- South Korea

- /

- Entertainment

- /

- KOSDAQ:A122870

High Growth Tech Stocks In South Korea This October 2024

Reviewed by Simply Wall St

The South Korean stock market has recently experienced fluctuations, with the KOSPI index hovering just above the 2,580-point mark after a mixed performance influenced by global earnings reports and sector-specific movements. In this environment of uncertainty and potential growth, identifying high-growth tech stocks requires careful consideration of their adaptability to market dynamics and resilience in the face of broader economic challenges.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 27.44% | 69.62% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 22.96% | 33.25% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 47 stocks from our KRX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

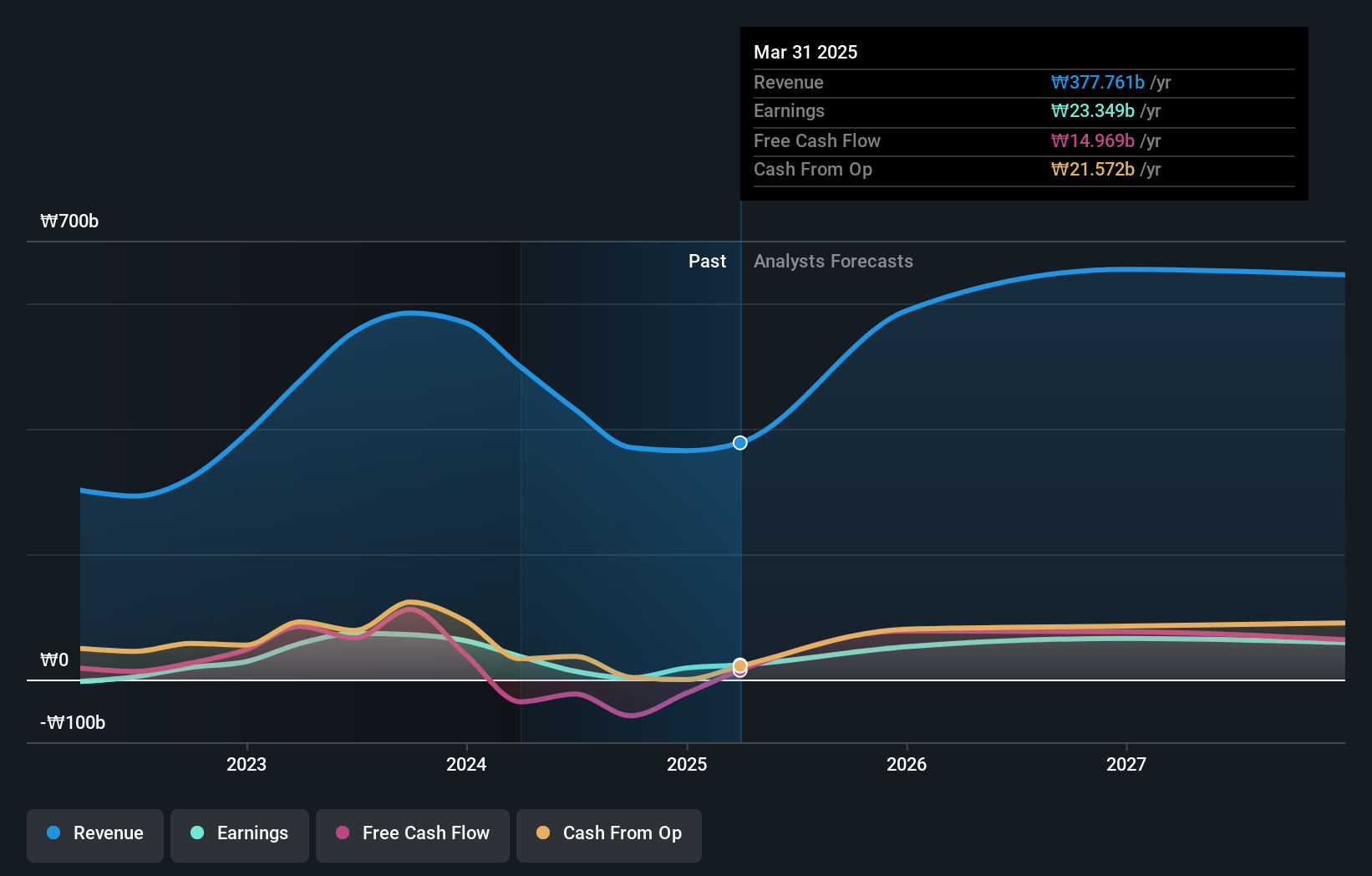

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YG Entertainment Inc. is an entertainment company operating in South Korea, Japan, and internationally, with a market cap of ₩772.48 billion.

Operations: The company generates revenue primarily from its entertainment segment, totaling approximately ₩493.91 billion.

YG Entertainment, amidst a challenging quarter with a significant net loss of KRW 1,924.89 million from KRW 21,719.77 million net income year-over-year, still forecasts robust future growth. Despite the recent dip in earnings and sales—KRW 0.00003 million this quarter compared to KRW 0.00002 million in the previous year—the company is expected to see its revenue increase by an impressive 17.6% annually and earnings potentially skyrocket by 65.4% per year over the next three years. This optimistic outlook is supported by substantial planned increases in R&D spending aimed at innovating within the entertainment sector, which could significantly enhance its competitive edge and market position.

- Delve into the full analysis health report here for a deeper understanding of YG Entertainment.

Understand YG Entertainment's track record by examining our Past report.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating primarily in South Korea, with a market cap of ₩2.38 trillion.

Operations: PharmaResearch, along with its subsidiaries, focuses on the biopharmaceutical sector in South Korea, generating revenue primarily from pharmaceuticals amounting to ₩296.59 billion.

PharmaResearch, a South Korean biotech firm, is navigating the competitive landscape with robust R&D investments and strategic private placements. In 2024, the company announced an issuance of over 1.17 million shares at KRW 170,119 each, amassing nearly KRW 200 billion in proceeds aimed at bolstering its research capabilities. This financial injection is critical as PharmaResearch's earnings are anticipated to surge by an impressive 22.2% annually. Moreover, their revenue growth projection stands at a notable 22.3% per year, outpacing the broader Korean market's average of 10.3%. These figures underscore a strategic emphasis on innovation and market expansion through significant reinvestment in R&D—essential for maintaining competitive advantage in the fast-evolving biotech sector.

- Get an in-depth perspective on PharmaResearch's performance by reading our health report here.

Explore historical data to track PharmaResearch's performance over time in our Past section.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩8.08 trillion.

Operations: The company generates revenue primarily through three segments: Label, Platform, and Solution. The Label segment leads with ₩1.28 trillion, followed by the Solution segment at ₩1.24 trillion, while the Platform segment contributes ₩361.12 billion to their earnings model.

HYBE, a South Korean entertainment conglomerate, is demonstrating significant growth with its earnings forecast to increase by 42.5% annually. This performance surpasses the industry's average growth of 7.3%, highlighting HYBE's competitive edge in a vibrant market. Recently, the company has strategically utilized private placements and share buybacks to reinforce financial stability and investor confidence; for instance, it repurchased 150,000 shares at KRW 26 billion in September 2024. Moreover, HYBE's commitment to innovation is evident from its R&D investments which are crucial for sustaining long-term growth in the fast-paced tech sector.

- Click here to discover the nuances of HYBE with our detailed analytical health report.

Review our historical performance report to gain insights into HYBE's's past performance.

Summing It All Up

- Navigate through the entire inventory of 47 KRX High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A122870

YG Entertainment

Operates as an entertainment company in South Korea, Japan, and internationally.

High growth potential with excellent balance sheet.