- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A278650

Investors Who Bought KNOTUSLtd (KOSDAQ:278650) Shares A Year Ago Are Now Up 26%

The KNOTUS Co.,Ltd (KOSDAQ:278650) share price has had a bad week, falling 14%. Taking a longer term view we see the stock is up over one year. But to be blunt its return of 26% fall short of what you could have got from an index fund (around 45%).

View our latest analysis for KNOTUSLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

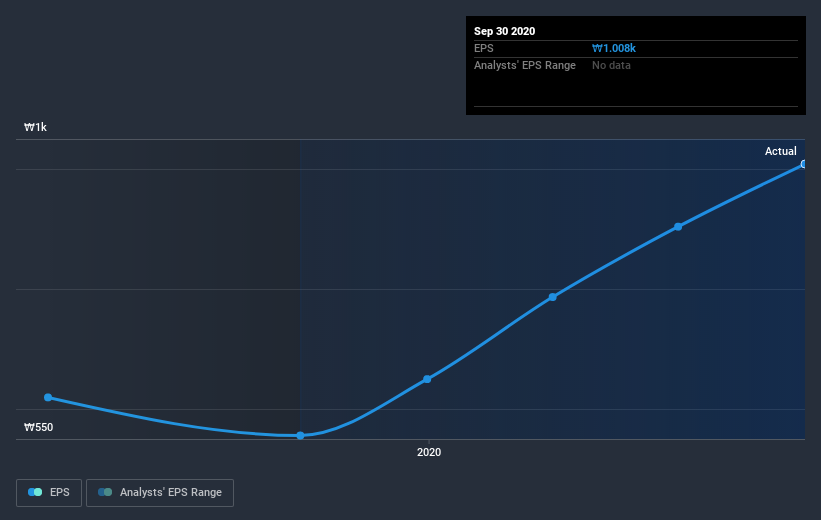

During the last year KNOTUSLtd grew its earnings per share (EPS) by 81%. This EPS growth is significantly higher than the 26% increase in the share price. Therefore, it seems the market isn't as excited about KNOTUSLtd as it was before. This could be an opportunity.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

KNOTUSLtd shareholders have gained 26% for the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 45%. The stock trailed the market by 17% in that time, testament to the power of passive investing. But a weak quarter certainly doesn't diminish the longer-term achievements of the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with KNOTUSLtd , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading KNOTUSLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HLB bioStepLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A278650

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives