- South Korea

- /

- Life Sciences

- /

- KOSE:A207940

Did You Miss Samsung BiologicsLtd's (KRX:207940) Impressive 112% Share Price Gain?

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. For example, the Samsung Biologics Co.,Ltd. (KRX:207940) share price has soared 112% in the last three years. How nice for those who held the stock! It's also up 18% in about a month.

View our latest analysis for Samsung BiologicsLtd

We don't think that Samsung BiologicsLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 3 years Samsung BiologicsLtd saw its revenue grow at 31% per year. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 28% compound over three years. But it does seem like the market is paying attention to strong revenue growth. Nonetheless, we'd say Samsung BiologicsLtd is still worth investigating - successful businesses can often keep growing for long periods.

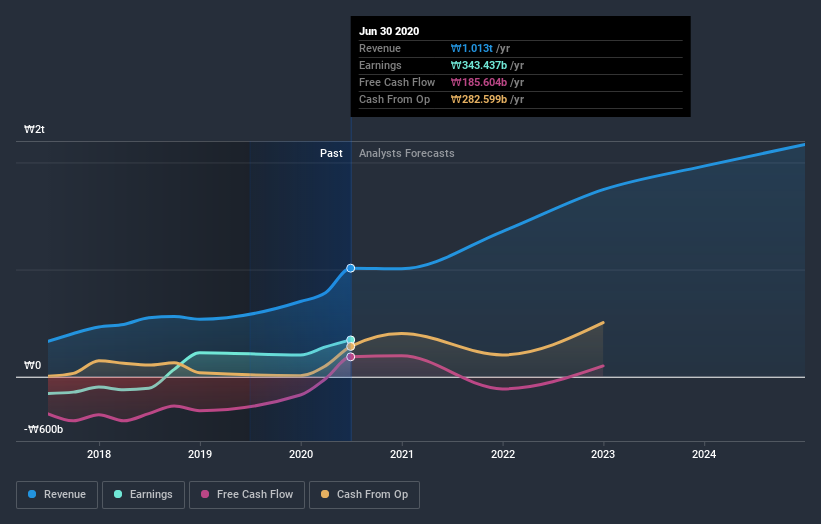

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Samsung BiologicsLtd has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Samsung BiologicsLtd's financial health with this free report on its balance sheet.

A Different Perspective

Pleasingly, Samsung BiologicsLtd's total shareholder return last year was 103%. That's better than the annualized TSR of 28% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Samsung BiologicsLtd , and understanding them should be part of your investment process.

Of course Samsung BiologicsLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Samsung BiologicsLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A207940

Samsung BiologicsLtd

Together with its subsidiaries engages in the manufacturing of biopharmaceuticals products in South Korea, Europe, the United States, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives