- South Korea

- /

- Biotech

- /

- KOSDAQ:A263050

Further weakness as Eutilex.Co.Ltd (KOSDAQ:263050) drops 11% this week, taking five-year losses to 83%

Eutilex.Co.,Ltd (KOSDAQ:263050) shareholders will doubtless be very grateful to see the share price up 35% in the last quarter. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. In fact, the share price has tumbled down a mountain to land 86% lower after that period. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since Eutilex.Co.Ltd has shed ₩12b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Eutilex.Co.Ltd

Eutilex.Co.Ltd recorded just ₩3,035,310,940 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Eutilex.Co.Ltd comes up with a great new product, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Eutilex.Co.Ltd investors have already had a taste of the bitterness stocks like this can leave in the mouth.

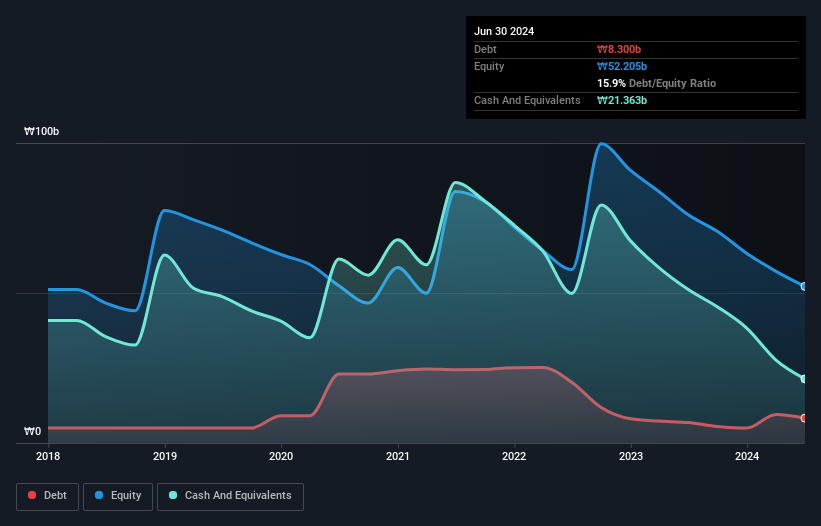

When it reported in June 2024 Eutilex.Co.Ltd had minimal cash in excess of all liabilities consider its expenditure: just ₩7.7b to be specific. So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. With that in mind, you can understand why the share price dropped 13% per year, over 5 years. You can see in the image below, how Eutilex.Co.Ltd's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

What About The Total Shareholder Return (TSR)?

We've already covered Eutilex.Co.Ltd's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Eutilex.Co.Ltd's TSR, at -83% is higher than its share price return of -86%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While the broader market gained around 7.0% in the last year, Eutilex.Co.Ltd shareholders lost 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 13% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 6 warning signs for Eutilex.Co.Ltd (3 are a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Eutilex.Co.Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A263050

Eutilex.Co.Ltd

Engages in the discovery and development of immunomodulatory antibody therapeutics to treat cancers and autoimmune diseases.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives