- South Korea

- /

- Biotech

- /

- KOSE:A011000

GeneOne Life Science (KRX:011000) shareholders are up 13% this past week, but still in the red over the last three years

It's nice to see the GeneOne Life Science, Inc. (KRX:011000) share price up 13% in a week. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 86% in that time. So it's about time shareholders saw some gains. Only time will tell if the company can sustain the turnaround. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for GeneOne Life Science

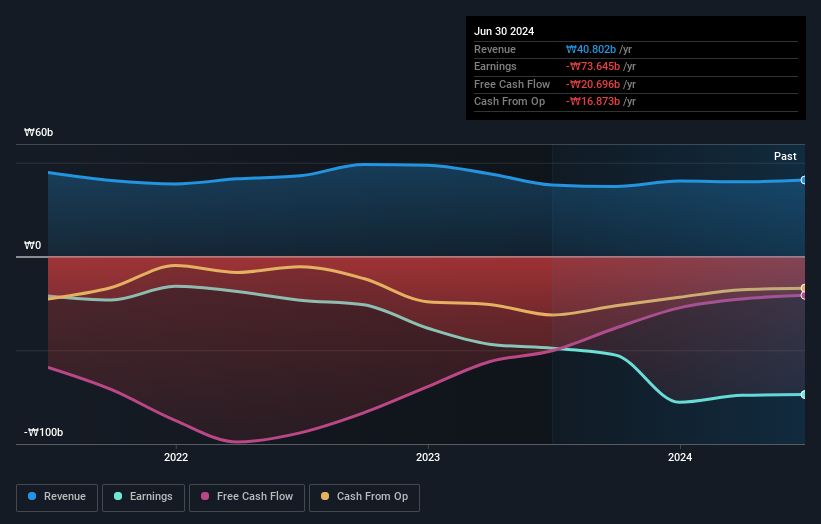

Because GeneOne Life Science made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, GeneOne Life Science's revenue dropped 2.5% per year. That's not what investors generally want to see. Having said that the 23% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at GeneOne Life Science's financial health with this free report on its balance sheet.

A Different Perspective

Investors in GeneOne Life Science had a tough year, with a total loss of 8.8%, against a market gain of about 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with GeneOne Life Science (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

But note: GeneOne Life Science may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011000

GeneOne Life Science

A biopharmaceutical company, engages in the research, development, and contract manufacturing of nucleic acid-based biopharmaceuticals.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives