- South Korea

- /

- Personal Products

- /

- KOSE:A161890

July 2025's Asian Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, Asian indices have shown resilience with China's stock markets posting gains despite mixed economic signals. In this context, identifying stocks that are trading below their intrinsic value can present potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Leapmotor Technology (SEHK:9863) | HK$57.90 | HK$115.32 | 49.8% |

| Taiyo Yuden (TSE:6976) | ¥2575.00 | ¥5105.39 | 49.6% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥23.15 | CN¥46.04 | 49.7% |

| JRCLtd (TSE:6224) | ¥1161.00 | ¥2302.99 | 49.6% |

| Evergreen Aviation Technologies (TWSE:2645) | NT$99.00 | NT$195.53 | 49.4% |

| Darbond Technology (SHSE:688035) | CN¥39.65 | CN¥78.34 | 49.4% |

| cottaLTD (TSE:3359) | ¥427.00 | ¥853.17 | 50% |

| Astroscale Holdings (TSE:186A) | ¥673.00 | ¥1345.95 | 50% |

| APAC Realty (SGX:CLN) | SGD0.48 | SGD0.95 | 49.2% |

| Accton Technology (TWSE:2345) | NT$813.00 | NT$1600.19 | 49.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

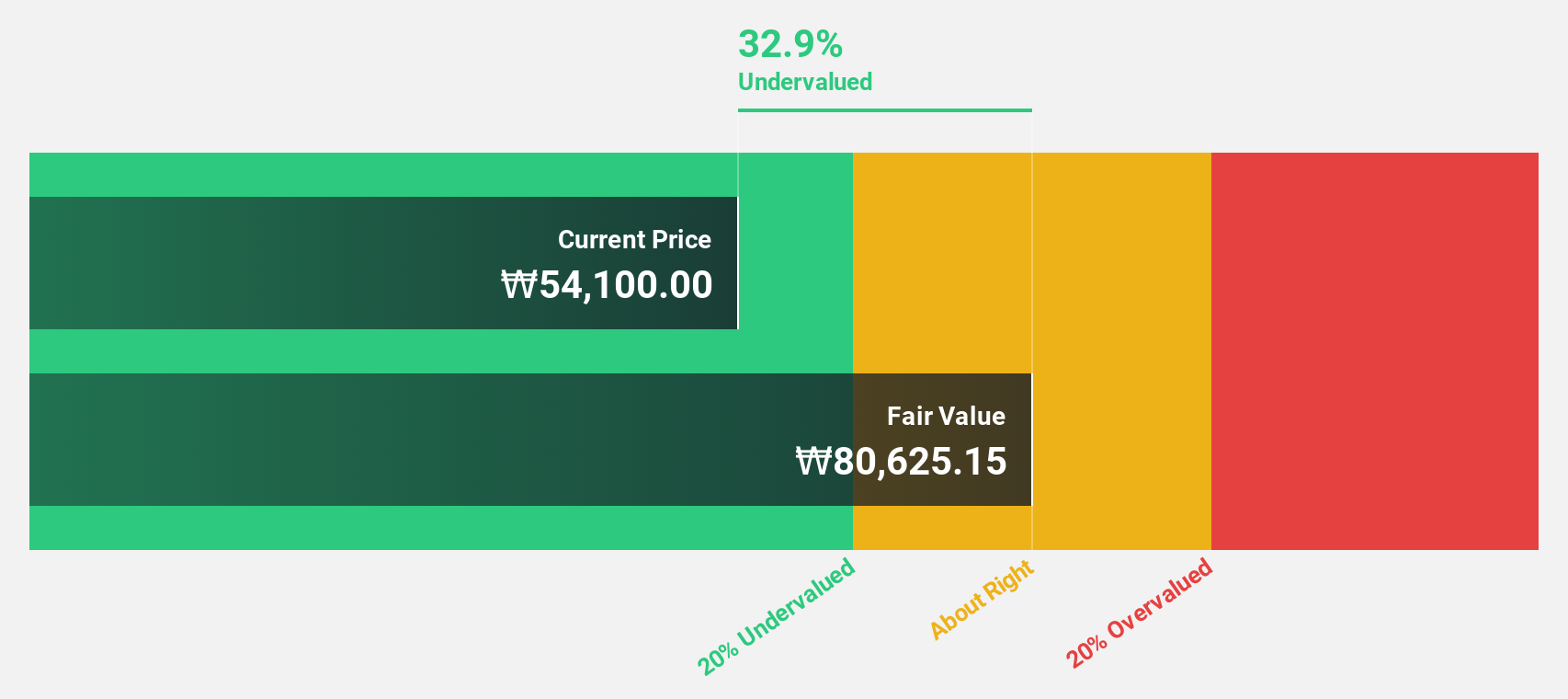

SILICON2 (KOSDAQ:A257720)

Overview: SILICON2 Co., Ltd. is involved in the global distribution of cosmetics products and has a market cap of approximately ₩3.58 trillion.

Operations: The company generates revenue primarily through its wholesale miscellaneous segment, which accounts for ₩787.27 million.

Estimated Discount To Fair Value: 47.4%

SILICON2 Co., Ltd. exhibits strong cash flow potential, trading at ₩54,600, which is 47.4% below its estimated fair value of ₩103,741.08. Despite recent volatility and slower-than-market earnings growth forecasts of 20.8% annually, the company's net income rose significantly to KRW 38.79 billion in Q1 2025 from KRW 25.54 billion a year ago, highlighting robust profit growth and high-quality earnings with a projected return on equity of 39.6%.

- Our growth report here indicates SILICON2 may be poised for an improving outlook.

- Take a closer look at SILICON2's balance sheet health here in our report.

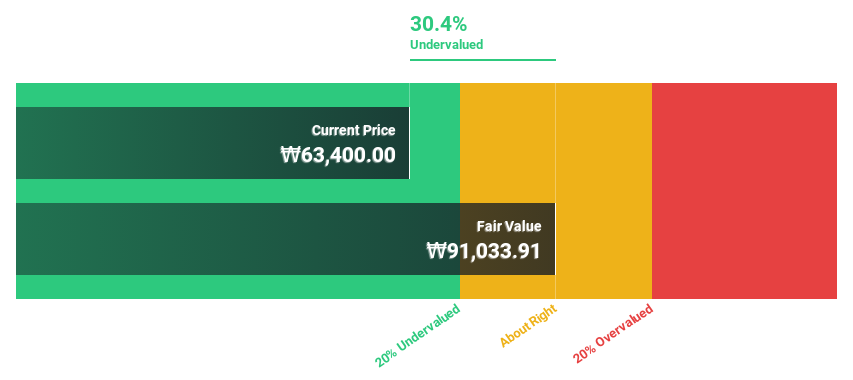

Kolmar Korea (KOSE:A161890)

Overview: Kolmar Korea Co., Ltd. is engaged in the research, development, production, and sale of beauty and health products both domestically and internationally, with a market cap of ₩2.58 trillion.

Operations: Kolmar Korea Co., Ltd. generates revenue from various segments, including Cosmetics (₩1.33 trillion), Medicines (₩838.45 billion), Packaging (₩272.41 billion), and Food (₩87.76 billion).

Estimated Discount To Fair Value: 36.6%

Kolmar Korea is currently trading at ₩109,200, significantly undervalued compared to its fair value estimate of ₩172,362.29. The company exhibits strong potential with earnings projected to grow 23.69% annually over the next three years, outpacing the Korean market's growth rate of 20.9%. However, despite high earnings growth and a favorable valuation gap of 36.6%, Kolmar Korea faces challenges such as low forecasted return on equity and substantial debt levels impacting financial stability.

- The growth report we've compiled suggests that Kolmar Korea's future prospects could be on the up.

- Click here to discover the nuances of Kolmar Korea with our detailed financial health report.

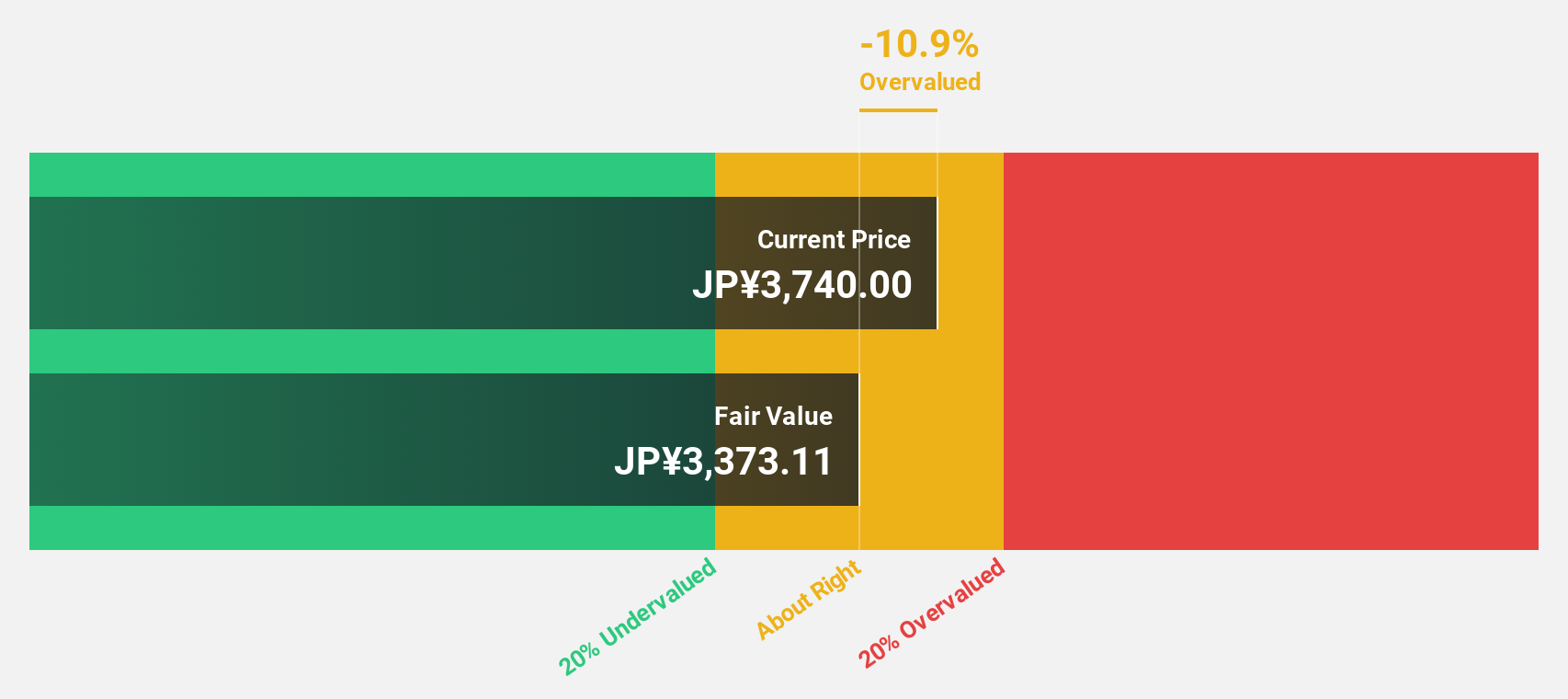

freee K.K (TSE:4478)

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥220.33 billion.

Operations: The company's revenue is primarily derived from its Platform Business segment, totaling ¥30.86 billion.

Estimated Discount To Fair Value: 45.9%

freee K.K. is trading at ¥3,725, significantly below its estimated fair value of ¥6,883.61, suggesting it is undervalued based on cash flows. The company's revenue is forecast to grow 17.6% annually, outpacing the Japanese market's 4.3% growth rate and contributing to earnings growth projected at 39.97% per year. Recent developments include plans for issuing new restricted shares and guidance for net sales of ¥33 billion for FY2025 ending June 30th.

- According our earnings growth report, there's an indication that freee K.K might be ready to expand.

- Unlock comprehensive insights into our analysis of freee K.K stock in this financial health report.

Summing It All Up

- Access the full spectrum of 270 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kolmar Korea might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A161890

Kolmar Korea

Researches, develops, produces, and sells beauty and health products in South Korea and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives