- South Korea

- /

- Entertainment

- /

- KOSDAQ:A069080

Exploring Three High Growth Tech Stocks in the Global Market

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and the potential impacts of a prolonged U.S. government shutdown, investor sentiment remains cautious, with key indices like the Nasdaq Composite and S&P 500 experiencing fluctuations driven by geopolitical uncertainties and enthusiasm for AI-related stocks. In this environment, identifying high growth tech stocks that can navigate such volatility requires a focus on companies with strong innovation capabilities and strategic partnerships that may offer resilience amid broader market challenges.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 34.27% | 44.80% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| KebNi | 23.54% | 74.03% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.64% | 43.11% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Webzen (KOSDAQ:A069080)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Webzen Inc. is a global gaming company involved in PC, online, and mobile gaming with a market cap of ₩365.08 billion.

Operations: Webzen Inc. generates revenue primarily from its entertainment software segment, which amounts to ₩185.90 billion.

Webzen, navigating through a challenging landscape, recently announced a promising uptick in earnings growth at 34.6% annually, outpacing the broader KR market's 25.7%. Despite a dip in net profit margins from 30.1% to 16.4%, the firm is set to exceed standard revenue growth forecasts with an annual increase of 15.7%, significantly higher than the market average of 8.3%. This robust financial trajectory is supported by high-quality earnings and strategic R&D investments aimed at sustaining innovation and competitive edge in entertainment technology. While facing some hurdles with negative earnings growth last year and a lower-than-expected future ROE of only 8.1%, Webzen's aggressive focus on expanding its technological capabilities could well position it for pivotal roles in future tech landscapes.

- Navigate through the intricacies of Webzen with our comprehensive health report here.

Examine Webzen's past performance report to understand how it has performed in the past.

Medy-Tox (KOSDAQ:A086900)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medy-Tox Inc. is a biopharmaceutical company based in South Korea with a market capitalization of ₩840.92 billion.

Operations: The company generates its revenue primarily from the biotechnology segment, which accounts for ₩234.63 billion.

Medy-Tox has demonstrated a remarkable earnings growth of 296.5% over the past year, significantly outstripping the biotech industry's average of 35.5%. This surge is supported by strategic R&D investments, which have not only fueled innovation but also positioned Medy-Tox favorably within high-growth tech sectors. Despite a challenging backdrop, the company's revenue is expected to grow at 15.6% annually, surpassing the broader KR market projection of 8.3%. Recent financial disclosures reveal robust sales and an upward trajectory in net income, reinforcing Medy-Tox’s potential in leveraging cutting-edge technology to sustain its competitive edge.

- Take a closer look at Medy-Tox's potential here in our health report.

Review our historical performance report to gain insights into Medy-Tox's's past performance.

SVI (SET:SVI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SVI Public Company Limited, along with its subsidiaries, offers electronic manufacturing services across Asia and Europe, with a market capitalization of THB13.13 billion.

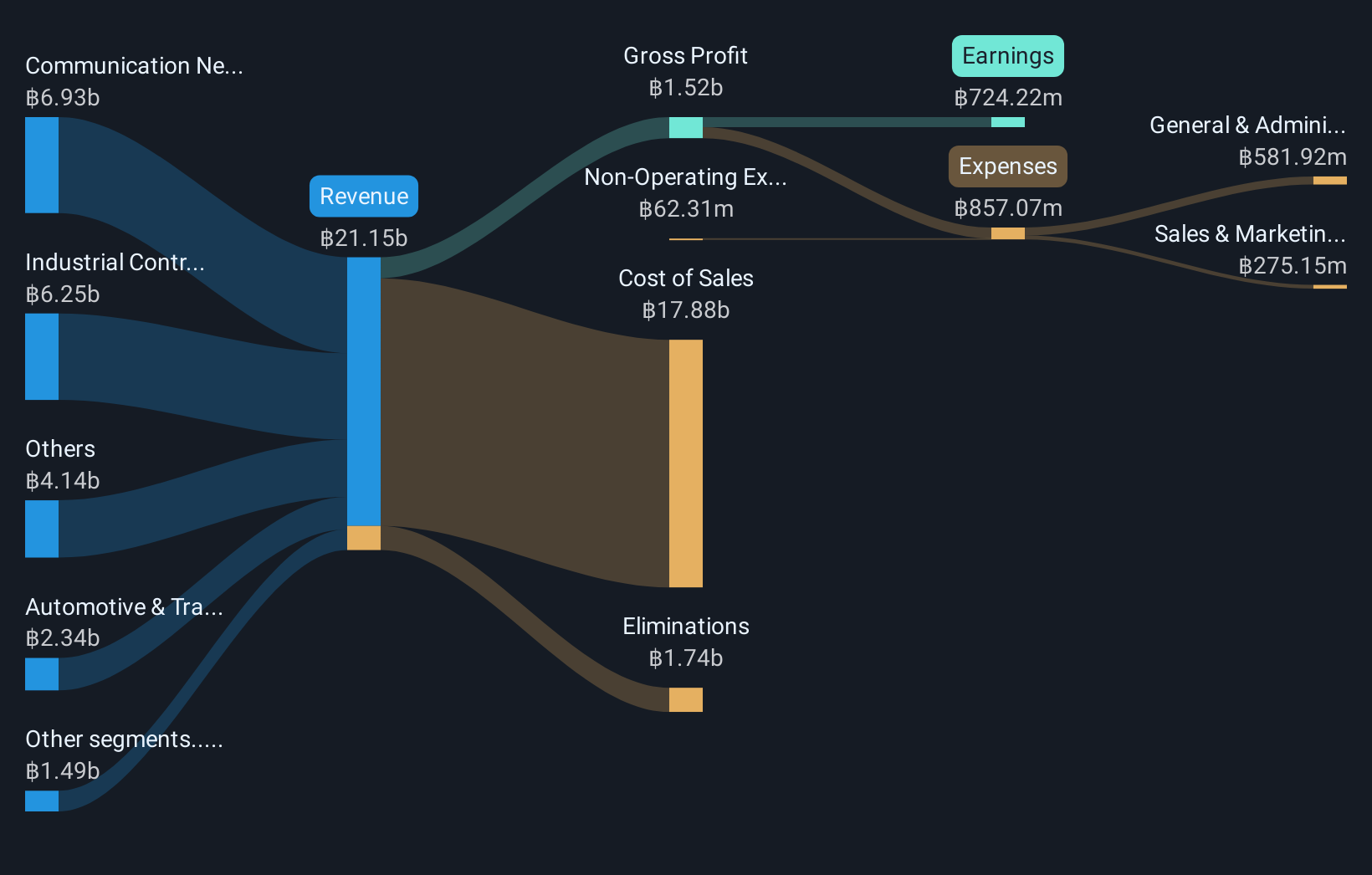

Operations: SVI Public Company Limited generates revenue primarily from electronic manufacturing services, with significant contributions from the Communication Network segment (THB6.93 billion) and Industrial Control System segment (THB6.25 billion). The company also serves sectors like Automotive & Transportation and Professional Audio and Video, contributing THB2.34 billion and THB1.49 billion respectively to its revenue streams.

SVI, despite a challenging year with earnings contraction of 48%, is set to rebound with an anticipated earnings growth of 24.5% annually, outpacing the Thai market's average of 11.5%. This resurgence is underpinned by robust R&D investments, aligning with industry shifts towards more sustainable and innovative tech solutions. Recent executive changes hint at strategic realignment, potentially invigorating SVI's approach towards harnessing emerging technologies to secure a competitive edge in the fast-evolving electronic sector.

Next Steps

- Explore the 246 names from our Global High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Webzen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A069080

Webzen

A game company, engages in the PC, online, and mobile gaming business worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives