- South Korea

- /

- Biotech

- /

- KOSDAQ:A064550

Bioneer Corporation's (KOSDAQ:064550) 27% Dip In Price Shows Sentiment Is Matching Revenues

Bioneer Corporation (KOSDAQ:064550) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

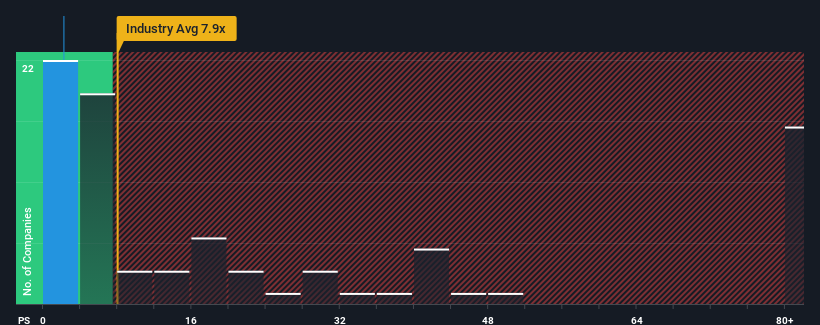

Since its price has dipped substantially, Bioneer's price-to-sales (or "P/S") ratio of 2.2x might make it look like a strong buy right now compared to the wider Biotechs industry in Korea, where around half of the companies have P/S ratios above 7.9x and even P/S above 43x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Bioneer

How Has Bioneer Performed Recently?

Bioneer's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bioneer.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Bioneer's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. As a result, it also grew revenue by 24% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 29% over the next year. That's shaping up to be materially lower than the 41% growth forecast for the broader industry.

In light of this, it's understandable that Bioneer's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Shares in Bioneer have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Bioneer maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Bioneer, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bioneer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A064550

Bioneer

Operates as a biotechnology company in South Korea, the Americas, Europe, Asia, Africa, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives