- South Korea

- /

- Biotech

- /

- KOSDAQ:A166480

CORESTEMCHEMON Inc.'s (KOSDAQ:166480) 27% Price Boost Is Out Of Tune With Revenues

CORESTEMCHEMON Inc. (KOSDAQ:166480) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The annual gain comes to 111% following the latest surge, making investors sit up and take notice.

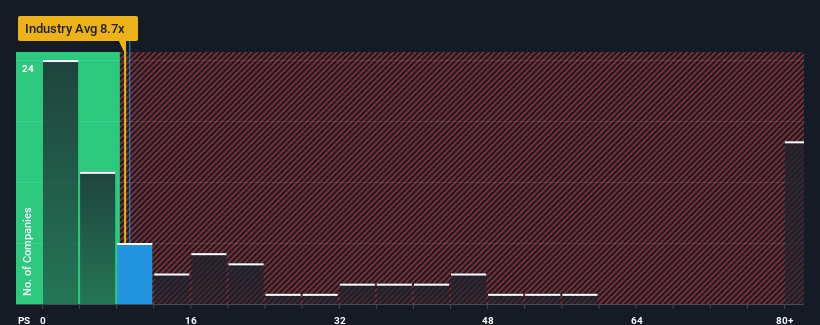

Even after such a large jump in price, there still wouldn't be many who think CORESTEMCHEMON's price-to-sales (or "P/S") ratio of 9.3x is worth a mention when the median P/S in Korea's Biotechs industry is similar at about 8.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for CORESTEMCHEMON

What Does CORESTEMCHEMON's Recent Performance Look Like?

For example, consider that CORESTEMCHEMON's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for CORESTEMCHEMON, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For CORESTEMCHEMON?

CORESTEMCHEMON's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 6.4% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 41% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that CORESTEMCHEMON's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From CORESTEMCHEMON's P/S?

CORESTEMCHEMON appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of CORESTEMCHEMON revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Having said that, be aware CORESTEMCHEMON is showing 3 warning signs in our investment analysis, and 2 of those are a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A166480

CORESTEMCHEMON

A bio-pharmaceutical company, engages in the development and production of stem cell therapies for the treatment of incurable diseases in South Korea.

Low risk and slightly overvalued.

Market Insights

Community Narratives