- South Korea

- /

- Pharma

- /

- KOSDAQ:A039200

With A 38% Price Drop For Oscotec Inc. (KOSDAQ:039200) You'll Still Get What You Pay For

The Oscotec Inc. (KOSDAQ:039200) share price has fared very poorly over the last month, falling by a substantial 38%. Looking at the bigger picture, even after this poor month the stock is up 28% in the last year.

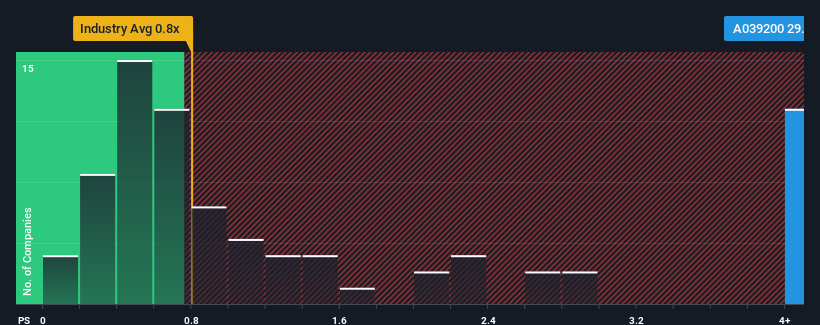

In spite of the heavy fall in price, when almost half of the companies in Korea's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Oscotec as a stock not worth researching with its 29.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Oscotec

How Oscotec Has Been Performing

With revenue growth that's superior to most other companies of late, Oscotec has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Oscotec.How Is Oscotec's Revenue Growth Trending?

In order to justify its P/S ratio, Oscotec would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen a 10% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been quite good for the company but it has also been volatile.

Turning to the outlook, the next year should generate growth of 128% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 48% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Oscotec's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Oscotec's P/S?

Even after such a strong price drop, Oscotec's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Oscotec's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Oscotec.

If these risks are making you reconsider your opinion on Oscotec, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A039200

Oscotec

Operates as a biotechnology company, engages in the drug development, functional materials and related products, and dental bone graft material businesses.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives