- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A248070

Exploring Three High Growth Tech Stocks in South Korea

Reviewed by Simply Wall St

South Korea's market dynamics have been influenced by a significant current account surplus, with notable increases in both exports and imports. In this context, identifying high-growth tech stocks becomes crucial as they can leverage the country's robust economic indicators to drive innovation and expansion.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, operates as a biopharmaceutical company primarily in South Korea and has a market cap of ₩1.93 trillion.

Operations: PharmaResearch Co., Ltd. generates revenue primarily from its pharmaceutical segment, which accounted for ₩296.59 billion. The company operates within the biopharmaceutical sector in South Korea, focusing on developing and commercializing medical products.

PharmaResearch, a standout in South Korea's tech sector, has seen earnings soar by 63.2% over the past year, outpacing the Biotech industry’s 6.1%. The company is expected to grow its revenue at 22.1% annually and earnings at 22.2%, although this lags behind the broader KR market’s projected growth of 28.6%. Notably, PharmaResearch has invested significantly in R&D, with expenditures reaching ₩100M in FY2023, highlighting its commitment to innovation and long-term growth.

- Get an in-depth perspective on PharmaResearch's performance by reading our health report here.

Understand PharmaResearch's track record by examining our Past report.

Pearl Abyss (KOSDAQ:A263750)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pearl Abyss Corp. is a company that specializes in software development for games, with a market capitalization of ₩2.07 trillion.

Operations: Pearl Abyss Corp. generates revenue primarily from game sales, amounting to ₩330.62 billion. The company focuses on software development for the gaming industry.

Pearl Abyss, known for its popular game "Black Desert," has been making waves in the South Korean tech scene. The company's earnings are projected to grow at an impressive 53.2% annually, far outpacing the broader KR market's 28.6%. Revenue is also expected to rise by 23.4% per year, supported by robust R&D investments that reached ₩19.7B in FY2023, signaling a strong commitment to future innovation and growth within the gaming industry.

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Solum Co., Ltd. manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally, with a market cap of ₩988.95 billion.

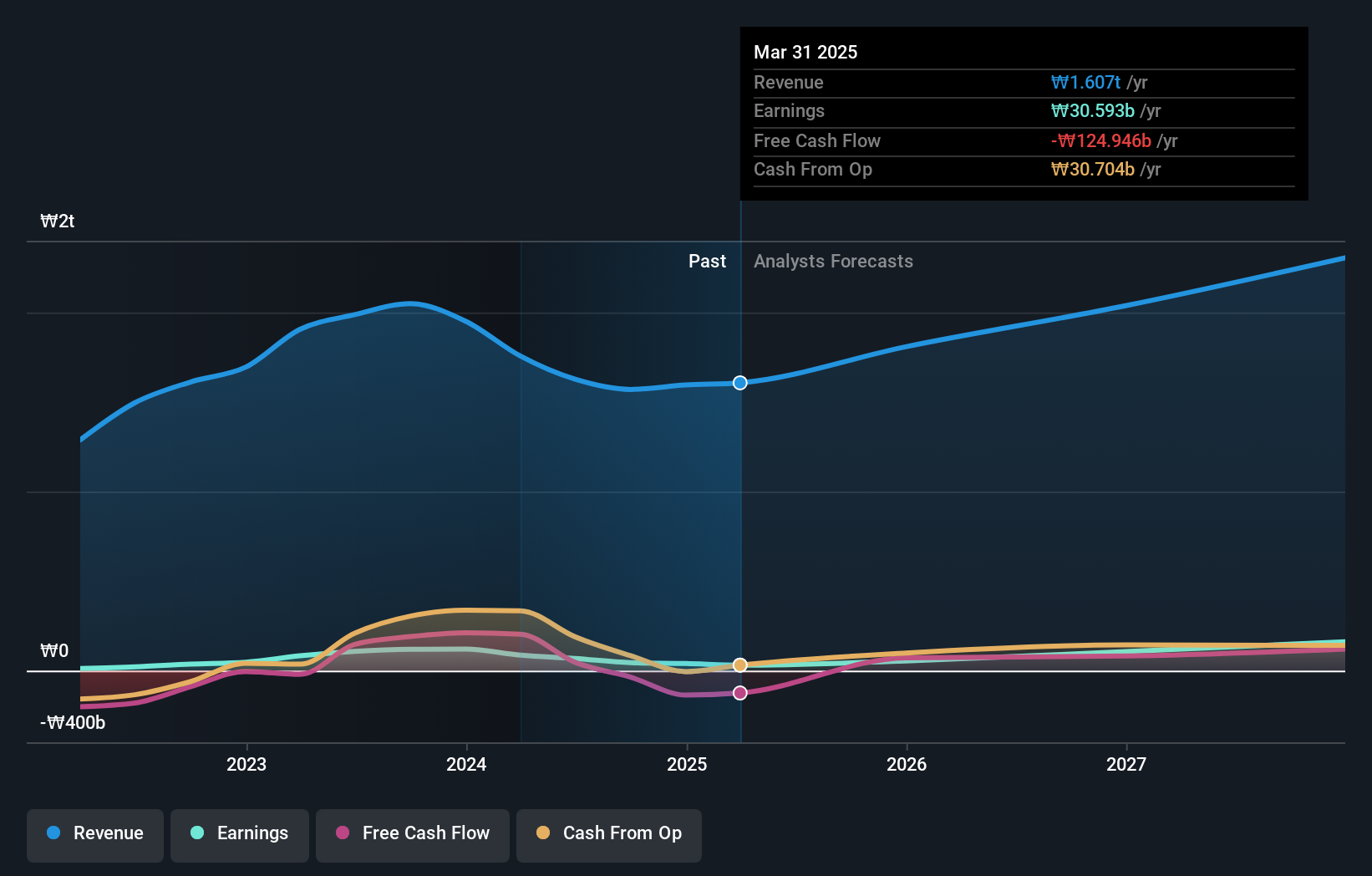

Operations: Solum Co., Ltd. generates revenue primarily from its ICT Business and Electronic Components Division, with the latter contributing ₩1.16 billion. The company serves both domestic and international markets through these segments.

Solum Co., Ltd. is making strides in South Korea's tech sector, with earnings forecasted to grow at 37.2% annually, outpacing the broader KR market's 28.6%. Despite a challenging past year with a -37.1% earnings growth, Solum's revenue is projected to increase by 14% per year, surpassing the KR market average of 10.3%. The company has committed ₩20B for share repurchases to stabilize stock prices and enhance shareholder value. R&D investments have been significant, reflecting a strong focus on future innovation and competitiveness in the electronic industry.

- Dive into the specifics of Solum here with our thorough health report.

Examine Solum's past performance report to understand how it has performed in the past.

Key Takeaways

- Discover the full array of 49 KRX High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A248070

Solum

Manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally.

High growth potential with excellent balance sheet.