- South Korea

- /

- Electrical

- /

- KOSE:A336260

Exploring Undervalued Opportunities On KRX With Discounts Ranging From 23.2% To 49.8%

Reviewed by Simply Wall St

The South Korean market has shown robust performance, climbing 2.2% in the last week and achieving an 11% increase over the past year, with earnings projected to grow by 30% annually. In this context, identifying undervalued stocks can offer investors potential opportunities for growth and value in a thriving market environment.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Global Standard Technology (KOSDAQ:A083450) | ₩18900.00 | ₩32403.06 | 41.7% |

| Caregen (KOSDAQ:A214370) | ₩22350.00 | ₩44549.16 | 49.8% |

| Revu (KOSDAQ:A443250) | ₩11320.00 | ₩20641.42 | 45.2% |

| Anapass (KOSDAQ:A123860) | ₩27950.00 | ₩48827.16 | 42.8% |

| NEXTIN (KOSDAQ:A348210) | ₩65100.00 | ₩109720.38 | 40.7% |

| KidariStudio (KOSE:A020120) | ₩4180.00 | ₩7294.66 | 42.7% |

| Genomictree (KOSDAQ:A228760) | ₩21900.00 | ₩39379.60 | 44.4% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩2015.00 | ₩4012.83 | 49.8% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩79900.00 | ₩149728.31 | 46.6% |

Let's take a closer look at a couple of our picks from the screened companies

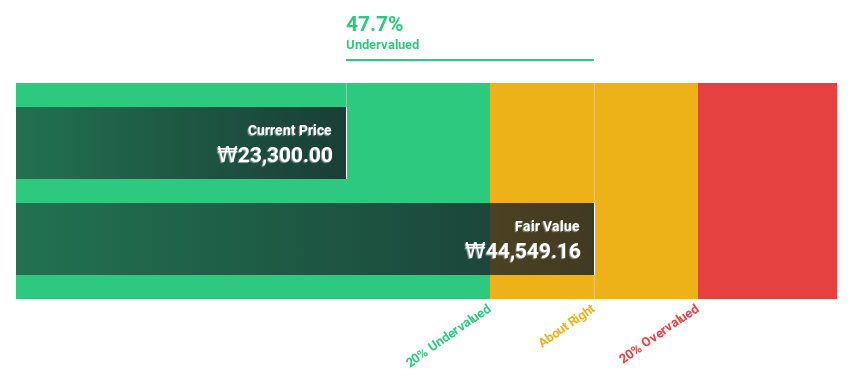

Caregen (KOSDAQ:A214370)

Overview: Caregen Co., Ltd. is a South Korean biotechnology firm that focuses on the research, development, and commercialization of biomimetic peptides globally, with a market capitalization of approximately ₩1.10 trillion.

Operations: The company generates revenue primarily from its personal products segment, totaling ₩74.99 billion.

Estimated Discount To Fair Value: 49.8%

Caregen, with a current price of ₩22,350, is valued significantly below its estimated fair value of ₩44,549.16, suggesting it is highly undervalued based on discounted cash flow analysis. Despite dividends not being well covered by cash flows, the company shows robust fundamentals with earnings expected to grow at 24.3% annually over the next three years—slightly under the South Korean market average but still substantial. Revenue growth projections outpace the market significantly at 20.9% annually. However, its dividend sustainability is questionable given the coverage issues.

- The growth report we've compiled suggests that Caregen's future prospects could be on the up.

- Get an in-depth perspective on Caregen's balance sheet by reading our health report here.

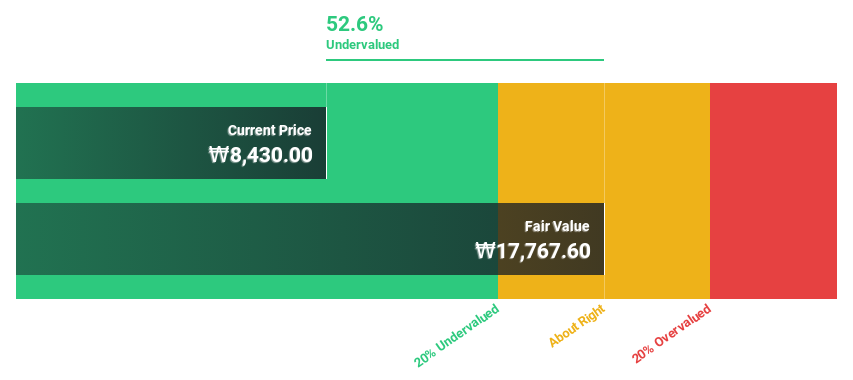

VIOL (KOSDAQ:A335890)

Overview: Viol Co., Ltd. specializes in the manufacturing of electrical diagnostics and medical devices, with a market capitalization of approximately ₩675.59 billion.

Operations: The company generates revenue primarily from its medical device segment, totaling approximately ₩35.49 billion.

Estimated Discount To Fair Value: 25.8%

VIOL, priced at ₩11,700, trades 25.8% below its fair value of ₩15,772.11, indicating significant undervaluation based on discounted cash flow analysis. The company's earnings have surged by 162.2% over the past year and are projected to grow at an annual rate of 30.6%, outpacing the South Korean market forecast of 29.6%. Similarly, revenue growth is expected to exceed the market with a yearly increase of 29.3%. These metrics suggest robust financial health and growth potential despite its current undervaluation.

- Our earnings growth report unveils the potential for significant increases in VIOL's future results.

- Navigate through the intricacies of VIOL with our comprehensive financial health report here.

Doosan Fuel Cell (KOSE:A336260)

Overview: Doosan Fuel Cell Co., Ltd. is a South Korean company specializing in the development and distribution of power generation fuel cells, with a market capitalization of approximately ₩1.35 trillion.

Operations: The company generates revenue primarily from the electric equipment segment, totaling approximately ₩0.26 billion.

Estimated Discount To Fair Value: 23.2%

Doosan Fuel Cell, valued at ₩20,650, is considered undervalued by 23.2%, with a fair value estimated at ₩26,873.53. The company's revenue growth is projected to outperform the South Korean market significantly at 25.1% annually. Despite challenges in covering interest payments with earnings and a forecasted low return on equity of 7.2% in three years, Doosan Fuel Cell is expected to turn profitable within this period, showcasing potential for substantial financial improvement amidst high share price volatility observed over the past three months.

- The analysis detailed in our Doosan Fuel Cell growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Doosan Fuel Cell.

Turning Ideas Into Actions

- Unlock our comprehensive list of 38 Undervalued KRX Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A336260

Doosan Fuel Cell

Develops and distributes power generation fuel cells in South Korea.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives