- South Korea

- /

- General Merchandise and Department Stores

- /

- KOSE:A023530

Lotte Shopping (KRX:023530) Shareholders Received A Total Return Of Negative 19% In The Last Five Years

While not a mind-blowing move, it is good to see that the Lotte Shopping Co., Ltd. (KRX:023530) share price has gained 20% in the last three months. But if you look at the last five years the returns have not been good. In fact, the share price is down 52%, which falls well short of the return you could get by buying an index fund.

See our latest analysis for Lotte Shopping

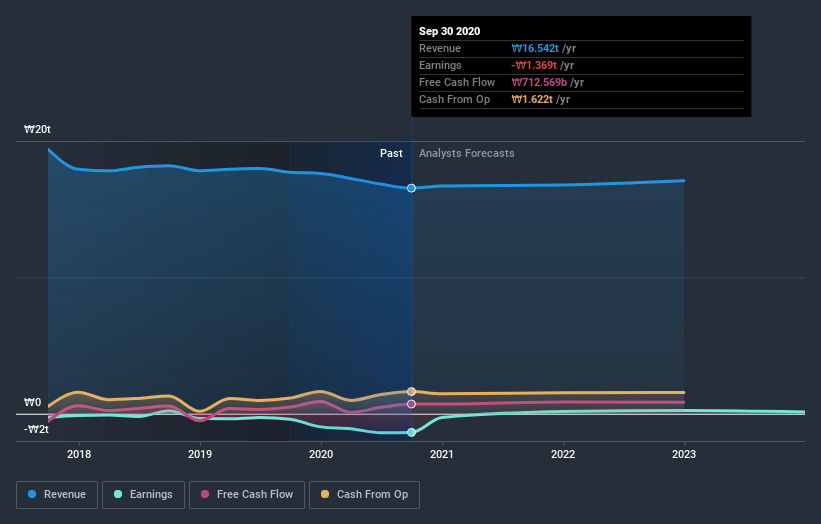

Lotte Shopping isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Lotte Shopping reduced its trailing twelve month revenue by 12% for each year. That's definitely a weaker result than most pre-profit companies report. It seems appropriate, then, that the share price slid about 9% annually during that time. It's fair to say most investors don't like to invest in loss making companies with falling revenue. This looks like a really risky stock to buy, at a glance.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Lotte Shopping is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Lotte Shopping will earn in the future (free analyst consensus estimates)

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Lotte Shopping's TSR for the last 5 years was -19%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 48% in the last year, Lotte Shopping shareholders lost 16% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Lotte Shopping you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Lotte Shopping or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A023530

Lotte Shopping

Engages in the retail operations through department stores, outlet stores, discount stores, supermarkets, electronics specialty stores, movie theaters, home shopping, and E-commerce channels.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives