longer-term as revenue is down 10% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 2.3% over the next year. Meanwhile, the rest of the industry is forecast to expand by 8.2%, which is noticeably more attractive.

With this in mind, we find it intriguing that Lotte Shopping's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Lotte Shopping's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about this 1 warning sign we've spotted with Lotte Shopping.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A023530

Lotte Shopping

Engages in the retail operations through department stores, outlet stores, discount stores, supermarkets, electronics specialty stores, movie theaters, home shopping, and E-commerce channels.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives