- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A238120

If You Like EPS Growth Then Check Out Aligned Genetics (KOSDAQ:238120) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Aligned Genetics (KOSDAQ:238120), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Aligned Genetics

Aligned Genetics's Improving Profits

In the last three years Aligned Genetics's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Aligned Genetics's EPS shot from ₩32.22 to ₩90.00, over the last year. Year on year growth of 179% is certainly a sight to behold.

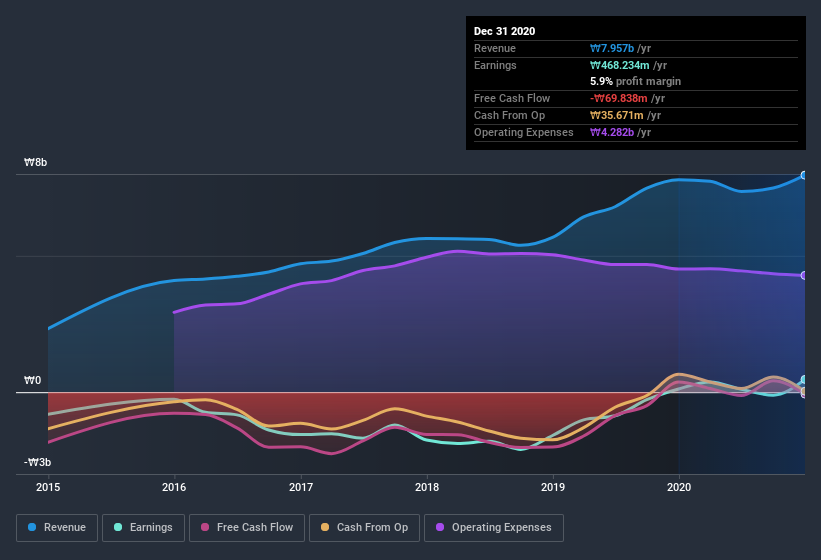

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Aligned Genetics maintained stable EBIT margins over the last year, all while growing revenue 2.1% to ₩8.0b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Aligned Genetics is no giant, with a market capitalization of ₩59b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Aligned Genetics Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Aligned Genetics shares worth a considerable sum. To be specific, they have ₩19b worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 32% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Aligned Genetics Deserve A Spot On Your Watchlist?

Aligned Genetics's earnings have taken off like any random crypto-currency did, back in 2017. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Aligned Genetics for a spot on your watchlist. Still, you should learn about the 2 warning signs we've spotted with Aligned Genetics .

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Aligned Genetics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A238120

Aligned Genetics

Offers cellular imaging and biomolecular analysis solutions worldwide.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives