- South Korea

- /

- Pharma

- /

- KOSDAQ:A084110

Huons Global Co., Ltd.'s (KOSDAQ:084110) Shares Climb 33% But Its Business Is Yet to Catch Up

Huons Global Co., Ltd. (KOSDAQ:084110) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. The annual gain comes to 112% following the latest surge, making investors sit up and take notice.

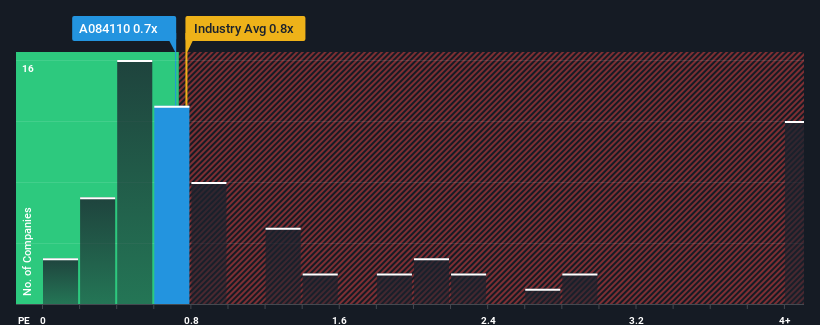

Even after such a large jump in price, it's still not a stretch to say that Huons Global's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Pharmaceuticals industry in Korea, where the median P/S ratio is around 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Huons Global

How Has Huons Global Performed Recently?

Revenue has risen firmly for Huons Global recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Huons Global will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Huons Global?

The only time you'd be comfortable seeing a P/S like Huons Global's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 44% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 16% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Huons Global's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Its shares have lifted substantially and now Huons Global's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Huons Global revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 3 warning signs for Huons Global (1 can't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Huons Global, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Huons Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A084110

Huons Global

Manufactures and sells pharmaceutical products for human health in South Korea and internationally.

Excellent balance sheet low.

Market Insights

Community Narratives