- South Korea

- /

- Biotech

- /

- KOSDAQ:A038070

Don't Buy Seoulin Bioscience Co.,Ltd. (KOSDAQ:038070) For Its Next Dividend Without Doing These Checks

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Seoulin Bioscience Co.,Ltd. (KOSDAQ:038070) is about to trade ex-dividend in the next three days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Thus, you can purchase Seoulin BioscienceLtd's shares before the 27th of December in order to receive the dividend, which the company will pay on the 28th of April.

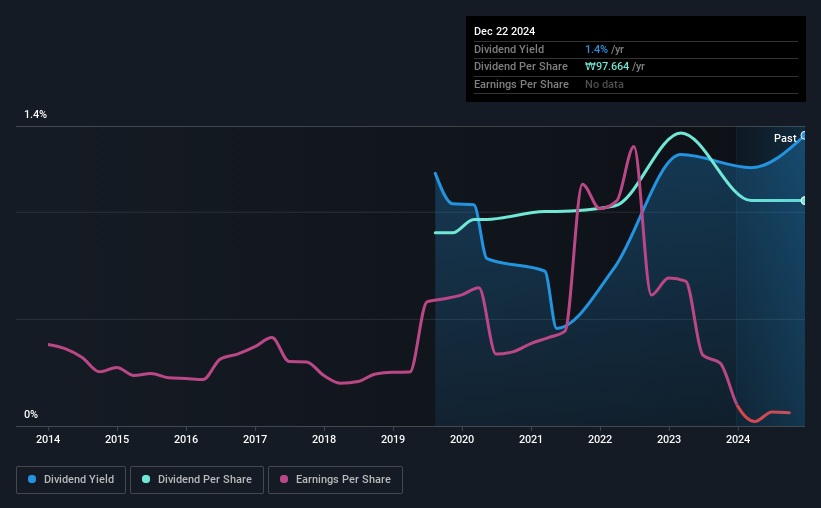

The company's next dividend payment will be ₩97.6639 per share, on the back of last year when the company paid a total of ₩97.66 to shareholders. Based on the last year's worth of payments, Seoulin BioscienceLtd stock has a trailing yield of around 1.4% on the current share price of ₩7200.00. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Seoulin BioscienceLtd

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Seoulin BioscienceLtd reported a loss last year, so it's not great to see that it has continued paying a dividend. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. It paid out more than half (74%) of its free cash flow in the past year, which is within an average range for most companies.

Click here to see how much of its profit Seoulin BioscienceLtd paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Seoulin BioscienceLtd reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Seoulin BioscienceLtd has delivered 3.1% dividend growth per year on average over the past five years.

Remember, you can always get a snapshot of Seoulin BioscienceLtd's financial health, by checking our visualisation of its financial health, here.

Final Takeaway

Is Seoulin BioscienceLtd worth buying for its dividend? It's hard to get used to Seoulin BioscienceLtd paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Seoulin BioscienceLtd.

So if you're still interested in Seoulin BioscienceLtd despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. To that end, you should learn about the 4 warning signs we've spotted with Seoulin BioscienceLtd (including 1 which is potentially serious).

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A038070

Seoulin BioscienceLtd

A bio healthcare company, provides solutions in life sciences and healthcare primarily in South Korea.

Excellent balance sheet slight.

Market Insights

Community Narratives