- South Korea

- /

- Biotech

- /

- KOSDAQ:A214450

Exploring These 3 High Growth Tech Stocks In South Korea

Reviewed by Simply Wall St

The South Korea stock market has faced a challenging period, finishing lower in seven consecutive sessions and shedding over 170 points or 6.4 percent. Despite this downturn, optimism regarding interest rates has provided a positive global forecast for Asian markets, leading to expectations of support for the KOSPI index. In light of these market conditions, identifying high-growth tech stocks that demonstrate resilience and potential for recovery is crucial for investors looking to capitalize on opportunities within South Korea's dynamic technology sector.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, operates as a biopharmaceutical company primarily in South Korea, with a market cap of ₩1.91 billion.

Operations: PharmaResearch Co., Ltd. generates revenue primarily from its pharmaceuticals segment, which accounted for ₩296.59 billion. The company focuses on biopharmaceutical products and operates mainly in South Korea.

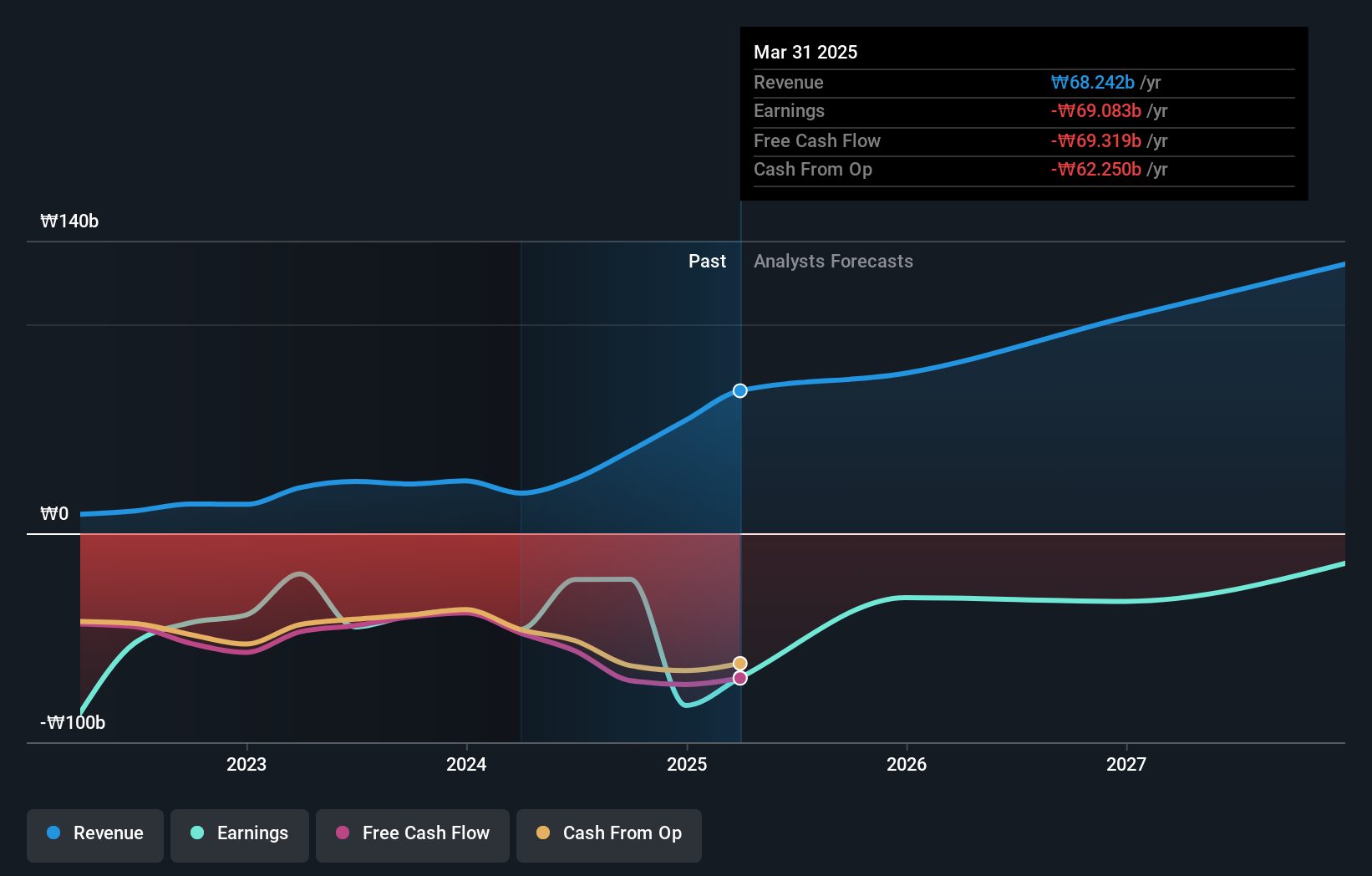

PharmaResearch's earnings growth of 63.2% over the past year significantly outpaced the Biotechs industry average of 6.1%, highlighting its robust performance. The company's revenue is forecast to grow at an impressive 22.1% per year, surpassing the South Korean market's expected growth of 10.3%. With a focus on innovative biotech solutions, PharmaResearch has allocated substantial resources to R&D, reflecting in their $100M expenditure last year, which supports future advancements and sustained growth potential.

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lunit Inc. develops and provides AI-based software solutions for cancer screening, diagnosis, and treatment, with a market cap of ₩1.21 trillion.

Operations: Lunit Inc. generates revenue primarily from its healthcare software segment, which reported ₩26.03 billion in sales. The company focuses on AI-driven solutions for cancer-related applications.

Lunit's AI-powered chest X-ray analysis software, Lunit INSIGHT CXR, has achieved a significant milestone with an AUC of 0.902 in TB detection, as reported by The Lancet Digital Health. The company's revenue is forecast to grow at an impressive 51.8% per year, far outpacing the South Korean market's expected growth of 10.3%. With earnings projected to increase by 104.9% annually and substantial R&D investments supporting advancements like Lunit INSIGHT CXR, the company is well-positioned for future growth in the healthcare IT sector.

- Unlock comprehensive insights into our analysis of Lunit stock in this health report.

Explore historical data to track Lunit's performance over time in our Past section.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. engages in music production, publishing, and artist development and management businesses with a market cap of ₩7.24 billion.

Operations: The company generates revenue primarily from its Label and Solution segments, with the Label segment contributing ₩1.28 trillion and the Solution segment adding ₩1.24 trillion. The Platform segment also adds to the revenue with ₩361.12 billion.

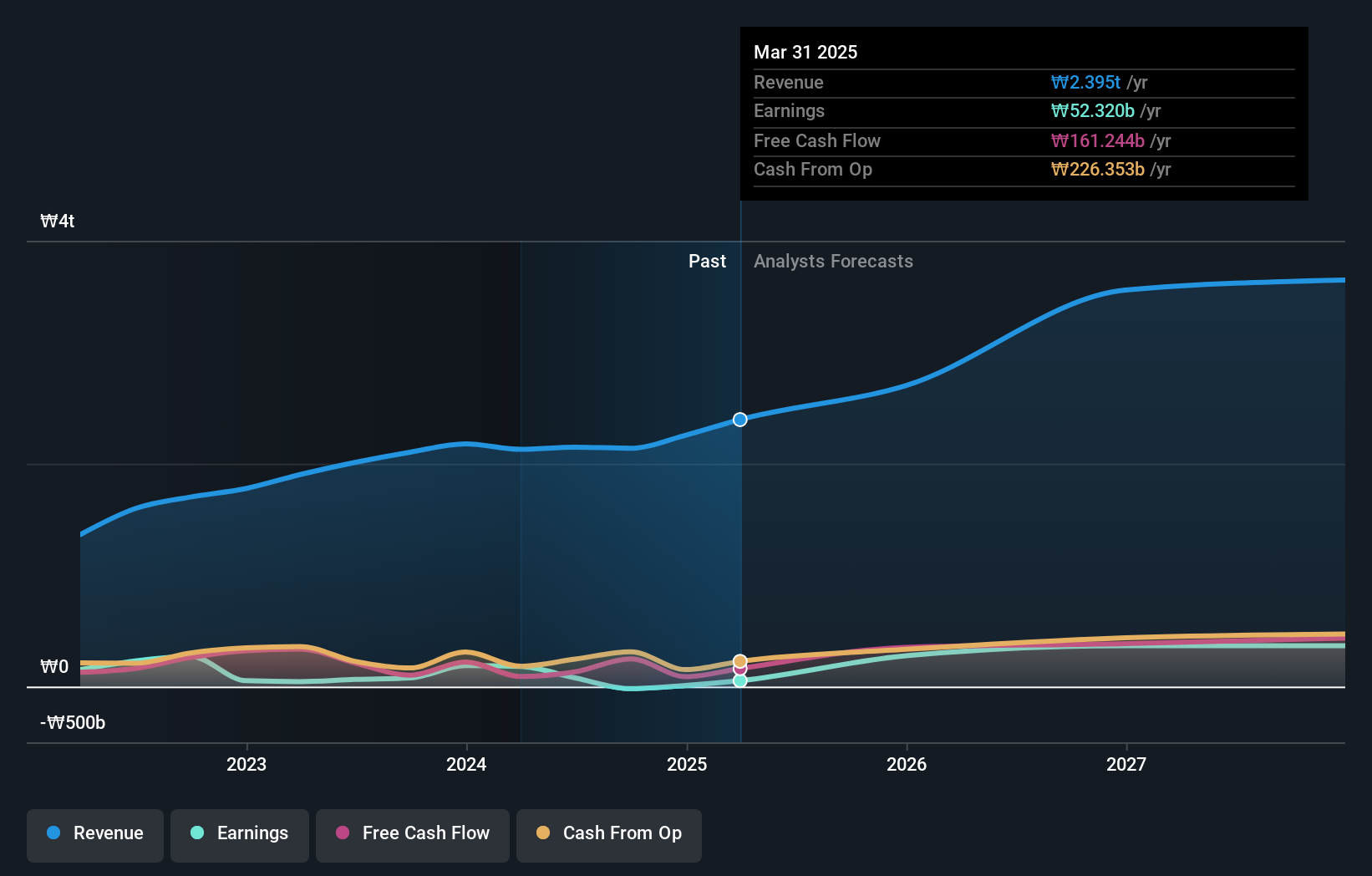

HYBE's revenue is expected to grow at 14.1% per year, outpacing the South Korean market's 10.3% growth rate. The company projects earnings growth of 42.5% annually over the next three years, signaling robust profitability prospects despite a significant one-off loss of ₩189.4B in the last fiscal year ending June 30, 2024. Notably, HYBE has announced a share repurchase program for up to 150,000 shares aimed at stabilizing stock prices by September 27, 2024.

- Dive into the specifics of HYBE here with our thorough health report.

Gain insights into HYBE's historical performance by reviewing our past performance report.

Make It Happen

- Navigate through the entire inventory of 49 KRX High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214450

PharmaResearch

Operates as a biopharmaceutical company primarily in South Korea.

Flawless balance sheet with high growth potential.