- South Korea

- /

- Pharma

- /

- KOSDAQ:A018620

WooGene B&G Co., Ltd's (KOSDAQ:018620) Share Price Could Signal Some Risk

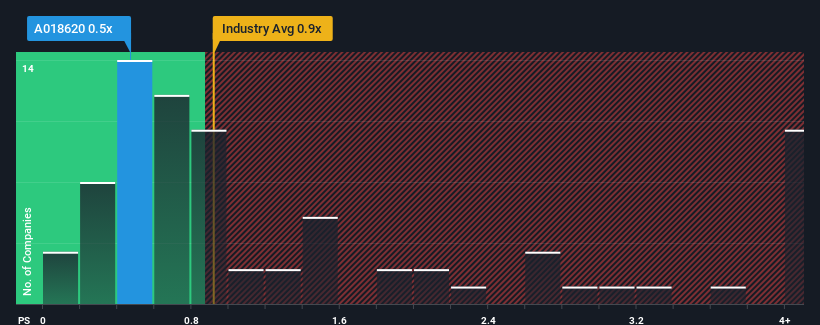

There wouldn't be many who think WooGene B&G Co., Ltd's (KOSDAQ:018620) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Pharmaceuticals industry in Korea is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for WooGene B&G

How WooGene B&G Has Been Performing

WooGene B&G certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for WooGene B&G, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is WooGene B&G's Revenue Growth Trending?

WooGene B&G's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. The latest three year period has also seen an excellent 58% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 60% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that WooGene B&G is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does WooGene B&G's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of WooGene B&G revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Before you take the next step, you should know about the 1 warning sign for WooGene B&G that we have uncovered.

If you're unsure about the strength of WooGene B&G's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if WooGene B&G might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A018620

WooGene B&G

Engages veterinary medicines, microbial technology, and vaccines business in South Korea and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives