As global markets navigate a landscape of mixed economic signals, Asian stock indices have demonstrated resilience, with particular strength in technology and AI sectors. In this context, identifying stocks that may be trading below their estimated value becomes crucial for investors seeking opportunities amidst fluctuating conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Takara Bio (TSE:4974) | ¥860.00 | ¥1700.65 | 49.4% |

| STI (KOSDAQ:A039440) | ₩26100.00 | ₩51792.38 | 49.6% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.16 | CN¥26.01 | 49.4% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩29350.00 | ₩57372.06 | 48.8% |

| Japan Eyewear Holdings (TSE:5889) | ¥1980.00 | ¥3878.96 | 49% |

| East Buy Holding (SEHK:1797) | HK$20.60 | HK$40.28 | 48.9% |

| China Beststudy Education Group (SEHK:3978) | HK$4.70 | HK$9.28 | 49.4% |

| Beijing Roborock Technology (SHSE:688169) | CN¥152.79 | CN¥300.81 | 49.2% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.38 | CN¥56.05 | 49.4% |

| ASE Technology Holding (TWSE:3711) | NT$224.50 | NT$439.85 | 49% |

We're going to check out a few of the best picks from our screener tool.

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on the research, development, and commercialization of drugs for central nervous system disorders, with a market cap of ₩10.80 billion.

Operations: Unfortunately, the provided Business operations text does not contain specific revenue segment information for SK Biopharmaceuticals Co., Ltd.

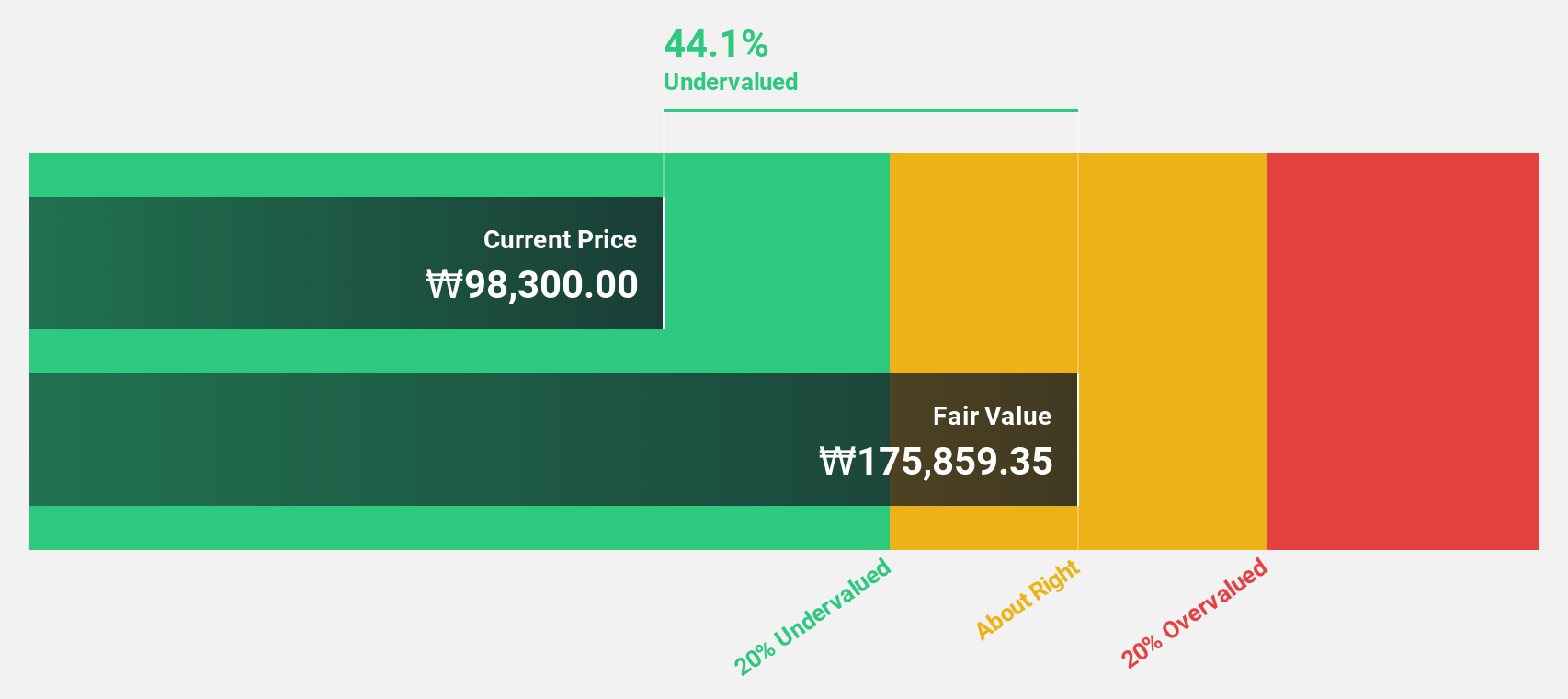

Estimated Discount To Fair Value: 20.6%

SK Biopharmaceuticals is trading at ₩137,900, significantly below its estimated fair value of ₩173,677.6. The company has demonstrated strong earnings growth and maintains a high level of non-cash earnings. Recent strategic alliances, including a license agreement for WT-7695 and the establishment of Mentis Care Inc., indicate robust expansion in radiopharmaceuticals and digital healthcare. Despite forecasted slower profit growth compared to the market, revenue is expected to outpace local industry averages.

- Our growth report here indicates SK Biopharmaceuticals may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of SK Biopharmaceuticals stock in this financial health report.

Innovent Biologics (SEHK:1801)

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on the research and development of antibody and protein medicine products in China, the United States, and internationally, with a market cap of HK$162.47 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥11.42 billion.

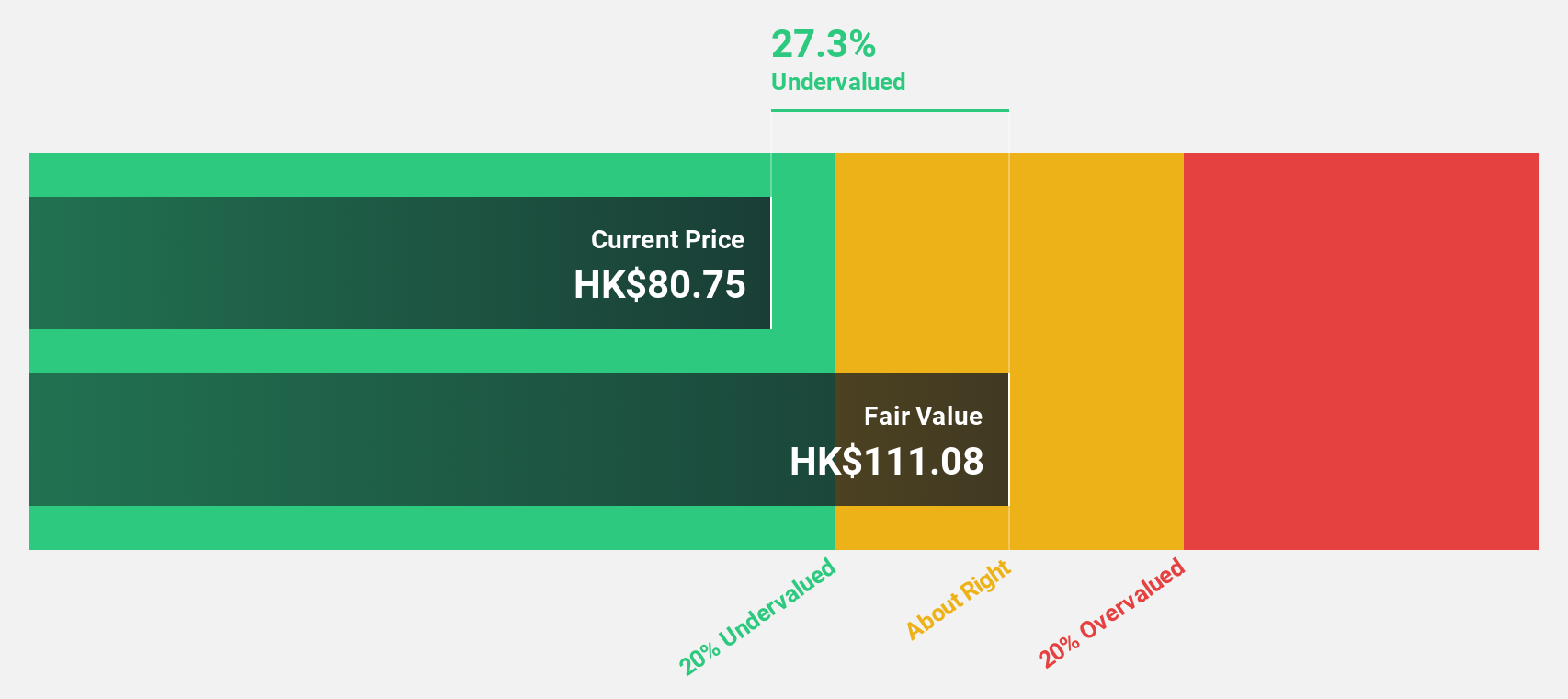

Estimated Discount To Fair Value: 22.7%

Innovent Biologics is currently trading at HK$94.8, below its estimated fair value of HK$122.59, suggesting it may be undervalued based on cash flows. The company has recently received approval for PECONDLE®? in China and has shown strong revenue growth driven by innovative products like mazdutide. Despite a lower forecasted return on equity, Innovent's earnings and revenue are expected to grow significantly faster than the Hong Kong market over the next three years.

- Insights from our recent growth report point to a promising forecast for Innovent Biologics' business outlook.

- Click here to discover the nuances of Innovent Biologics with our detailed financial health report.

Kunshan Huguang Auto HarnessLtd (SHSE:605333)

Overview: Kunshan Huguang Auto Harness Co., Ltd. specializes in the R&D, production, and sales of automotive wiring harness assemblies both in China and internationally, with a market cap of CN¥14.52 billion.

Operations: Kunshan Huguang Auto Harness Co., Ltd. generates revenue through the development, manufacturing, and distribution of high and low voltage wiring harness assemblies for the automotive industry in both domestic and international markets.

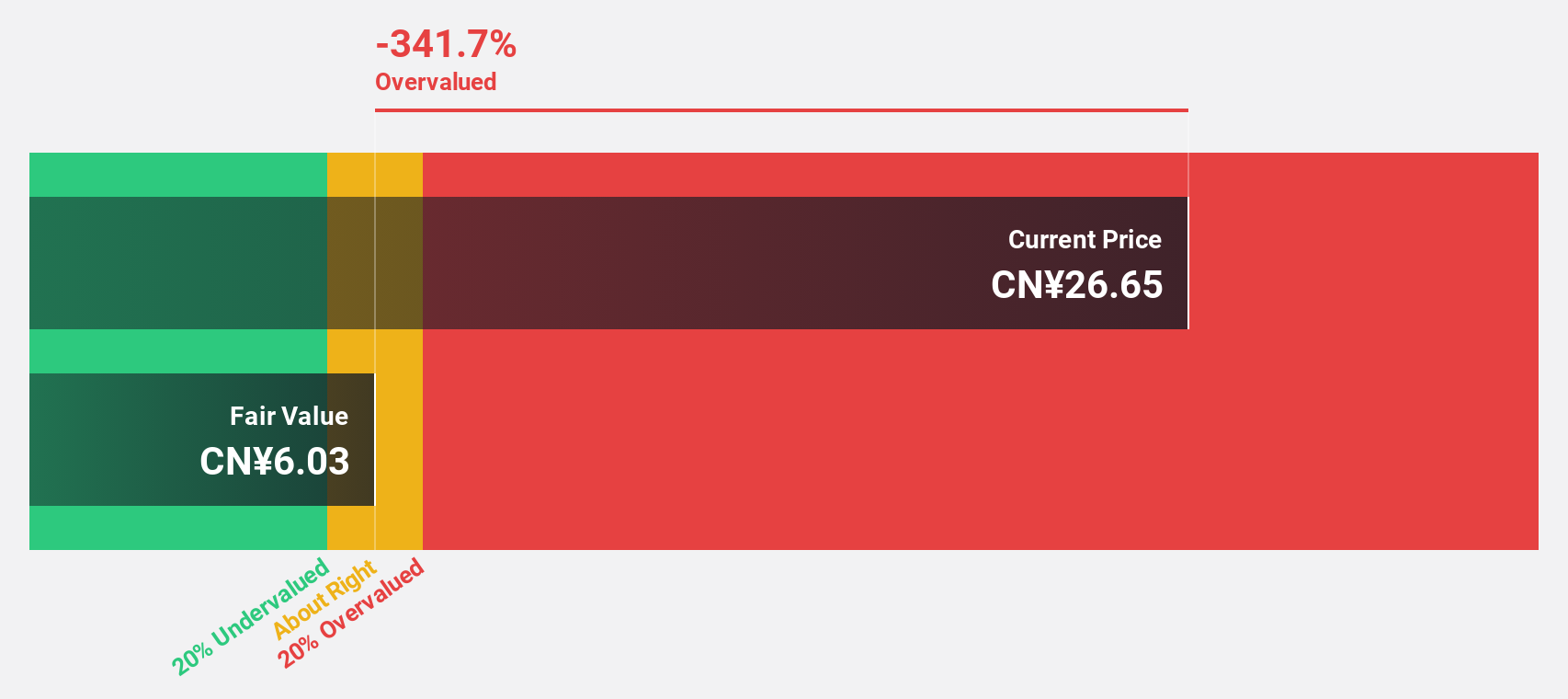

Estimated Discount To Fair Value: 38.7%

Kunshan Huguang Auto Harness Ltd. is trading at CNY 31.3, well below its estimated fair value of CNY 51.04, highlighting potential undervaluation based on cash flows. Recent earnings showed stable revenue growth but a slight dip in net income compared to the previous year. Despite this, revenue is forecasted to grow faster than the Chinese market average, although profit growth may lag behind market expectations over the coming years.

- According our earnings growth report, there's an indication that Kunshan Huguang Auto HarnessLtd might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Kunshan Huguang Auto HarnessLtd.

Turning Ideas Into Actions

- Reveal the 271 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, engages in the research and development of antibody and protein medicine products in the People’s Republic of China, the United States, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026