- South Korea

- /

- Biotech

- /

- KOSDAQ:A214450

High Growth Tech Stocks in South Korea for October 2024

Reviewed by Simply Wall St

In the last week, the South Korean market has been flat, but over the past 12 months, it has risen by 6.3%, with earnings forecasted to grow by 30% annually. In this context of steady growth and promising earnings potential, identifying high-growth tech stocks becomes essential for investors seeking to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of ₩19.10 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, totaling ₩90.79 billion. Its focus on innovative biotechnological solutions positions it within a specialized market niche.

ALTEOGEN, a South Korean biotech firm, recently marked a significant stride in its growth trajectory with the MFDS's approval of Tergase®, showcasing over 99% purity and versatility in medical applications. This approval could expand market opportunities beyond traditional uses of animal-derived hyaluronidases. Financially, ALTEOGEN is navigating through unprofitability with a sharp focus on R&D investment, which is evident from its substantial revenue growth forecast at 64.2% annually. Despite current financial losses and share dilution over the past year, the company's aggressive R&D strategy aligns with an expected surge in earnings by nearly 99.5% per year, positioning it potentially above average market growth projections for profitability within three years.

- Delve into the full analysis health report here for a deeper understanding of ALTEOGEN.

Review our historical performance report to gain insights into ALTEOGEN's's past performance.

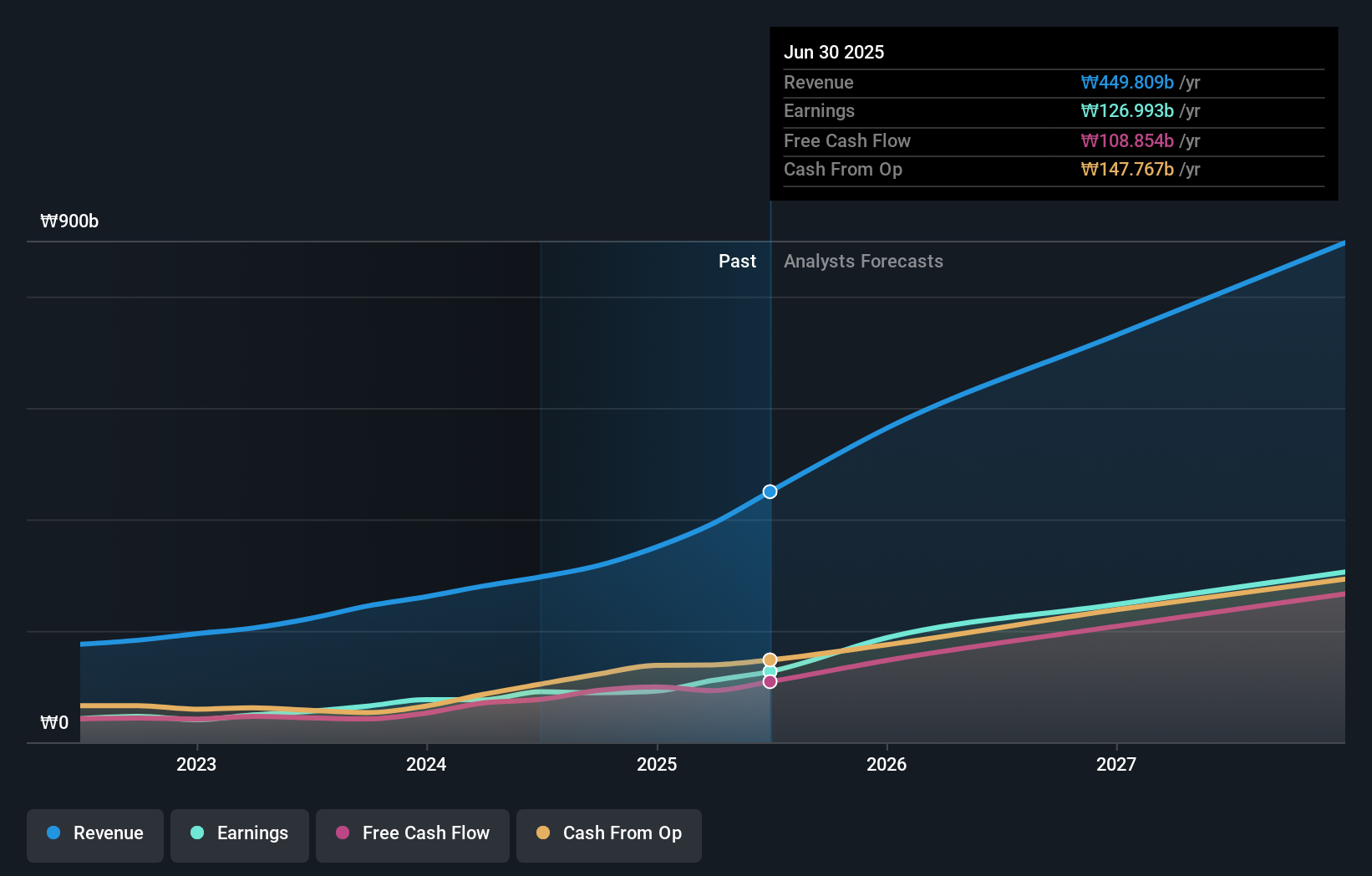

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating primarily in South Korea, with a market cap of ₩2.22 trillion.

Operations: PharmaResearch Co., Ltd. generates its revenue primarily from the Pharmaceuticals segment, amounting to ₩296.59 billion.

PharmaResearch, amidst a vibrant South Korean tech landscape, is steering towards robust growth with projected annual revenue and earnings increases of 22.1% and 22.2%, respectively. This growth trajectory is underpinned by a strategic emphasis on R&D, which not only fuels innovation but also aligns with broader industry trends towards enhanced pharmaceutical solutions. The recent private placement of over KRW 199 billion underscores a commitment to leveraging financial flexibility for further development, despite the competitive pressures and high expectations set by its peers in the biotech sector. With its focus on expanding capabilities and enhancing market reach, PharmaResearch is poised to capitalize on emerging opportunities within the high-growth tech sphere in South Korea.

- Click to explore a detailed breakdown of our findings in PharmaResearch's health report.

Examine PharmaResearch's past performance report to understand how it has performed in the past.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market capitalization of ₩7.23 trillion.

Operations: HYBE generates revenue primarily through its Label and Solution segments, contributing ₩1.28 trillion and ₩1.24 trillion respectively. The Platform segment adds an additional ₩361.12 billion to the company's revenue streams.

HYBE, a South Korean entertainment powerhouse, is navigating through a dynamic tech landscape with its recent share repurchase initiative aimed at stabilizing stock prices. Amidst this financial maneuvering, the company reported a notable 21.6% growth in earnings over the past year and forecasts an impressive 42% annual growth rate moving forward. Despite facing challenges marked by significant one-off losses amounting to ₩189.4 billion, HYBE's strategic focus on innovation and market expansion is underscored by its commitment to R&D spending, which aligns with its revenue growth projections of 14% annually—outpacing the broader Korean market's expectation of 10.5%. This blend of aggressive financial strategies and robust growth metrics positions HYBE uniquely within South Korea's high-tech entertainment sector as it continues to evolve and adapt to shifting industry dynamics.

- Get an in-depth perspective on HYBE's performance by reading our health report here.

Gain insights into HYBE's historical performance by reviewing our past performance report.

Where To Now?

- Gain an insight into the universe of 48 KRX High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214450

PharmaResearch

Operates as a biopharmaceutical company primarily in South Korea.

Flawless balance sheet with high growth potential.