David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies AbClon Inc. (KOSDAQ:174900) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for AbClon

How Much Debt Does AbClon Carry?

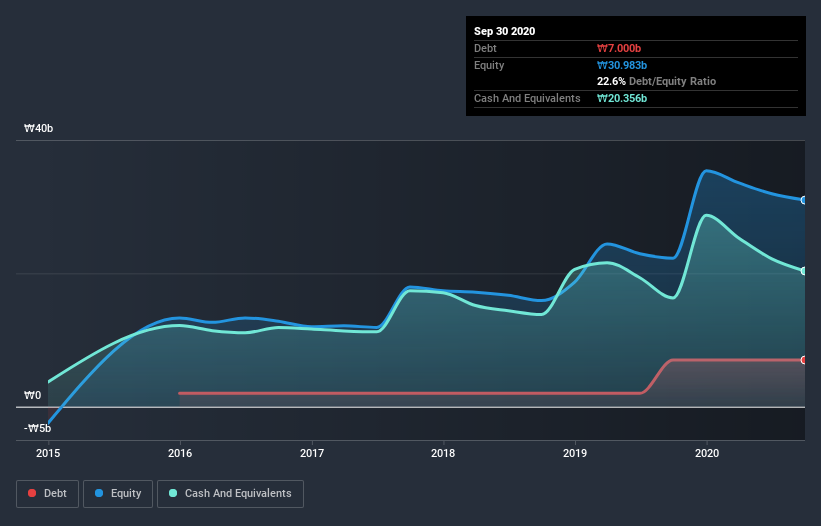

The chart below, which you can click on for greater detail, shows that AbClon had ₩7.00b in debt in September 2020; about the same as the year before. However, its balance sheet shows it holds ₩20.4b in cash, so it actually has ₩13.4b net cash.

How Healthy Is AbClon's Balance Sheet?

We can see from the most recent balance sheet that AbClon had liabilities of ₩4.44b falling due within a year, and liabilities of ₩6.26b due beyond that. On the other hand, it had cash of ₩20.4b and ₩1.68b worth of receivables due within a year. So it can boast ₩11.3b more liquid assets than total liabilities.

This short term liquidity is a sign that AbClon could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that AbClon has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is AbClon's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year AbClon had a loss before interest and tax, and actually shrunk its revenue by 78%, to ₩3.2b. That makes us nervous, to say the least.

So How Risky Is AbClon?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year AbClon had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of ₩10.0b and booked a ₩5.5b accounting loss. But at least it has ₩13.4b on the balance sheet to spend on growth, near-term. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for AbClon you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading AbClon or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A174900

AbClon

Engages in the research and development of antibody drugs in South Korea and Sweden.

Excellent balance sheet low.

Market Insights

Community Narratives