- South Korea

- /

- Biotech

- /

- KOSDAQ:A314130

Genome & Company's (KOSDAQ:314130) market cap up ₩32b last week, benefiting both individual investors who own 57% as well as insiders

Key Insights

- Genome's significant individual investors ownership suggests that the key decisions are influenced by shareholders from the larger public

- The top 12 shareholders own 43% of the company

- Insider ownership in Genome is 22%

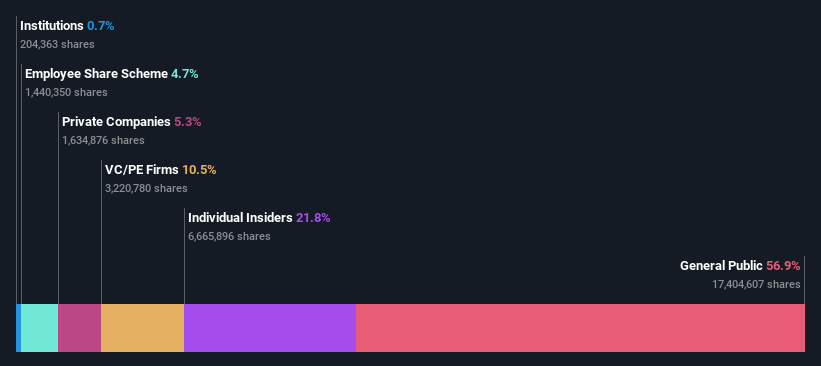

Every investor in Genome & Company (KOSDAQ:314130) should be aware of the most powerful shareholder groups. The group holding the most number of shares in the company, around 57% to be precise, is individual investors. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

Following a 31% increase in the stock price last week, individual investors profited the most, but insiders who own 22% stock also stood to gain from the increase.

Let's delve deeper into each type of owner of Genome, beginning with the chart below.

View our latest analysis for Genome

What Does The Lack Of Institutional Ownership Tell Us About Genome?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

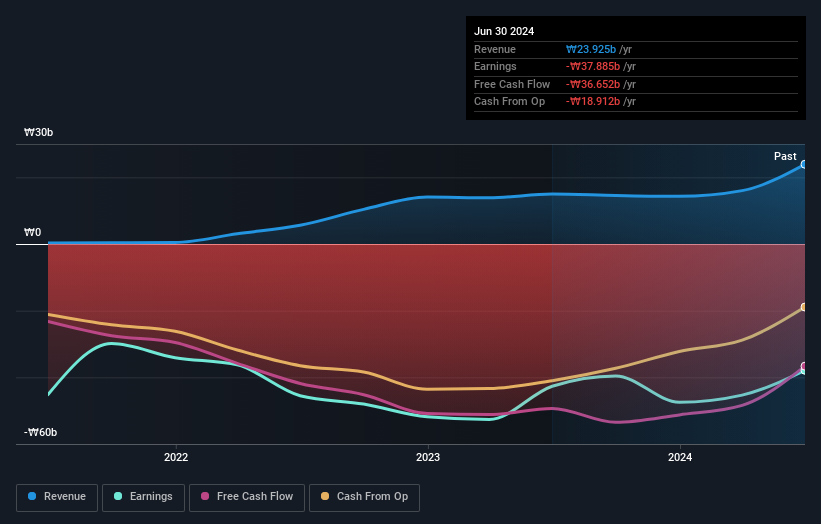

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. Alternatively, there might be something about the company that has kept institutional investors away. Genome's earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Genome is not owned by hedge funds. The company's largest shareholder is Han-Su Park, with ownership of 11%. Ji-Su Bae is the second largest shareholder owning 10% of common stock, and Intervest Open Innovation Private Equity Fund holds about 5.3% of the company stock.

A deeper look at our ownership data shows that the top 12 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Genome

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders maintain a significant holding in Genome & Company. It has a market capitalization of just ₩136b, and insiders have ₩30b worth of shares in their own names. We would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public -- including retail investors -- own 57% of Genome. This level of ownership gives investors from the wider public some power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Private Equity Ownership

With an ownership of 11%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Private Company Ownership

Our data indicates that Private Companies hold 5.3%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Genome better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Genome (including 1 which is significant) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A314130

Genome

A clinical stage biotechnology company, researches and develops novel-targeted immuno-oncology therapeutics in the field of immuno-oncology, skin diseases, and autism in South Korea.

Excellent balance sheet low.