As global markets navigate a volatile landscape marked by fluctuating corporate earnings and competitive pressures in the AI sector, the technology-oriented Nasdaq Composite has experienced notable declines, reflecting broader market sentiment. In this environment, identifying high-growth tech stocks involves evaluating companies that are well-positioned to leverage innovation and maintain resilience amidst economic uncertainties and evolving industry dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ABL Bio Inc. is a biotech research company specializing in the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩1.84 billion.

Operations: ABL Bio Inc. generates revenue primarily from its biotechnology segment, specifically focusing on startups, with reported revenues of ₩32.32 million. The company operates within the biotech sector, targeting therapeutic solutions for immuno-oncology and neurodegenerative diseases.

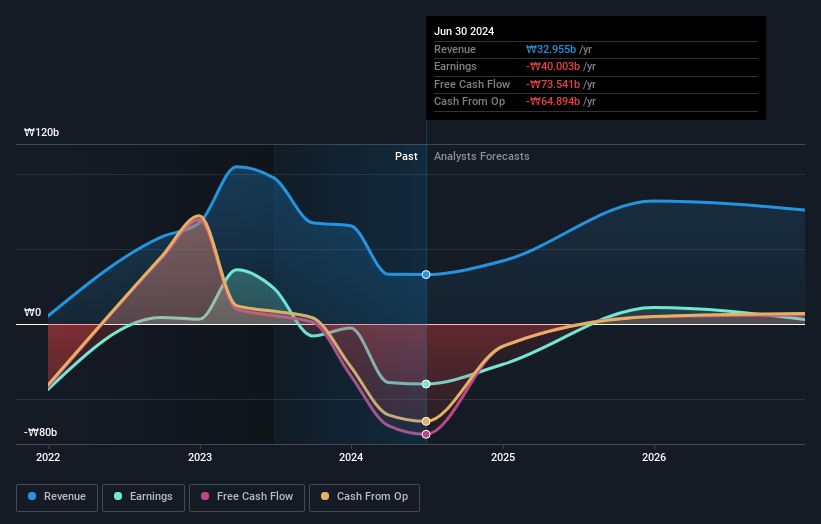

ABL Bio, despite its current unprofitability, is poised for significant growth with revenue expected to surge by 25.5% annually. This outpaces the broader KR market's 8.9% growth rate, highlighting its robust potential in a competitive landscape. The company's commitment to innovation is evident from recent discussions in special calls on January 17, 2025, where management detailed their R&D strategies and business plans for the upcoming year. Furthermore, earnings are projected to grow at an impressive rate of 50.32% per year, setting a promising trajectory towards profitability within three years. Despite a forecasted low return on equity of 9.1%, ABL Bio’s aggressive growth strategy and R&D focus suggest it could soon redefine benchmarks in its sector.

- Dive into the specifics of ABL Bio here with our thorough health report.

Review our historical performance report to gain insights into ABL Bio's's past performance.

Taiji Computer (SZSE:002368)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taiji Computer Corporation Limited operates as a software and information technology service company with a market cap of CN¥15.44 billion.

Operations: The company generates revenue primarily from software development and IT services. Its cost structure is largely influenced by R&D expenses and personnel costs. The net profit margin has shown variability over recent periods, reflecting fluctuations in operational efficiency and market conditions.

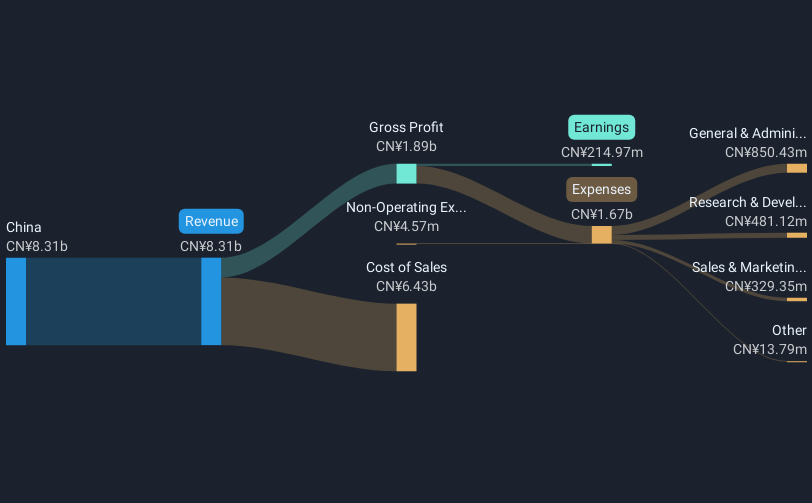

Taiji Computer's strategic positioning in the tech industry is underscored by its robust earnings growth forecast at 37.2% annually, significantly outpacing the broader CN market's 25.1%. Despite a challenging past year with earnings contraction of 45%, the firm's focus on innovation is evident from its R&D commitment, which remains critical as it navigates below-market revenue growth projections of 16.6% compared to the market average of 13.5%. The recent appointment considerations for a new audit firm highlight governance adjustments potentially aimed at bolstering future financial health and transparency amidst these dynamic conditions.

- Click to explore a detailed breakdown of our findings in Taiji Computer's health report.

Gain insights into Taiji Computer's historical performance by reviewing our past performance report.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing SuperMap Software Co., Ltd. offers geographic information system and spatial intelligence software products and services both in China and internationally, with a market cap of CN¥8.44 billion.

Operations: The company generates revenue through the sale of geographic information system and spatial intelligence software products and services. It operates both domestically in China and internationally, serving a diverse client base.

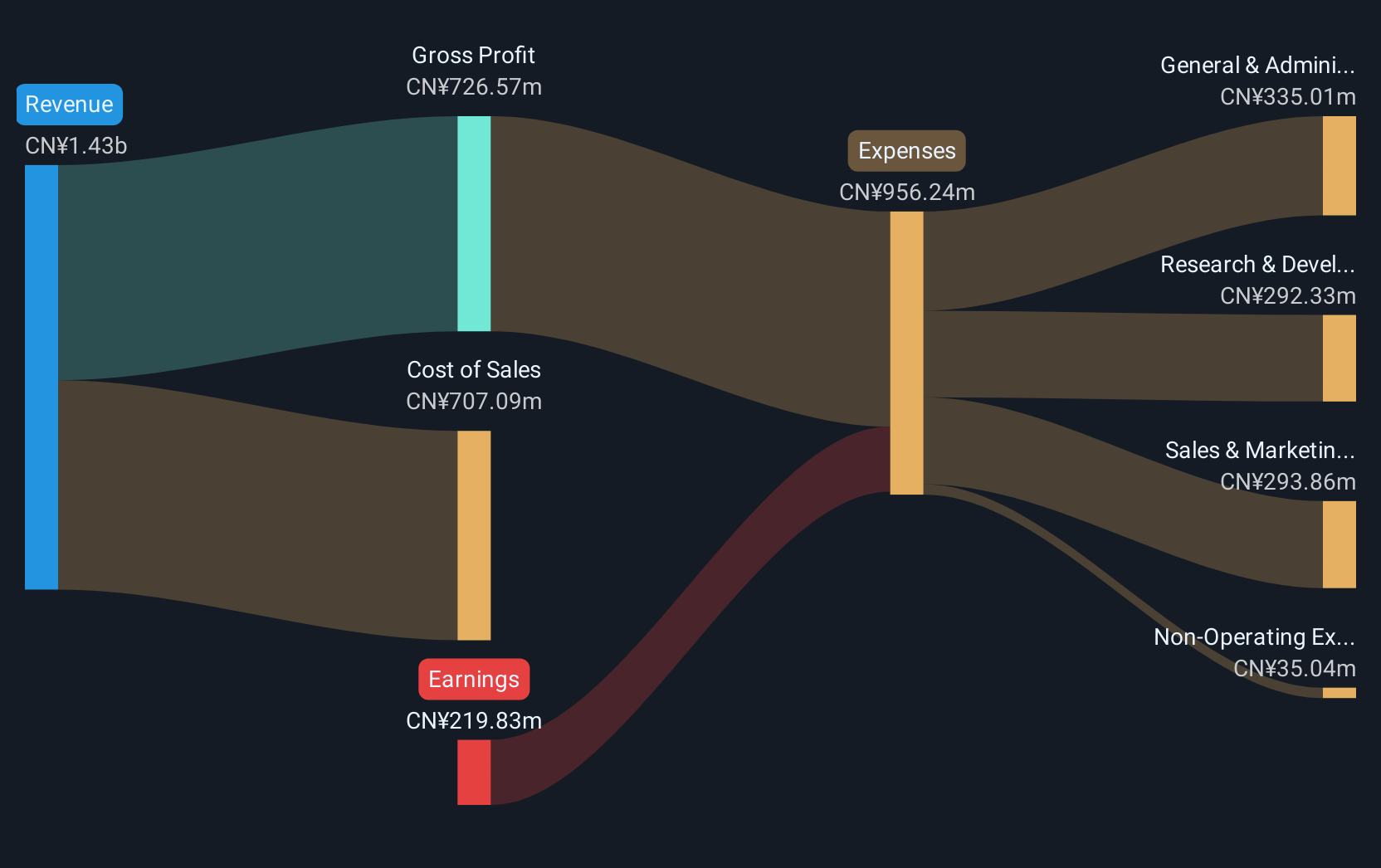

Beijing SuperMap Software is distinguishing itself in the tech sector with an impressive annual revenue growth rate of 24.4%, surpassing the broader Chinese market's average of 13.5%. This growth is complemented by a remarkable forecast in earnings increase at 54.2% annually, which also exceeds market expectations of 25.1%. Despite these strong financial metrics, the company faces challenges, as indicated by its recent extraordinary shareholders meeting to address changes in accounting estimates, suggesting a focus on refining financial strategies and governance. These developments underscore Beijing SuperMap's potential to adapt and thrive amidst evolving industry demands while maintaining a competitive edge through strategic adjustments and robust growth metrics.

Seize The Opportunity

- Explore the 1226 names from our High Growth Tech and AI Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Beijing SuperMap Software, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing SuperMap Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300036

Beijing SuperMap Software

Provides geographic information system and spatial intelligence software products and services in China and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives