- South Korea

- /

- Entertainment

- /

- KOSE:A352820

Exploring Three High Growth Tech Stocks in South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has remained flat, yet it has seen a notable increase of 6.4% over the past year with earnings forecasted to grow by 31% annually. In this context, identifying high growth tech stocks that align with these positive earnings projections can be crucial for investors seeking opportunities in this dynamic sector.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩19.60 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 million. With a market cap of approximately ₩19.60 billion, it focuses on innovative biotechnological solutions such as long-acting biobetters and antibody biosimilars.

In the dynamic landscape of South Korea's tech sector, ALTEOGEN stands out with its impressive projected revenue growth at 64.2% annually, eclipsing the broader KR market's 10.5% pace. Despite current unprofitability, forecasts suggest a robust turnaround with earnings potentially surging by 99.46% each year over the next three years. This optimism is underpinned by substantial R&D investments that align well with industry trends towards advanced biotechnologies—a sector where innovation directly fuels growth potential and competitive edge. However, shareholders have experienced dilution in the past year, a factor that might temper immediate enthusiasm but is counterbalanced by strong future ROE projections of 66.3%, signaling promising financial health ahead if these aggressive growth targets are met.

- Take a closer look at ALTEOGEN's potential here in our health report.

Explore historical data to track ALTEOGEN's performance over time in our Past section.

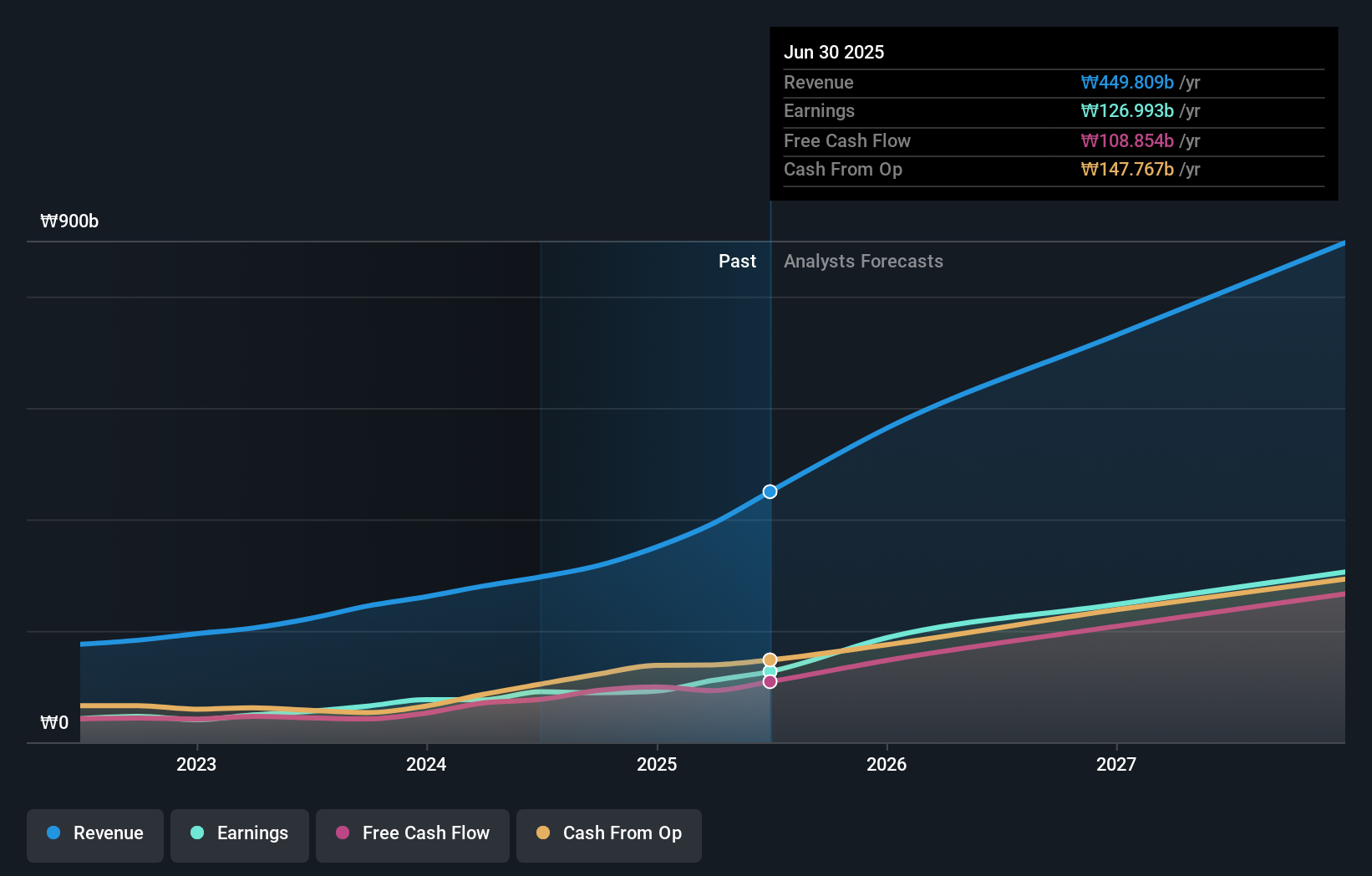

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, functions as a biopharmaceutical company mainly in South Korea, with a market cap of ₩2.15 trillion.

Operations: PharmaResearch Co., Ltd. generates revenue primarily from its pharmaceuticals segment, amounting to ₩296.59 billion.

PharmaResearch is navigating South Korea's competitive tech landscape with a notable focus on R&D, dedicating 22.3% of its revenue to these efforts, which is pivotal in driving its projected annual earnings growth of 22.2%. This strategic allocation underscores its commitment to innovation, particularly following its recent private placement aimed at bolstering research capabilities. With earnings having surged by 63.2% over the past year, PharmaResearch's aggressive investment in development positions it well amidst industry shifts towards more advanced biotechnologies. Despite facing challenges like shareholder dilution from new share issues, the company’s robust R&D funding and strong financial forecasts suggest promising avenues for sustained growth and industry impact.

- Click here to discover the nuances of PharmaResearch with our detailed analytical health report.

Understand PharmaResearch's track record by examining our Past report.

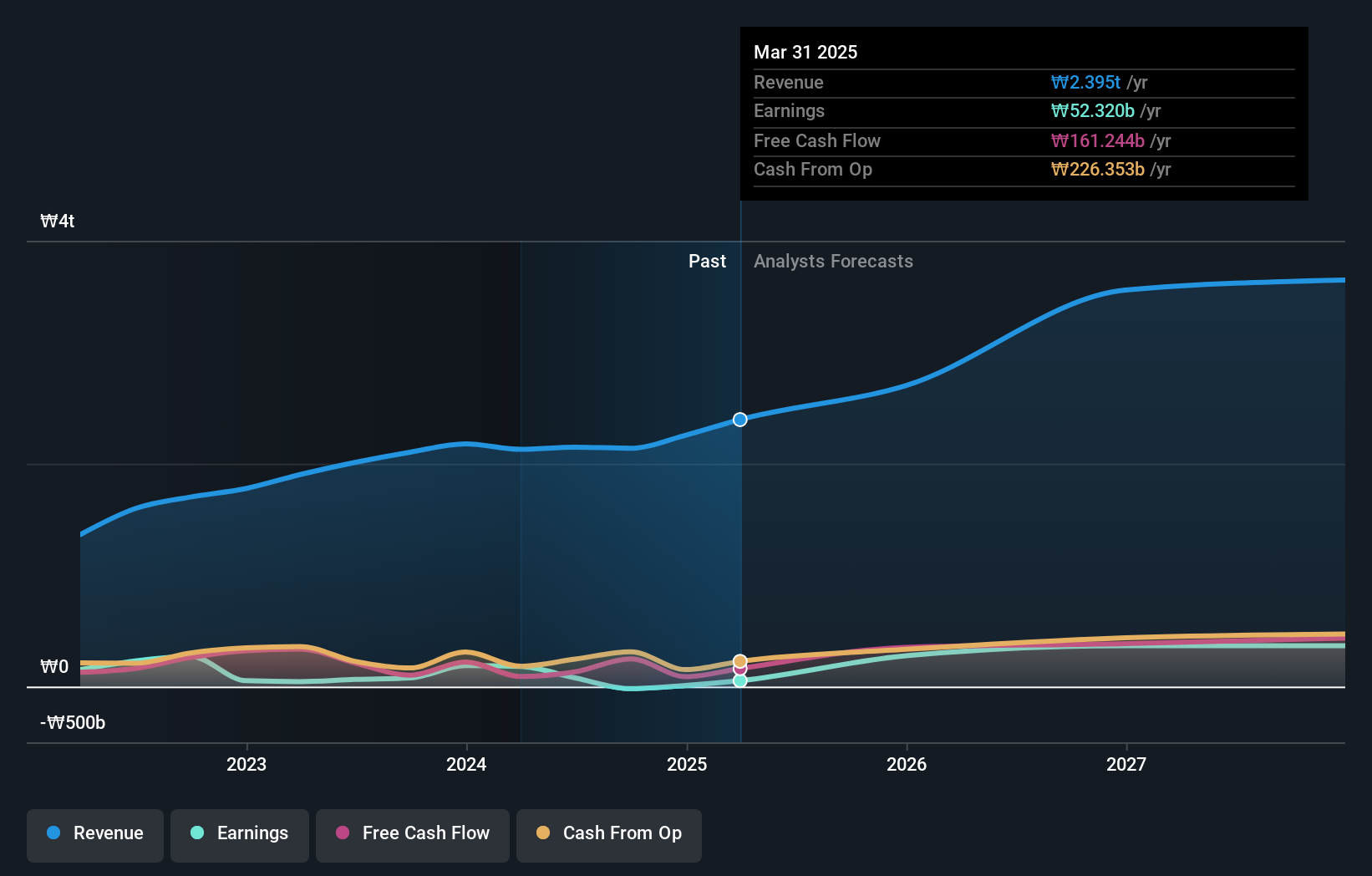

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market cap of ₩7.45 trillion.

Operations: The company's revenue streams include Label, Platform, and Solution segments, with the Label segment generating the highest revenue at ₩1.28 trillion. The Platform and Solution segments contribute ₩361.12 billion and ₩1.24 trillion respectively.

HYBE's recent strategic maneuvers, including a substantial share repurchase program, underscore its commitment to stabilizing stock prices amidst fluctuating market conditions. With R&D expenses constituting 14% of its revenue, the company is poised to innovate within the entertainment tech sector. This focus on development is complemented by an impressive forecast of 42.2% annual earnings growth, significantly outpacing the broader South Korean market's expectations. These efforts are critical as they navigate through a challenging financial period marked by notable one-off losses and a competitive tech landscape where innovation remains key to sustainability and growth.

Where To Now?

- Navigate through the entire inventory of 48 KRX High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Excellent balance sheet with reasonable growth potential.