- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A166090

3 KRX Stocks Estimated To Be Undervalued By At Least 26.4%

Reviewed by Simply Wall St

The South Korean market has experienced a slight dip of 2.8% over the last week, yet it remains up by 4.7% over the past year with earnings projected to grow by 30% annually. In this context, identifying stocks that are potentially undervalued can offer attractive opportunities for investors looking to capitalize on anticipated growth within the market.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Samwha ElectricLtd (KOSE:A009470) | ₩48900.00 | ₩93614.29 | 47.8% |

| APR (KOSE:A278470) | ₩264000.00 | ₩527494.80 | 50% |

| PharmaResearch (KOSDAQ:A214450) | ₩214500.00 | ₩423128.33 | 49.3% |

| T'Way Air (KOSE:A091810) | ₩3120.00 | ₩5618.81 | 44.5% |

| TSE (KOSDAQ:A131290) | ₩50600.00 | ₩100006.13 | 49.4% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7560.00 | ₩14926.00 | 49.4% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩82300.00 | ₩153018.31 | 46.2% |

| ABCO Electronics (KOSDAQ:A036010) | ₩5920.00 | ₩11499.86 | 48.5% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1668.00 | ₩2976.60 | 44% |

| Global Tax Free (KOSDAQ:A204620) | ₩3620.00 | ₩6409.89 | 43.5% |

We'll examine a selection from our screener results.

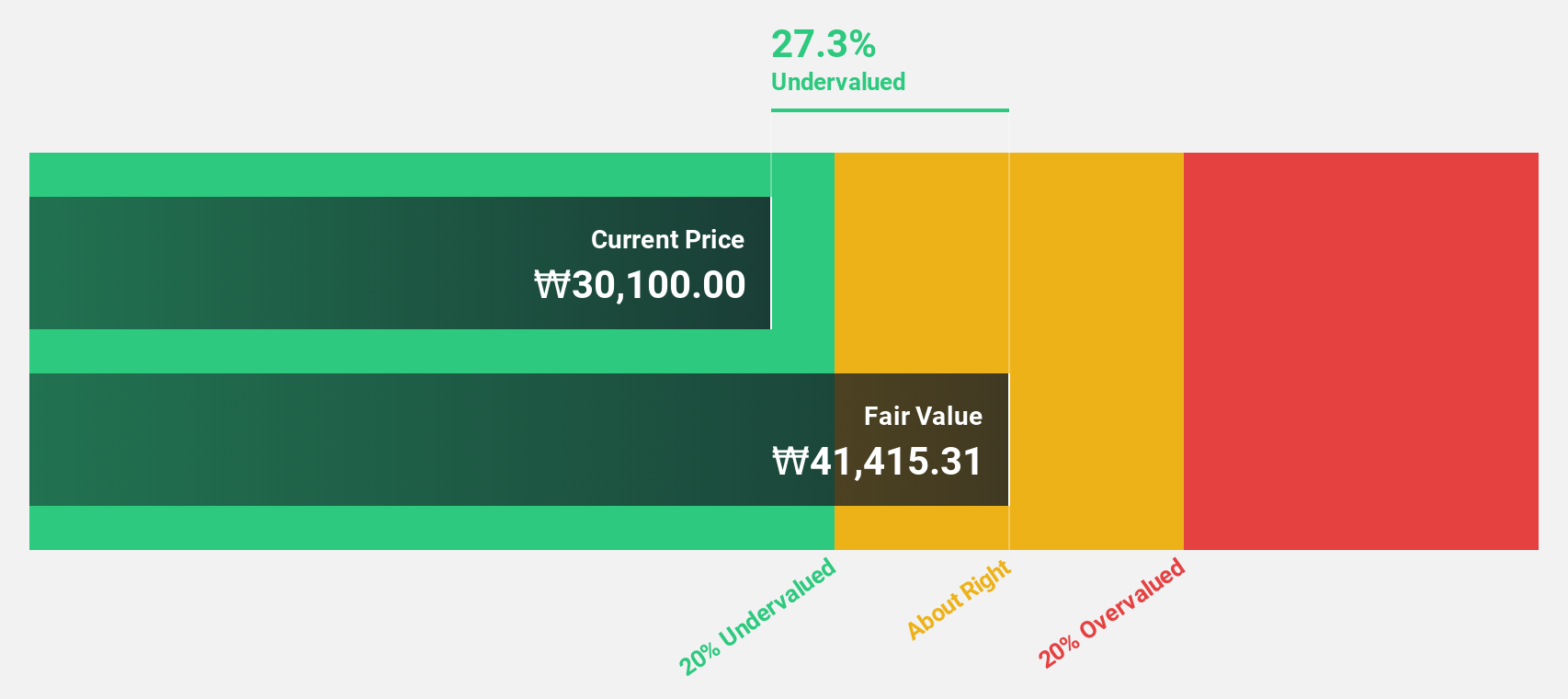

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Overview: JUSUNG ENGINEERING Co., Ltd. manufactures and sells semiconductor, display, solar, and lighting equipment both in South Korea and internationally, with a market cap of ₩1.30 trillion.

Operations: The company's revenue from semiconductor equipment and services amounts to ₩338.28 billion.

Estimated Discount To Fair Value: 32.8%

Jusung Engineering Ltd. is trading at ₩27,600, significantly below its estimated fair value of ₩41,042.82, making it highly undervalued based on discounted cash flow analysis. Despite a forecasted earnings growth of 21% annually, which lags behind the broader Korean market's 29.9%, its revenue is expected to grow at a robust 21.7% per year—outpacing the market average of 10.5%. Recent earnings growth was strong at 43.5%.

- Our comprehensive growth report raises the possibility that JUSUNG ENGINEERINGLtd is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of JUSUNG ENGINEERINGLtd.

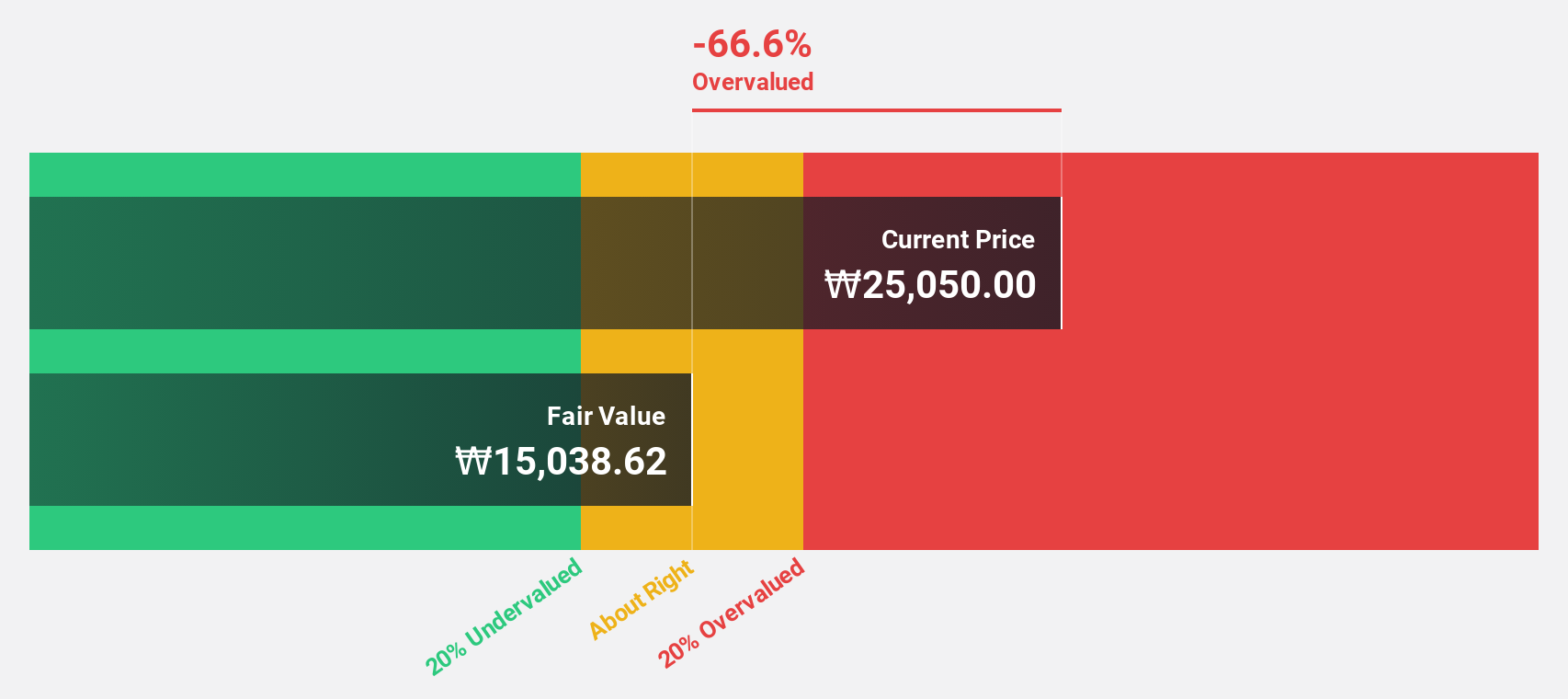

Hana Materials (KOSDAQ:A166090)

Overview: Hana Materials Inc. is a South Korean company that manufactures and sells silicon electrodes and rings, with a market cap of approximately ₩630.34 billion.

Operations: Revenue Segments (in millions of ₩): Silicon electrodes: 150,000; Rings: 250,000.

Estimated Discount To Fair Value: 26.4%

Hana Materials is trading at ₩32,250, well below its estimated fair value of ₩43,808.52. With earnings projected to grow significantly at 49.3% per year and revenue growth expected at 19.3%, the company shows strong cash flow potential despite high debt levels and declining profit margins from last year. Analysts agree on a potential price increase of 65.7%. Recent buybacks include repurchasing 109,720 shares for KRW 3,089.1 million by September 2024.

- According our earnings growth report, there's an indication that Hana Materials might be ready to expand.

- Unlock comprehensive insights into our analysis of Hana Materials stock in this financial health report.

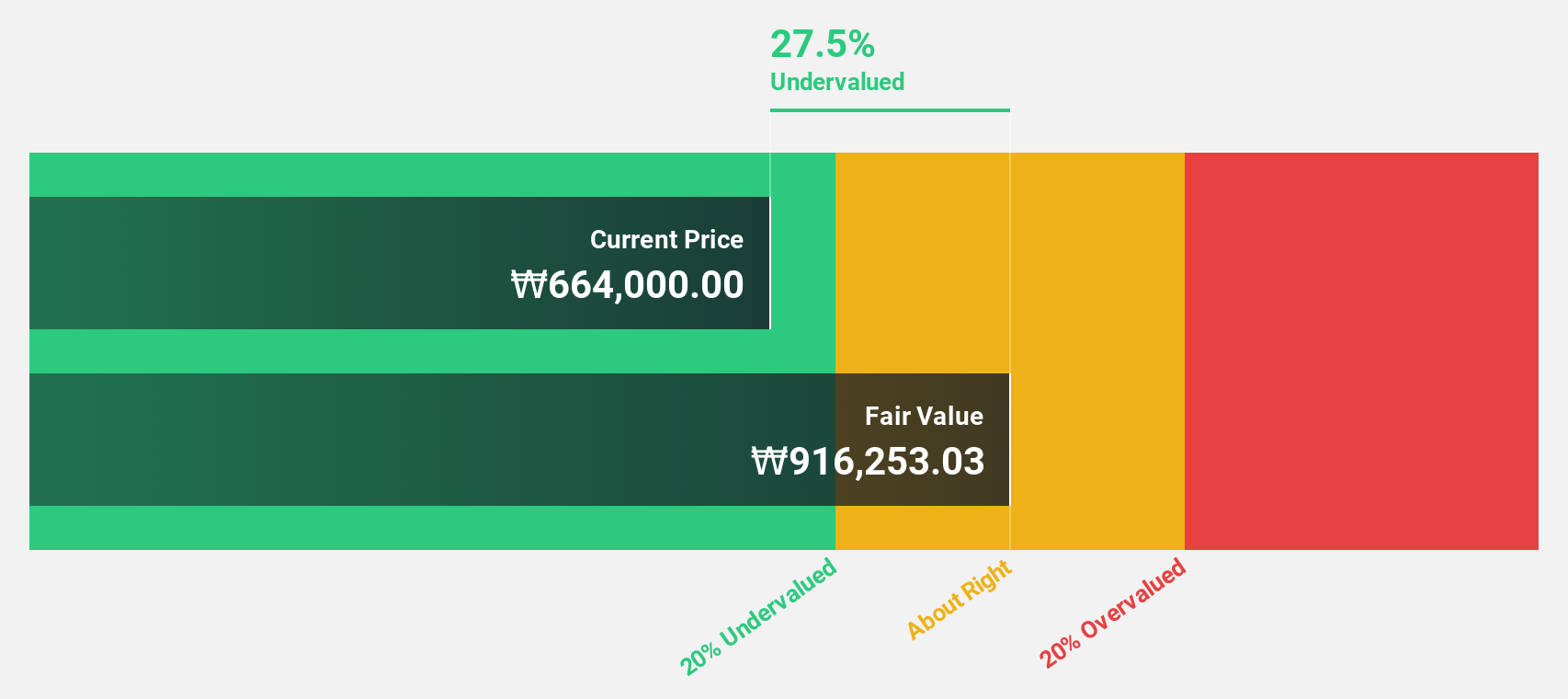

PharmaResearch (KOSDAQ:A214450)

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating primarily in South Korea, with a market cap of ₩2.22 trillion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to ₩296.59 billion.

Estimated Discount To Fair Value: 49.3%

PharmaResearch is trading at ₩214,500, significantly below its estimated fair value of ₩423,128.33. Earnings are projected to grow 22.22% annually, with revenue growth outpacing the market at 22.1% per year. Despite earnings growth trailing the broader KR market's pace, the company's valuation and cash flow prospects appear strong. The recent private placement involving Polish Company Limited could enhance capital structure ahead of expected earnings improvements over the next three years.

- In light of our recent growth report, it seems possible that PharmaResearch's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of PharmaResearch.

Make It Happen

- Dive into all 35 of the Undervalued KRX Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hana Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A166090

Hana Materials

Manufactures and sells silicon electrodes and rings in South Korea.

Reasonable growth potential with adequate balance sheet.