- South Korea

- /

- Biotech

- /

- KOSDAQ:A298380

We Think ABL Bio (KOSDAQ:298380) Can Afford To Drive Business Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should ABL Bio (KOSDAQ:298380) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for ABL Bio

When Might ABL Bio Run Out Of Money?

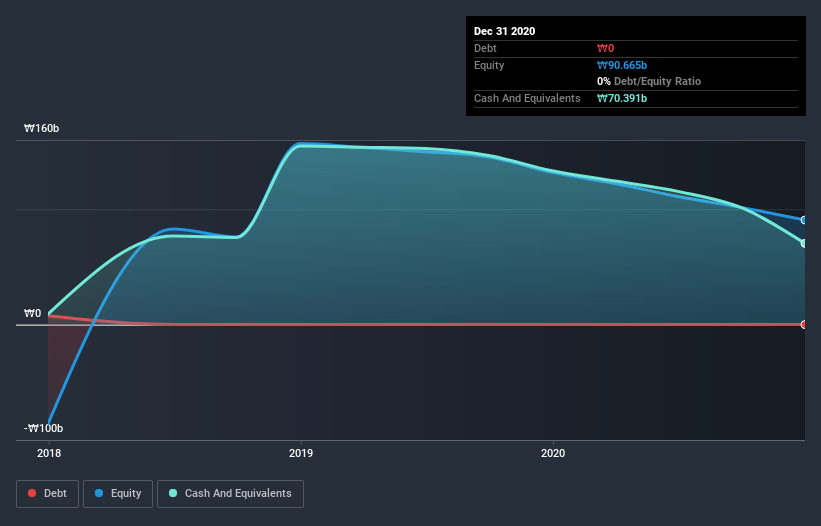

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When ABL Bio last reported its balance sheet in December 2020, it had zero debt and cash worth ₩70b. Importantly, its cash burn was ₩48b over the trailing twelve months. That means it had a cash runway of around 18 months as of December 2020. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. The image below shows how its cash balance has been changing over the last few years.

How Well Is ABL Bio Growing?

ABL Bio boosted investment sharply in the last year, with cash burn ramping by 72%. It seems likely that the vociferous operating revenue growth of 103% during that time may well have given management confidence to ramp investment. On balance, we'd say the company is improving over time. In reality, this article only makes a short study of the company's growth data. You can take a look at how ABL Bio is growing revenue over time by checking this visualization of past revenue growth.

How Easily Can ABL Bio Raise Cash?

While ABL Bio seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

ABL Bio's cash burn of ₩48b is about 4.6% of its ₩1.0t market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About ABL Bio's Cash Burn?

On this analysis of ABL Bio's cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Separately, we looked at different risks affecting the company and spotted 3 warning signs for ABL Bio (of which 1 is a bit concerning!) you should know about.

Of course ABL Bio may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading ABL Bio or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A298380

ABL Bio

A biotech research company, focuses on the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives