- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A245620

Eone Diagnomics Genome Center (KOSDAQ:245620) Is Carrying A Fair Bit Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Eone Diagnomics Genome Center Co., Ltd. (KOSDAQ:245620) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Eone Diagnomics Genome Center

What Is Eone Diagnomics Genome Center's Net Debt?

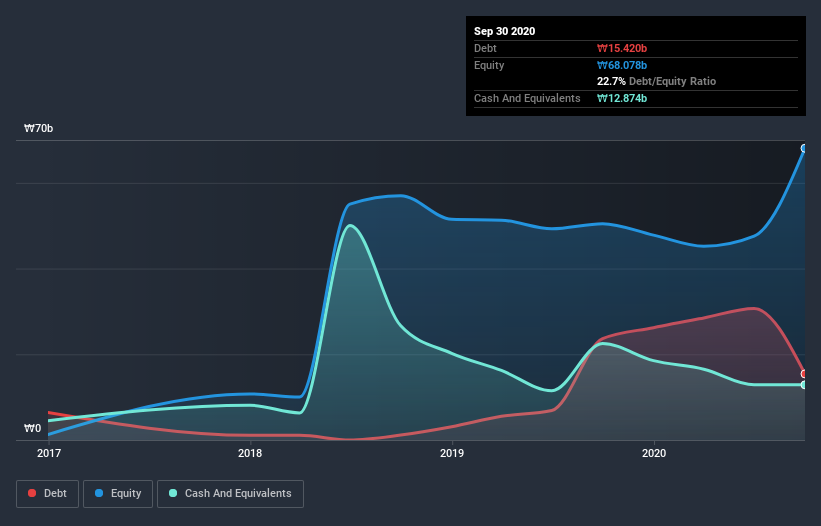

You can click the graphic below for the historical numbers, but it shows that Eone Diagnomics Genome Center had ₩15.4b of debt in September 2020, down from ₩23.6b, one year before. On the flip side, it has ₩12.9b in cash leading to net debt of about ₩2.55b.

How Strong Is Eone Diagnomics Genome Center's Balance Sheet?

We can see from the most recent balance sheet that Eone Diagnomics Genome Center had liabilities of ₩31.2b falling due within a year, and liabilities of ₩7.62b due beyond that. On the other hand, it had cash of ₩12.9b and ₩20.2b worth of receivables due within a year. So it has liabilities totalling ₩5.75b more than its cash and near-term receivables, combined.

This state of affairs indicates that Eone Diagnomics Genome Center's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the ₩392.9b company is short on cash, but still worth keeping an eye on the balance sheet. Carrying virtually no net debt, Eone Diagnomics Genome Center has a very light debt load indeed. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Eone Diagnomics Genome Center will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Eone Diagnomics Genome Center wasn't profitable at an EBIT level, but managed to grow its revenue by 46%, to ₩81b. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Despite the top line growth, Eone Diagnomics Genome Center still had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at ₩6.7b. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through ₩12b of cash over the last year. So to be blunt we think it is risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Eone Diagnomics Genome Center you should be aware of, and 2 of them are a bit concerning.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Eone Diagnomics Genome Center or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eone Diagnomics Genome Center might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A245620

Eone Diagnomics Genome Center

Provides genetic information analysis services in South Korea.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.