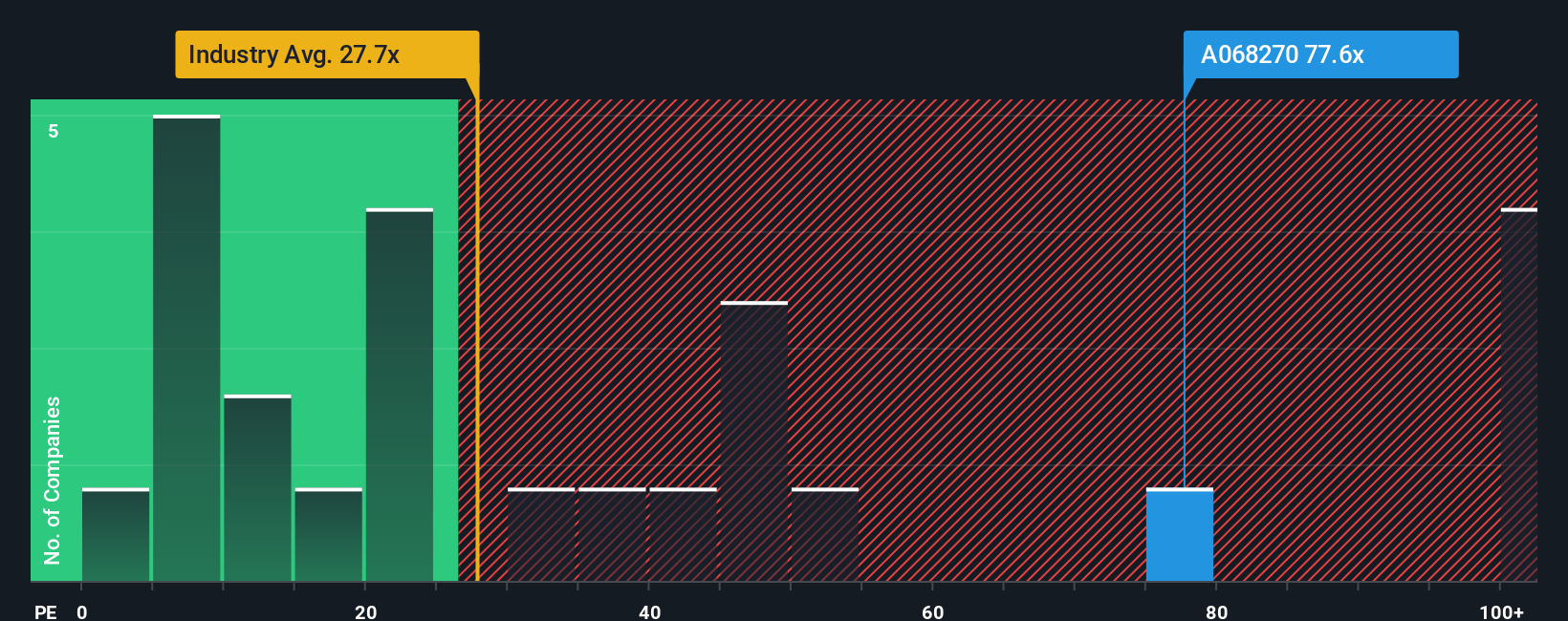

With a price-to-earnings (or "P/E") ratio of 77.6x Celltrion, Inc. (KRX:068270) may be sending very bearish signals at the moment, given that almost half of all companies in Korea have P/E ratios under 14x and even P/E's lower than 7x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Celltrion has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Celltrion

Is There Enough Growth For Celltrion?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Celltrion's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 30% last year. Still, incredibly EPS has fallen 35% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 47% per year over the next three years. That's shaping up to be materially higher than the 18% each year growth forecast for the broader market.

With this information, we can see why Celltrion is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Celltrion's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Celltrion's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Celltrion with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Celltrion, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A068270

Celltrion

A biopharmaceutical company, engages in the development, production, and sale of various therapeutic proteins for the treatment of oncology diseases.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives