- South Korea

- /

- Retail Distributors

- /

- KOSDAQ:A257720

Asian Stocks Estimated To Be Trading Below Fair Value In March 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by economic uncertainties and changing policy dynamics, Asian stock indices have shown varied performances, with some regions experiencing gains while others face challenges. Amid this complex environment, identifying stocks trading below their fair value can offer opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Chison Medical Technologies (SHSE:688358) | CN¥31.37 | CN¥61.63 | 49.1% |

| Guangdong Mingyang ElectricLtd (SZSE:301291) | CN¥48.19 | CN¥94.51 | 49% |

| Cosmax (KOSE:A192820) | ₩182500.00 | ₩361447.79 | 49.5% |

| Takara Bio (TSE:4974) | ¥846.00 | ¥1686.79 | 49.8% |

| APAC Realty (SGX:CLN) | SGD0.43 | SGD0.85 | 49.5% |

| LITALICO (TSE:7366) | ¥1089.00 | ¥2126.58 | 48.8% |

| Food & Life Companies (TSE:3563) | ¥4493.00 | ¥8723.30 | 48.5% |

| Zhejiang Juhua (SHSE:600160) | CN¥24.30 | CN¥47.67 | 49% |

| Sunny Optical Technology (Group) (SEHK:2382) | HK$85.55 | HK$167.82 | 49% |

| CHEMTRONICS.Co.Ltd (KOSDAQ:A089010) | ₩28350.00 | ₩55031.72 | 48.5% |

Let's review some notable picks from our screened stocks.

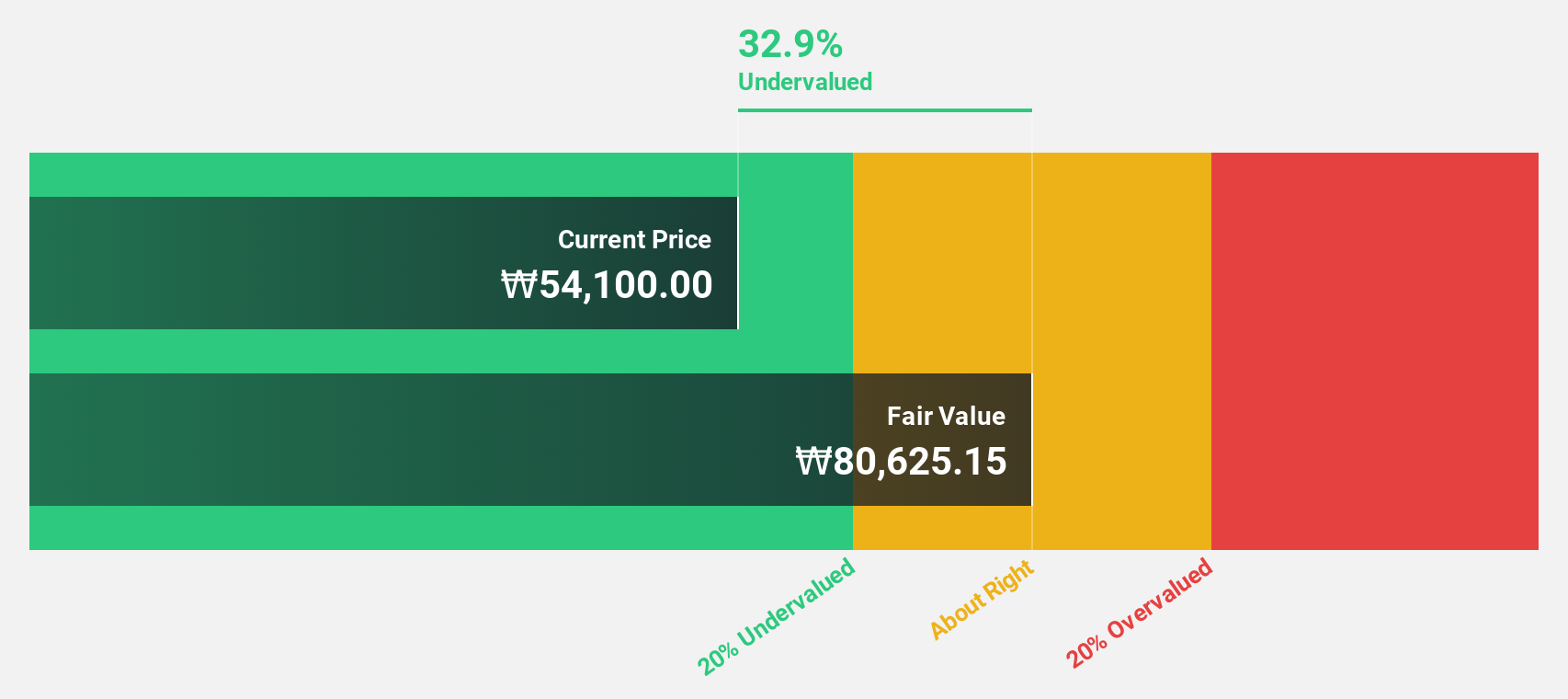

SILICON2 (KOSDAQ:A257720)

Overview: SILICON2 Co., Ltd. is involved in the global distribution of cosmetics products and has a market cap of approximately ₩1.73 billion.

Operations: The company's revenue primarily comes from its wholesale segment, generating approximately ₩623.64 million.

Estimated Discount To Fair Value: 29.1%

SILICON2 is trading at ₩28,350, significantly below its estimated fair value of ₩39,983.14, indicating it is undervalued based on cash flows. Analysts forecast robust earnings growth of 38.2% annually over the next three years, outpacing the KR market. Despite recent share price volatility and high non-cash earnings levels, revenue growth remains strong at 35.1% per year. The company recently completed a private placement to raise approximately ₩144 billion to enhance financial flexibility.

- Our earnings growth report unveils the potential for significant increases in SILICON2's future results.

- Unlock comprehensive insights into our analysis of SILICON2 stock in this financial health report.

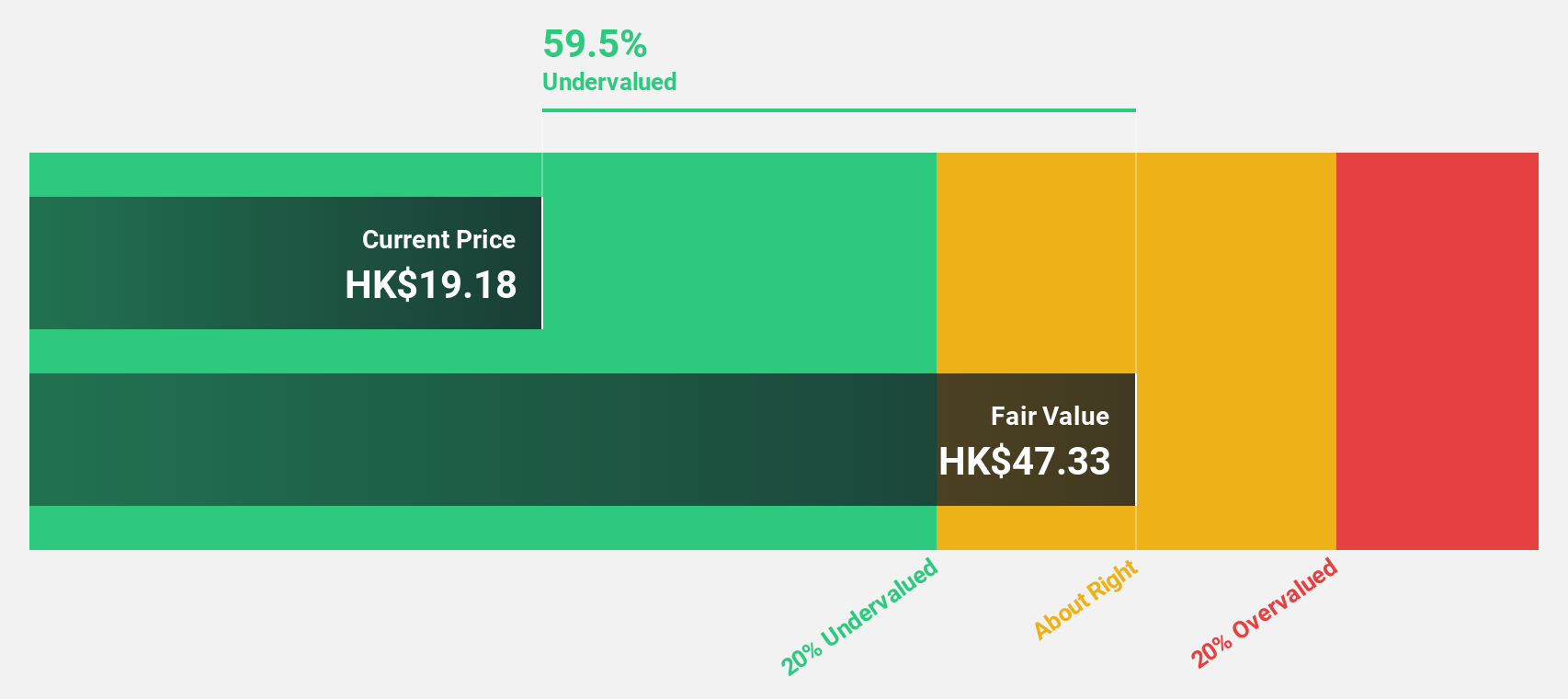

Zijin Mining Group (SEHK:2899)

Overview: Zijin Mining Group Company Limited, along with its subsidiaries, is involved in the exploration, mining, processing, refining, and sale of gold and non-ferrous metals both in Mainland China and internationally, with a market cap of approximately HK$506.31 billion.

Operations: Zijin Mining Group's revenue is primarily derived from its Smelting Products segment, which accounts for CN¥201.37 billion, followed by its Mineral Products segment at CN¥95.36 billion, and Trading activities contributing CN¥134.06 billion.

Estimated Discount To Fair Value: 36%

Zijin Mining Group is trading at HK$18.14, significantly below its fair value estimate of HK$28.34, suggesting it is undervalued based on cash flows. The company reported strong financial results for 2024, with net income rising to CNY 32.05 billion from CNY 21.12 billion the previous year, reflecting a substantial earnings increase of approximately 51%. Despite a high debt level and moderate revenue growth forecasts of 8% annually, its earnings are expected to grow faster than the Hong Kong market average at 13.2% per year.

- Our comprehensive growth report raises the possibility that Zijin Mining Group is poised for substantial financial growth.

- Get an in-depth perspective on Zijin Mining Group's balance sheet by reading our health report here.

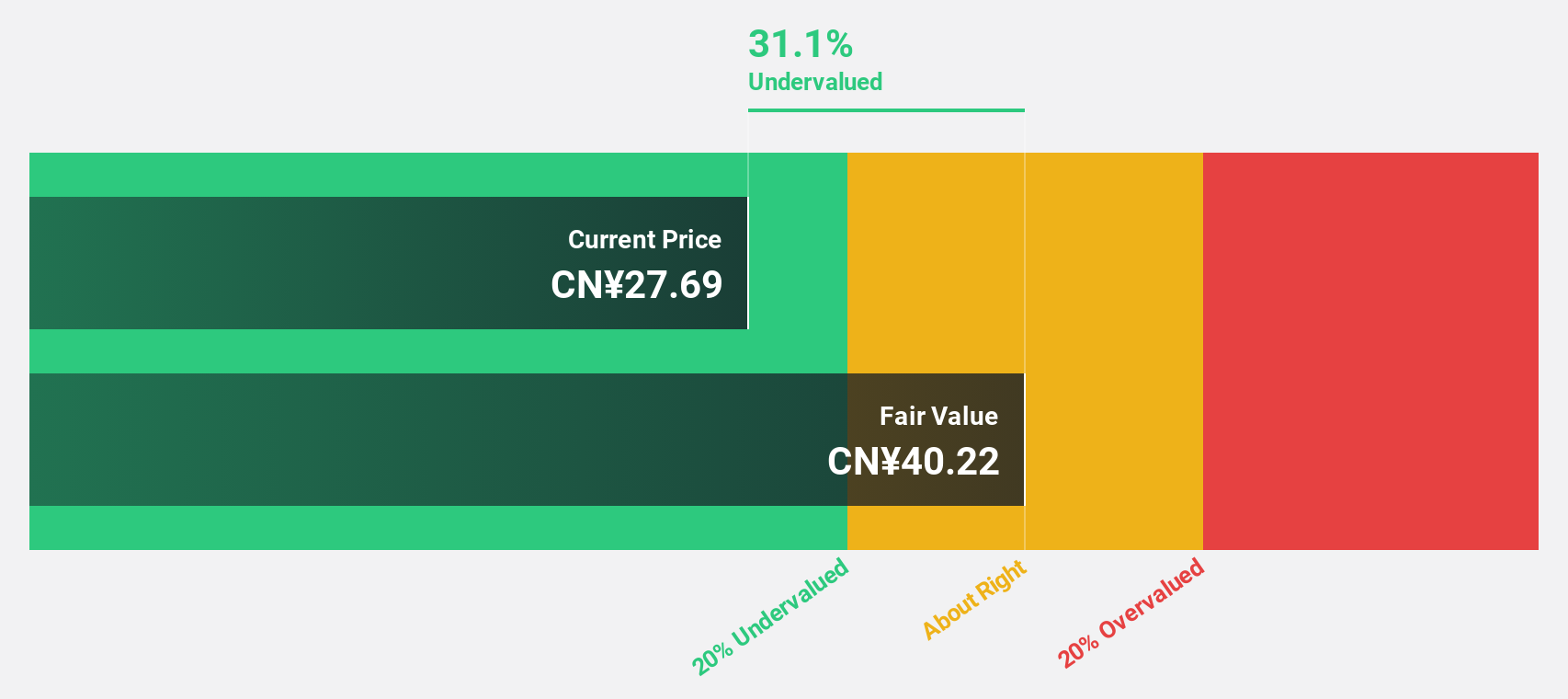

Chongqing Baiya Sanitary Products (SZSE:003006)

Overview: Chongqing Baiya Sanitary Products Co., Ltd. operates in the sanitary products industry and has a market capitalization of approximately CN¥10.30 billion.

Operations: The company generates revenue from its Personal Products segment, amounting to CN¥3.25 billion.

Estimated Discount To Fair Value: 23%

Chongqing Baiya Sanitary Products is trading at CN¥23.98, below its estimated fair value of CN¥31.13, positioning it as undervalued based on cash flows. The company's 2024 earnings showed an increase to CN¥285.17 million from CN¥238.25 million in 2023, with revenue expected to grow over 21% annually, outpacing the Chinese market average. However, its dividend yield of 2.29% is not well covered by free cash flows despite strong profit growth forecasts exceeding market expectations at approximately 28% per year.

- The growth report we've compiled suggests that Chongqing Baiya Sanitary Products' future prospects could be on the up.

- Click here to discover the nuances of Chongqing Baiya Sanitary Products with our detailed financial health report.

Summing It All Up

- Explore the 279 names from our Undervalued Asian Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A257720

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives