- South Korea

- /

- Pharma

- /

- KOSDAQ:A044960

Eagle Veterinary TechnologyLtd (KOSDAQ:044960) Has A Rock Solid Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Eagle Veterinary Technology Co.,Ltd (KOSDAQ:044960) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Eagle Veterinary TechnologyLtd

How Much Debt Does Eagle Veterinary TechnologyLtd Carry?

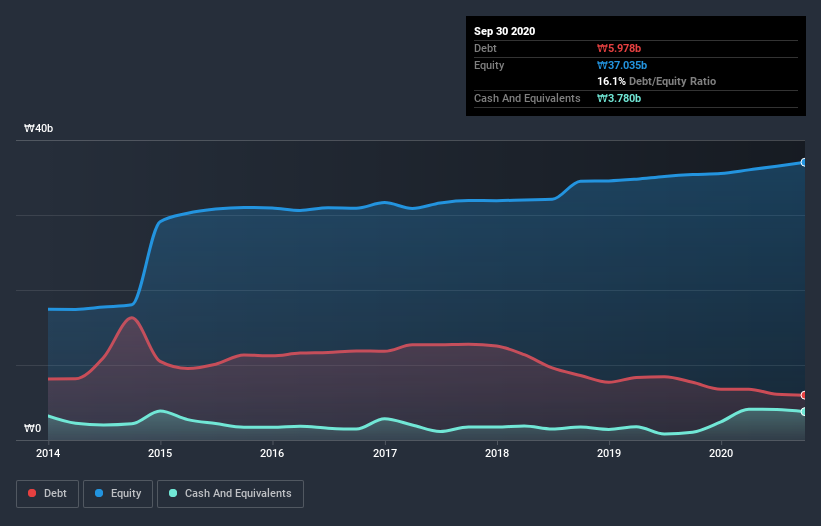

The image below, which you can click on for greater detail, shows that Eagle Veterinary TechnologyLtd had debt of ₩5.98b at the end of September 2020, a reduction from ₩7.69b over a year. However, it does have ₩3.78b in cash offsetting this, leading to net debt of about ₩2.20b.

How Strong Is Eagle Veterinary TechnologyLtd's Balance Sheet?

The latest balance sheet data shows that Eagle Veterinary TechnologyLtd had liabilities of ₩7.69b due within a year, and liabilities of ₩3.33b falling due after that. Offsetting this, it had ₩3.78b in cash and ₩8.78b in receivables that were due within 12 months. So it actually has ₩1.54b more liquid assets than total liabilities.

This state of affairs indicates that Eagle Veterinary TechnologyLtd's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the ₩139.7b company is short on cash, but still worth keeping an eye on the balance sheet.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Eagle Veterinary TechnologyLtd's net debt is only 0.47 times its EBITDA. And its EBIT easily covers its interest expense, being 11.5 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On top of that, Eagle Veterinary TechnologyLtd grew its EBIT by 73% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Eagle Veterinary TechnologyLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Eagle Veterinary TechnologyLtd generated free cash flow amounting to a very robust 97% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Happily, Eagle Veterinary TechnologyLtd's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! We think Eagle Veterinary TechnologyLtd is no more beholden to its lenders, than the birds are to birdwatchers. For investing nerds like us its balance sheet is almost charming. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Eagle Veterinary TechnologyLtd (1 shouldn't be ignored!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Eagle Veterinary TechnologyLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eagle Veterinary TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A044960

Eagle Veterinary TechnologyLtd

Manufactures and sells animal health care products.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.