- South Korea

- /

- Biotech

- /

- KOSE:A302440

Subdued Growth No Barrier To SK bioscience Co.,Ltd. (KRX:302440) With Shares Advancing 25%

SK bioscience Co.,Ltd. (KRX:302440) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

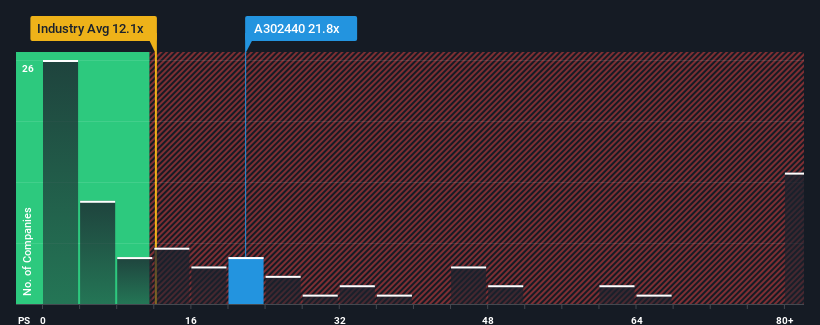

Following the firm bounce in price, SK bioscienceLtd may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 21.8x, when you consider almost half of the companies in the Biotechs industry in Korea have P/S ratios under 12.1x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for SK bioscienceLtd

What Does SK bioscienceLtd's P/S Mean For Shareholders?

SK bioscienceLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SK bioscienceLtd.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as SK bioscienceLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 52% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 78% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 17% per year during the coming three years according to the seven analysts following the company. With the industry predicted to deliver 85% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that SK bioscienceLtd's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does SK bioscienceLtd's P/S Mean For Investors?

Shares in SK bioscienceLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see SK bioscienceLtd trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about this 1 warning sign we've spotted with SK bioscienceLtd.

If these risks are making you reconsider your opinion on SK bioscienceLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A302440

SK bioscienceLtd

Engages in the research and development, production, and distribution of vaccines and biopharmaceuticals in Korea and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.