PharmaResearch And 2 Other Stocks That Could Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate a period of mixed signals, with U.S. consumer confidence dipping and European stocks showing resilience, investors are keenly observing potential opportunities amid fluctuating indices. In this environment, identifying undervalued stocks becomes crucial as they may offer promising prospects for those looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7288.65 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| GlobalData (AIM:DATA) | £1.875 | £3.74 | 49.8% |

| Atlas Arteria (ASX:ALX) | A$4.83 | A$9.64 | 49.9% |

| Cettire (ASX:CTT) | A$1.51 | A$3.01 | 49.9% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.53 | CN¥9.01 | 49.7% |

| Merus Power Oyj (HLSE:MERUS) | €3.71 | €7.39 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.05 | US$129.48 | 49.8% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.53 | CN¥126.49 | 49.8% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.88 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

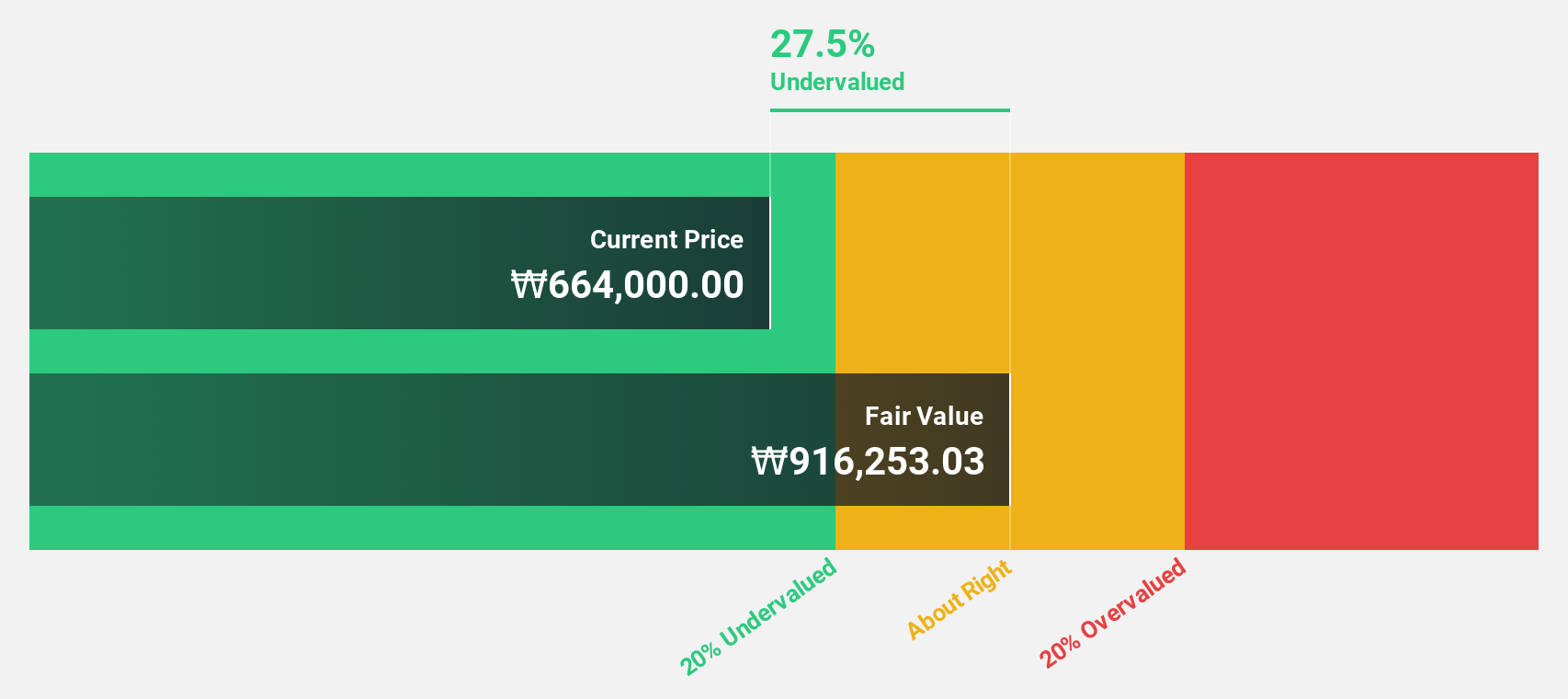

PharmaResearch (KOSDAQ:A214450)

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating primarily in South Korea, with a market capitalization of ₩2.73 trillion.

Operations: The company's revenue primarily comes from its pharmaceuticals segment, totaling ₩316.99 billion.

Estimated Discount To Fair Value: 38.5%

PharmaResearch is trading at ₩262,500, significantly below its estimated fair value of ₩427.13K, suggesting it may be undervalued based on cash flows. Despite earnings forecasted to grow 27.95% annually over the next three years, this growth is slightly slower than the Korean market's average. However, revenue growth is expected to outpace the market significantly at 24.2% per year. Recent private placements could impact future financial strategies and valuations.

- Our comprehensive growth report raises the possibility that PharmaResearch is poised for substantial financial growth.

- Navigate through the intricacies of PharmaResearch with our comprehensive financial health report here.

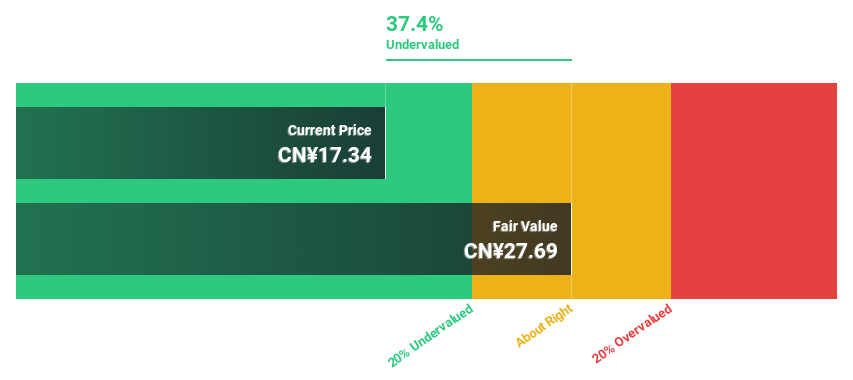

NBTM New Materials Group (SHSE:600114)

Overview: NBTM New Materials Group Co., Ltd. produces and sells powder metallurgy mechanical parts globally, with a market cap of CN¥10.39 billion.

Operations: The company generates revenue from the production and sale of powder metallurgy mechanical parts on a global scale.

Estimated Discount To Fair Value: 46.1%

NBTM New Materials Group is trading at CN¥16.85, considerably below its fair value estimate of CN¥31.29, highlighting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 26.35% annually over the next three years, outpacing the Chinese market average. Despite this growth trajectory, return on equity is forecasted to remain modest at 17.5%. Recent earnings reports show substantial profit growth with net income reaching CN¥276.66 million for nine months ending September 2024.

- Our expertly prepared growth report on NBTM New Materials Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of NBTM New Materials Group stock in this financial health report.

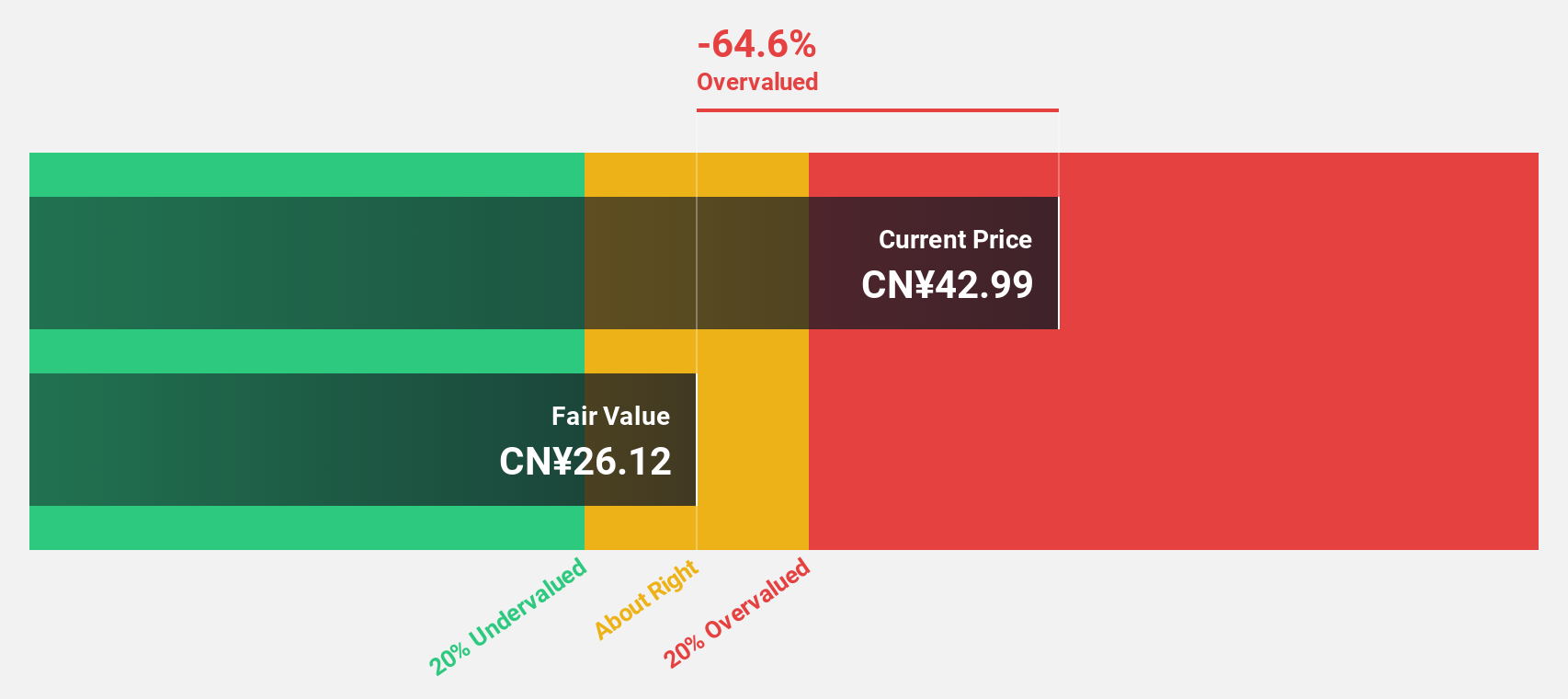

Haisco Pharmaceutical Group (SZSE:002653)

Overview: Haisco Pharmaceutical Group Co., Ltd. engages in the research, development, manufacturing, and sale of pharmaceuticals in China with a market cap of approximately CN¥37.94 billion.

Operations: Haisco Pharmaceutical Group Co., Ltd. generates revenue through its core activities of researching, developing, manufacturing, and selling pharmaceuticals within China.

Estimated Discount To Fair Value: 38.6%

Haisco Pharmaceutical Group's current trading price of CN¥34.2 is significantly below its estimated fair value of CN¥55.7, suggesting undervaluation based on cash flows. The company's earnings and revenue are forecasted to grow substantially at 35.7% and 23% annually, respectively, outpacing the broader Chinese market. Recent earnings reports reveal strong financial performance with net income rising to CNY 381.82 million for the nine months ending September 2024, despite low return on equity projections at 16.1%.

- Our earnings growth report unveils the potential for significant increases in Haisco Pharmaceutical Group's future results.

- Click here to discover the nuances of Haisco Pharmaceutical Group with our detailed financial health report.

Turning Ideas Into Actions

- Access the full spectrum of 886 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haisco Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002653

Haisco Pharmaceutical Group

Research, develops, manufactures, and sells pharmaceuticals in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives