- South Korea

- /

- Pharma

- /

- KOSE:A017180

Introducing MYUNGMOON PharmLtd (KRX:017180), A Stock That Climbed 77% In The Last Five Years

MYUNGMOON Pharm co.,Ltd (KRX:017180) shareholders have seen the share price descend 22% over the month. But the silver lining is the stock is up over five years. In that time, it is up 77%, which isn't bad, but is below the market return of 83%. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 38% decline over the last three years: that's a long time to wait for profits.

Check out our latest analysis for MYUNGMOON PharmLtd

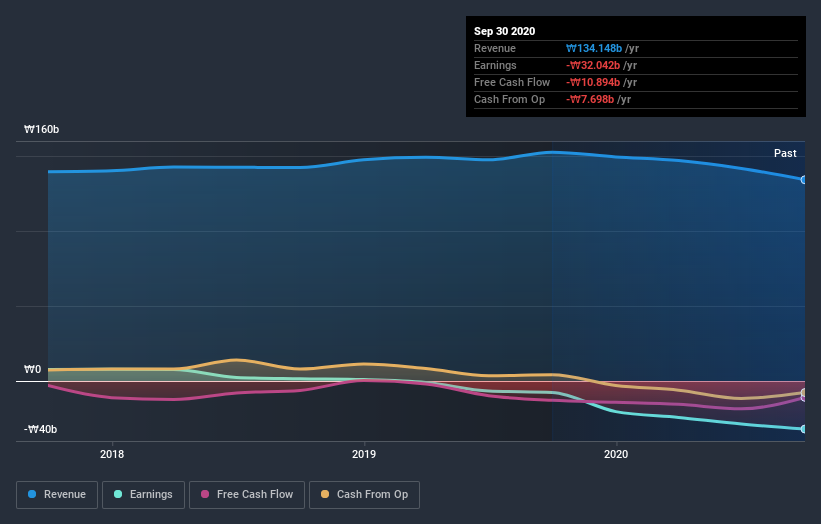

Because MYUNGMOON PharmLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years MYUNGMOON PharmLtd saw its revenue grow at 2.5% per year. Put simply, that growth rate fails to impress. The modest growth is probably broadly reflected in the share price, which is up 12%, per year over 5 years. We'd be looking for the underlying business to grow revenue a bit faster.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at MYUNGMOON PharmLtd's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between MYUNGMOON PharmLtd's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that MYUNGMOON PharmLtd's TSR of 88% over the last 5 years is better than the share price return.

A Different Perspective

MYUNGMOON PharmLtd shareholders are up 30% for the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 13% over half a decade It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for MYUNGMOON PharmLtd (2 are a bit unpleasant) that you should be aware of.

Of course MYUNGMOON PharmLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade MYUNGMOON PharmLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A017180

MYUNGMOON PharmLtd

Engages in the research, development, production, distribution, and sale of pharmaceuticals in South Korea and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives