- South Korea

- /

- Specialty Stores

- /

- KOSDAQ:A114840

Discovering iFamilySC and Two Other Emerging Small Caps with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, including rate adjustments by major central banks and fluctuating corporate earnings, small-cap stocks have experienced varied performances. In this dynamic environment, identifying promising small-cap companies requires a focus on unique market opportunities and resilience to broader economic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Petrolimex Insurance | 32.25% | 4.70% | 7.91% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

iFamilySC (KOSDAQ:A114840)

Simply Wall St Value Rating: ★★★★☆☆

Overview: iFamilySC Co. Ltd is an interactive branding company that integrates content and products across online and offline platforms in South Korea and internationally, with a market cap of ₩449.53 billion.

Operations: iFamilySC generates revenue primarily from its Cosmetics Business Division, contributing ₩193.88 billion, while the Wedding Business Sector adds ₩4.61 billion.

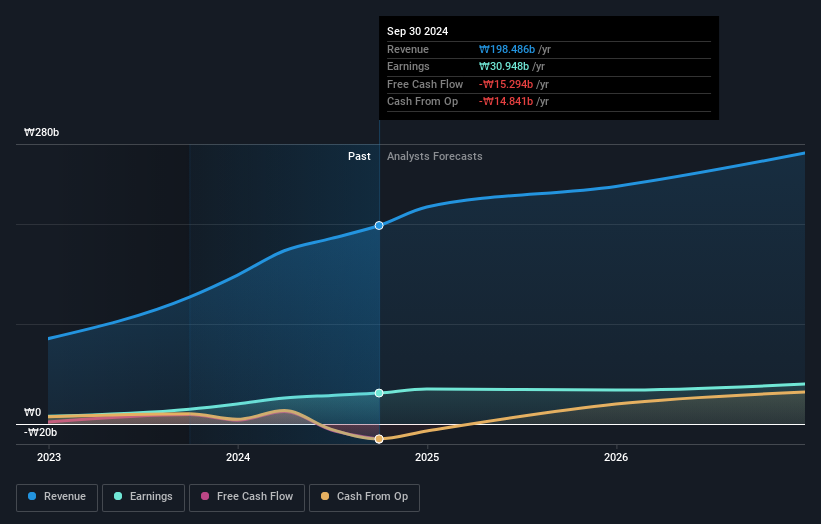

iFamilySC, a smaller player in the market, showcases impressive earnings growth of 110% over the past year, outpacing its Specialty Retail industry peers at 48%. Despite a volatile share price recently, its net debt to equity ratio stands at a satisfactory 1.6%, signaling strong financial health. The company has not been free cash flow positive lately but seems to manage interest payments effectively. With high non-cash earnings and completed share repurchases worth KRW 2,995 million for 117,000 shares by January's end, iFamilySC appears poised for continued growth with forecasted annual earnings expansion of over 25%.

- Navigate through the intricacies of iFamilySC with our comprehensive health report here.

Examine iFamilySC's past performance report to understand how it has performed in the past.

Xuchang Yuandong Drive ShaftLtd (SZSE:002406)

Simply Wall St Value Rating: ★★★★★★

Overview: Xuchang Yuandong Drive Shaft Co. Ltd, along with its subsidiaries, focuses on the research, development, production, and sale of transmission drive shafts and related components both in China and internationally, with a market capitalization of CN¥4.78 billion.

Operations: The primary revenue stream for Xuchang Yuandong Drive Shaft Co. Ltd comes from its automotive parts segment, generating CN¥1.29 billion.

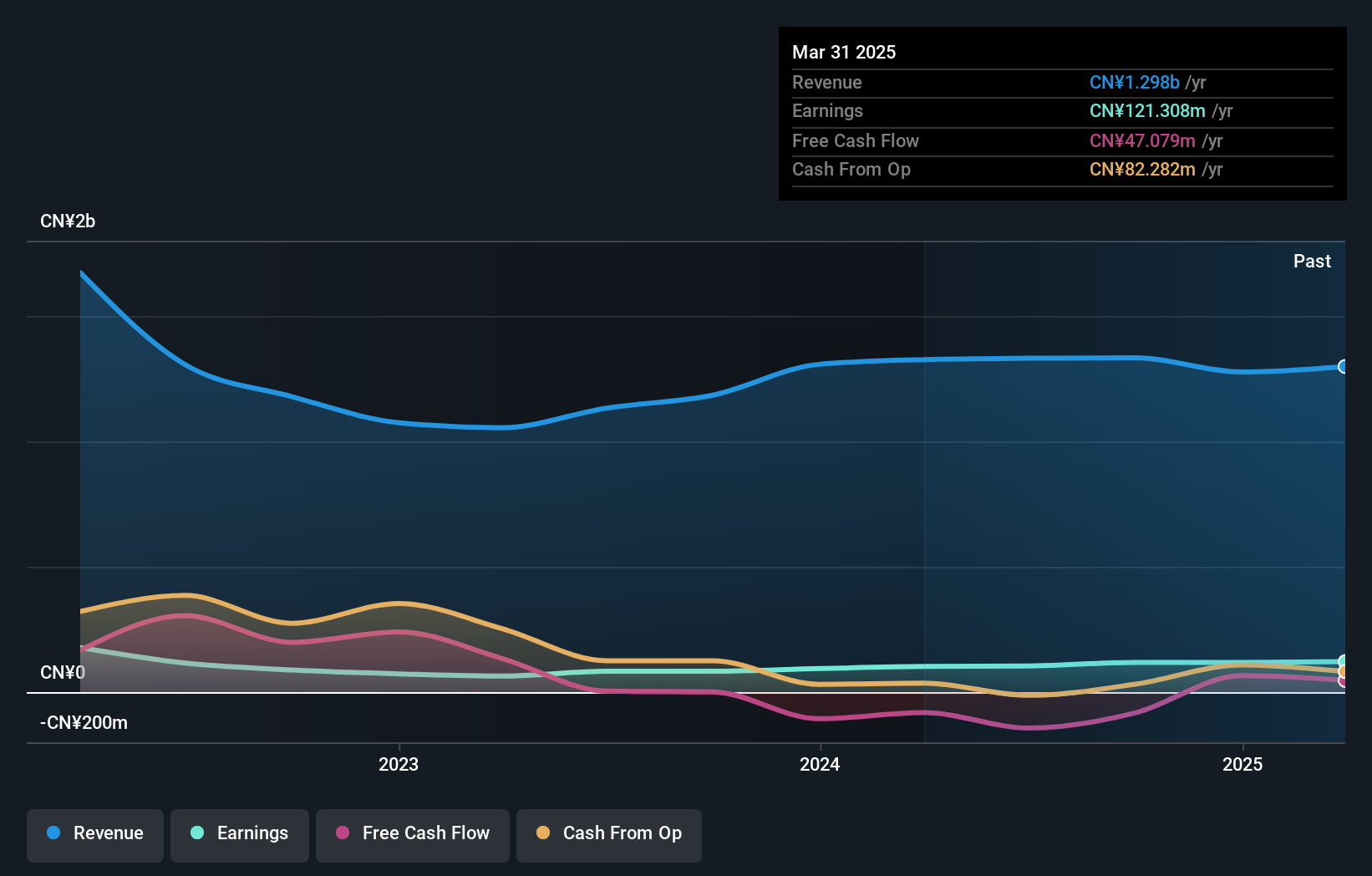

Xuchang Yuandong Drive Shaft, a small player in the auto components sector, has shown notable earnings growth of 41.8% over the past year, surpassing the industry average of 10.5%. However, this performance is partly influenced by a significant one-off gain of CN¥43.4M in its recent financial results. Over five years, their debt-to-equity ratio impressively decreased from 23.8% to just 0.4%, highlighting improved financial stability and more cash than total debt on hand. Despite these positives, free cash flow remains negative and earnings have seen an annual decline of 29.3% over five years, suggesting challenges ahead for sustained profitability.

China Motor (TWSE:2204)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Motor Corporation is involved in the manufacture and sale of automobiles and related parts both in Taiwan and internationally, with a market capitalization of NT$45.95 billion.

Operations: China Motor Corporation generates revenue primarily from its manufacturing segment, which contributes NT$41.30 billion. The company's financial performance includes adjustments and write-offs amounting to -NT$756.97 million.

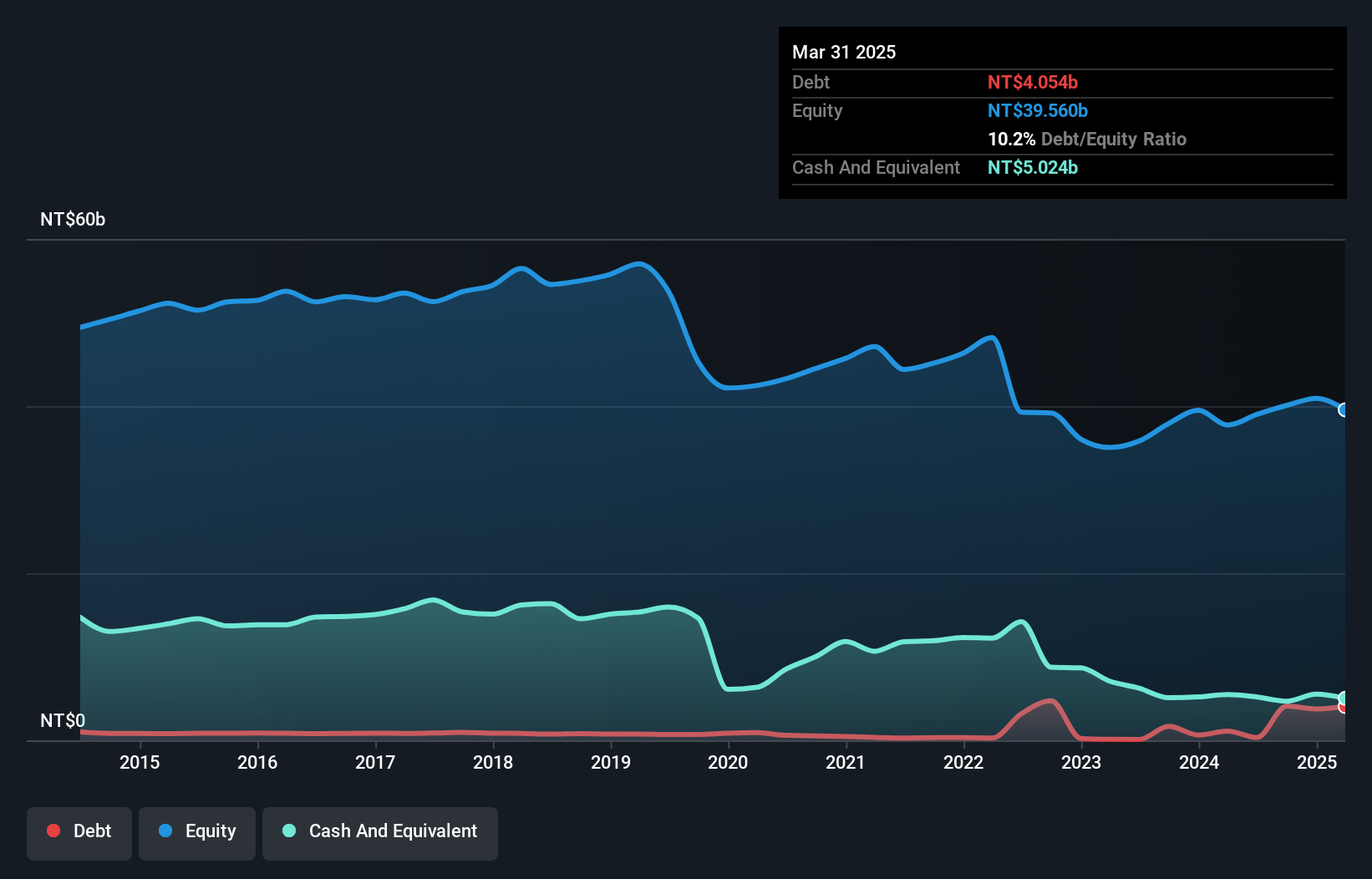

China Motor's recent financials reveal a mixed performance, with third-quarter sales at TWD 8.13 billion, down from TWD 8.91 billion the previous year, and net income at TWD 809.8 million compared to last year's TWD 1.34 billion. Despite this dip, earnings over the past year surged by nearly 269%, significantly outpacing the auto industry's -2.7% growth rate. The company is trading at a favorable price-to-earnings ratio of 10x versus the Taiwanese market's average of 20x, suggesting potential undervaluation despite challenges like increased debt-to-equity from 1.6 to 10.2 over five years and negative free cash flow in recent quarters.

Taking Advantage

- Click through to start exploring the rest of the 4710 Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iFamilySC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A114840

iFamilySC

iFamilySC Co. Ltd operates as an interactive branding company that connects content and products online and offline in South Korea and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives