- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A079370

3 Stocks That May Be Priced Below Estimated Worth In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are navigating a landscape marked by tariff uncertainties and mixed economic signals. While U.S. stocks have faced recent declines due to trade tensions, European indices have shown resilience, and China's consumer spending has provided some positive momentum. In this environment, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer potential value amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.60 | CN¥33.16 | 49.9% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.97 | CN¥55.65 | 49.7% |

| National World (LSE:NWOR) | £0.225 | £0.45 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$89.90 | NT$179.40 | 49.9% |

| Celsius Holdings (NasdaqCM:CELH) | US$22.41 | US$44.68 | 49.8% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.20 | 49.7% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.24 | SEK165.67 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.03 | 49.7% |

| Kinaxis (TSX:KXS) | CA$165.40 | CA$330.68 | 50% |

| 29Metals (ASX:29M) | A$0.205 | A$0.41 | 49.9% |

Here's a peek at a few of the choices from the screener.

ZeusLtd (KOSDAQ:A079370)

Overview: Zeus Co., Ltd. offers semiconductor, robot, and display total solutions both in South Korea and internationally, with a market cap of ₩424.90 billion.

Operations: The company's revenue is primarily derived from its Equipment Division, generating ₩477.92 billion, complemented by its Valve segment contributing ₩23.54 billion.

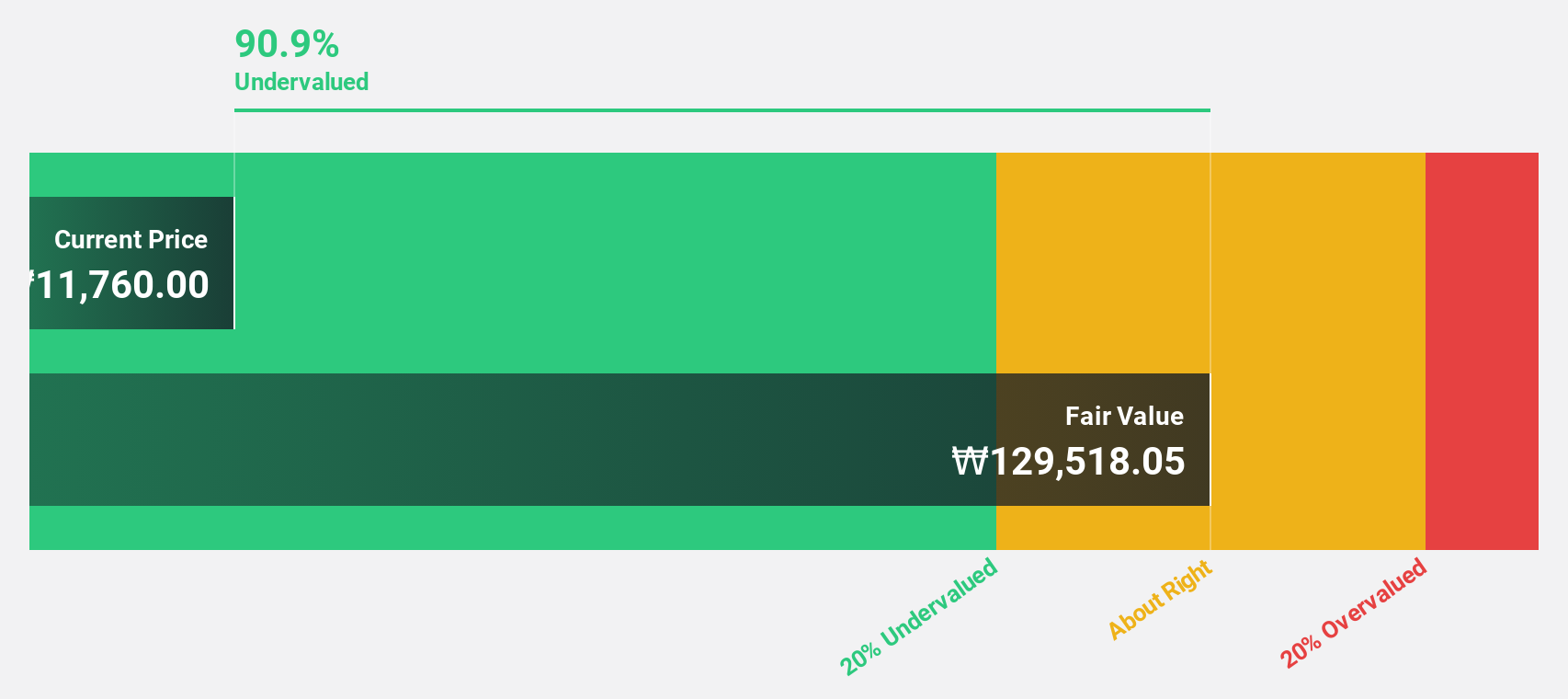

Estimated Discount To Fair Value: 28.6%

Zeus Ltd. appears undervalued based on cash flows, trading at 28.6% below its estimated fair value of ₩19,877.19 per share. Recent earnings reports show substantial profit growth, with net income rising from KRW 4.31 million to KRW 11.48 million year-over-year for Q3 2024, and a notable nine-month net income increase to KRW 23.21 million from KRW 2.80 million previously, highlighting strong financial performance despite slower revenue growth forecasts compared to peers.

- Our earnings growth report unveils the potential for significant increases in ZeusLtd's future results.

- Navigate through the intricacies of ZeusLtd with our comprehensive financial health report here.

Park Systems (KOSDAQ:A140860)

Overview: Park Systems Corp. develops, manufactures, and sells atomic force microscopy systems globally with a market cap of ₩1.61 trillion.

Operations: The company generates revenue primarily from its Scientific & Technical Instruments segment, amounting to ₩157.20 billion.

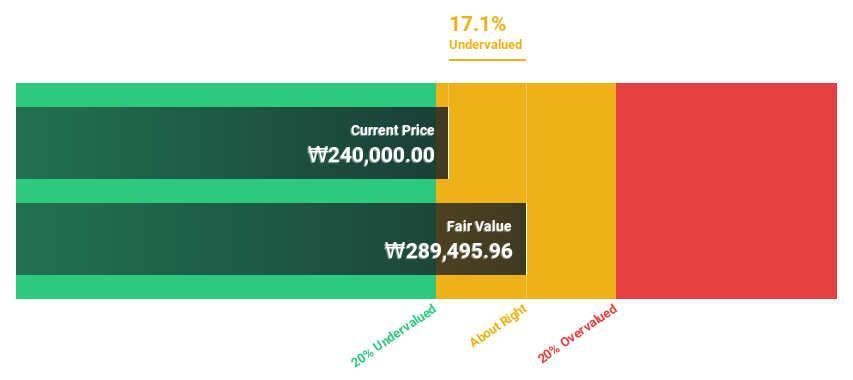

Estimated Discount To Fair Value: 15%

Park Systems is trading at ₩237,000, approximately 15% below its estimated fair value of ₩278,847.87. The company has shown strong financial performance with earnings growing by 25.7% last year and is expected to continue this trend with a forecasted annual growth rate of 35.3%, outpacing the KR market's average. Revenue growth is anticipated at 22.7% per year, supported by high-quality earnings and a projected return on equity of 25.7%.

- Our expertly prepared growth report on Park Systems implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Park Systems with our detailed financial health report.

GC Biopharma (KOSE:A006280)

Overview: GC Biopharma Corp. is a biopharmaceutical company that develops and sells pharmaceutical drugs both in South Korea and internationally, with a market cap of ₩1.54 trillion.

Operations: The company's revenue segments include ₩1.50 trillion from the manufacturing and sales of pharmaceuticals and ₩208.75 million from the diagnosis and analysis of samples, etc.

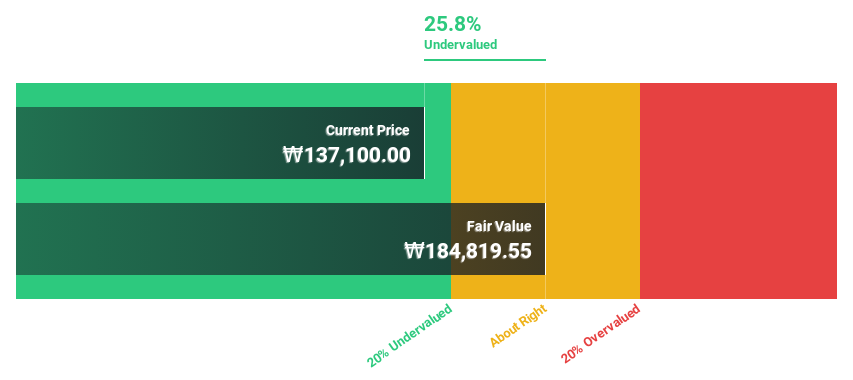

Estimated Discount To Fair Value: 24.9%

GC Biopharma is trading at ₩137,800, over 20% below its estimated fair value of ₩183,478.32. The company has demonstrated improved financial performance with net income rising significantly in recent quarters. Earnings are projected to grow by more than 100% annually, despite slower revenue growth compared to peers. Recent developments include the introduction of ALYGLO™ for primary immunodeficiency treatment and a multinational clinical trial for 'GC1130A', highlighting potential future revenue streams amidst current undervaluation based on cash flows.

- Our growth report here indicates GC Biopharma may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in GC Biopharma's balance sheet health report.

Key Takeaways

- Delve into our full catalog of 903 Undervalued Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZeusLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A079370

ZeusLtd

Provides semiconductor, robot, and display total solutions in South Korea and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives