- South Korea

- /

- Entertainment

- /

- KOSE:A352820

High Growth Tech Stocks in South Korea with Promising Potential

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has experienced a decline of 2.8%, yet it has shown resilience with a 4.7% increase over the past year, and earnings are projected to grow by 30% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these promising market conditions.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩19.10 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 billion. It focuses on developing innovative biopharmaceutical products such as long-acting biobetters and antibody-drug conjugates.

With a projected annual revenue growth of 64.2%, ALTEOGEN is outpacing the South Korean market's average by a significant margin, which stands at just 10.5%. This surge is underpinned by its recent MFDS approval for Tergase®, developed using proprietary Hybrozyme™ Technology, promising over 99% purity and lower immunogenicity compared to existing products. The company's focus on R&D has led to an impressive forecast of earnings growth at 99.46% annually, positioning it well for future profitability despite current unprofitability and high market volatility. This strategic emphasis on high-quality biotechnological advancements could reshape competitive dynamics in biotech sectors beyond traditional applications, enhancing ALTEOGEN’s commercial prospects significantly.

- Click here and access our complete health analysis report to understand the dynamics of ALTEOGEN.

Review our historical performance report to gain insights into ALTEOGEN's's past performance.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd. operates as a biopharmaceutical company primarily in South Korea, with a market capitalization of ₩2.22 trillion.

Operations: The company's primary revenue stream is from its pharmaceuticals segment, generating ₩296.59 billion.

PharmaResearch's recent private placement of shares at KRW 170,119 each, totaling nearly KRW 200 billion, underscores its aggressive capital strategy to fuel R&D and expansion. With a revenue growth forecast at 22.1% annually, outpacing the South Korean market average of 10.5%, the company is strategically positioned to leverage its innovations in biotechnology. Despite slower earnings growth projections at 22.2% compared to the broader market's 29.9%, PharmaResearch's commitment to high-quality earnings and substantial investment in research (reflected in their significant R&D expenses) could enhance its competitive edge in a rapidly evolving industry landscape.

- Click to explore a detailed breakdown of our findings in PharmaResearch's health report.

Explore historical data to track PharmaResearch's performance over time in our Past section.

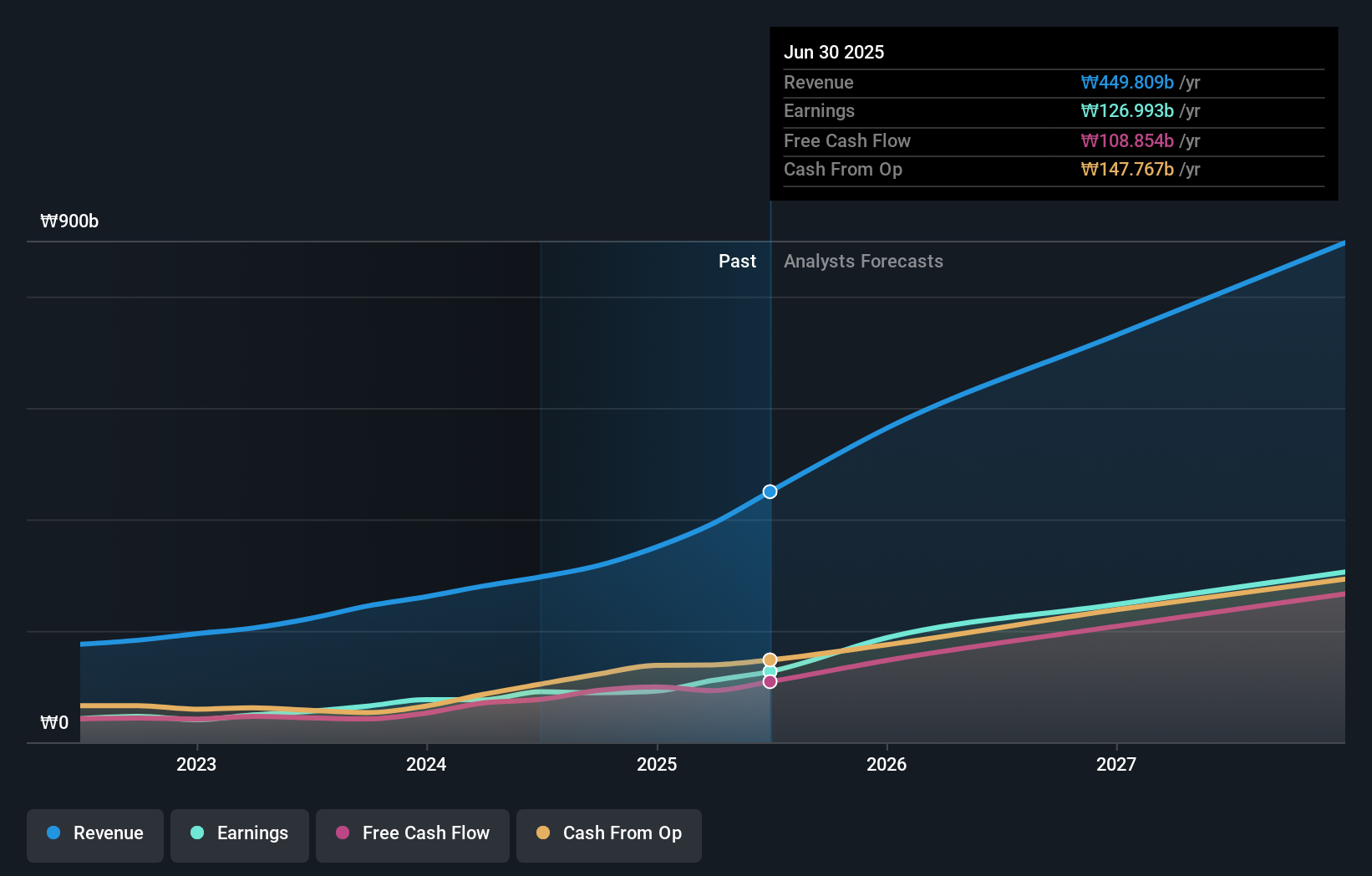

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market cap of ₩7.23 trillion.

Operations: The company generates revenue primarily through its Label and Solution segments, with the Label segment contributing ₩1.28 trillion and the Solution segment adding ₩1.24 trillion. The Platform segment provides additional income of ₩361.12 billion, while internal transactions reduce overall revenue by ₩732.08 billion.

HYBE's strategic focus on innovation is evident from its substantial investment in R&D, which aligns with a robust earnings forecast of 42% annual growth. This commitment to research not only fuels technological advancements but also significantly outpaces the broader Korean market's growth expectations. Moreover, the company recently completed a share repurchase program valued at KRW 26.09 billion, underscoring confidence in its financial stability and future prospects. These actions reflect HYBE’s proactive approach in maintaining its competitive edge within the high-growth tech sector of South Korea, leveraging both financial strategies and continuous innovation to stay ahead.

Key Takeaways

- Access the full spectrum of 48 KRX High Growth Tech and AI Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Excellent balance sheet with reasonable growth potential.