- South Korea

- /

- Pharma

- /

- KOSE:A000230

Ildong Holdings (KRX:000230) shareholders are up 36% this past week, but still in the red over the last three years

It is doubtless a positive to see that the Ildong Holdings Co., Ltd. (KRX:000230) share price has gained some 41% in the last three months. Meanwhile over the last three years the stock has dropped hard. In that time, the share price dropped 56%. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

While the last three years has been tough for Ildong Holdings shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Ildong Holdings moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

The modest 0.9% dividend yield is unlikely to be guiding the market view of the stock. With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. There doesn't seem to be any clear correlation between the fundamental business metrics and the share price. That could mean that the stock was previously overrated, or it could spell opportunity now.

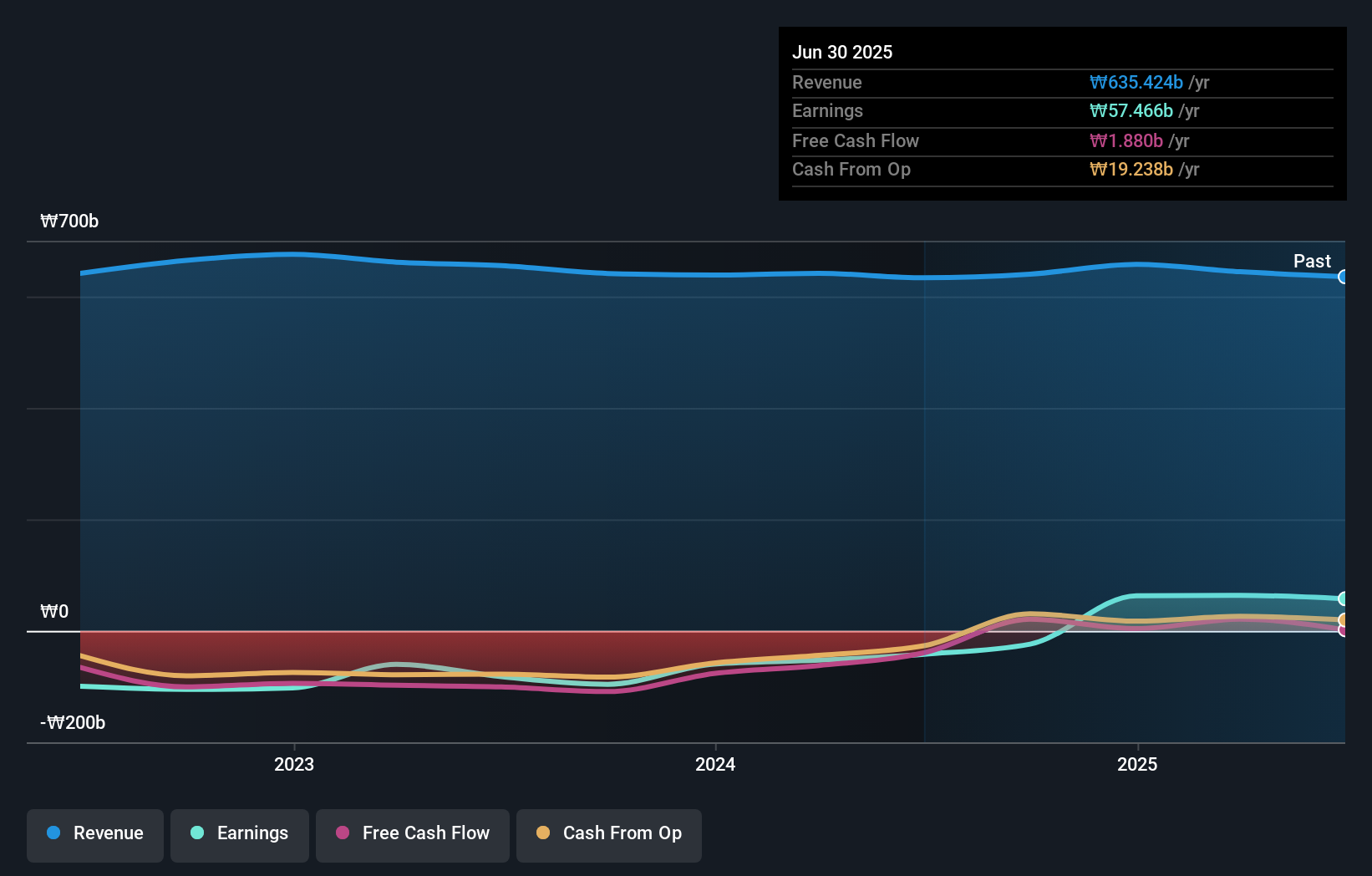

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Ildong Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Ildong Holdings provided a TSR of 52% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 5% over half a decade This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Ildong Holdings is showing 3 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000230

Ildong Holdings

Develops, manufactures, and supplies pharmaceutical products in South Korea and internationally.

Good value with acceptable track record.

Market Insights

Community Narratives