- South Korea

- /

- Pharma

- /

- KOSDAQ:A002800

If You Had Bought Sinsin Pharmaceutical (KOSDAQ:002800) Stock A Year Ago, You Could Pocket A 24% Gain Today

It might be of some concern to shareholders to see the Sinsin Pharmaceutical Co., Ltd (KOSDAQ:002800) share price down 13% in the last month. Looking on the brighter side, the stock is actually up over twelve months. In that time, it is up 24%, which isn't bad, but is below the market return of 42%.

View our latest analysis for Sinsin Pharmaceutical

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Sinsin Pharmaceutical actually saw its earnings per share drop 41%.

Given the share price gain, we doubt the market is measuring progress with EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We doubt the modest 0.3% dividend yield is doing much to support the share price. Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

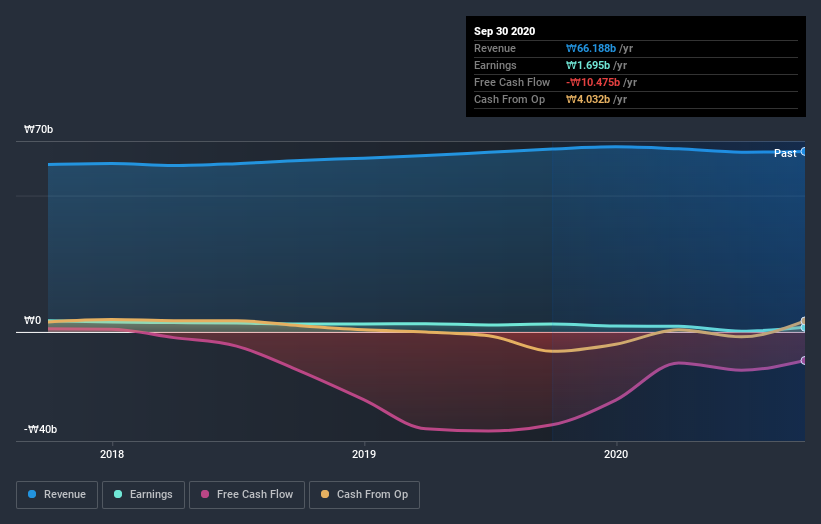

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Sinsin Pharmaceutical stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Over the last year Sinsin Pharmaceutical shareholders have received a TSR of 24%. While you don't go broke making a profit, this return was actually lower than the average market return of about 42%. On the bright side, that's certainly better than the yearly loss of about 6% endured over the last three years, implying that the company is doing better recently. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Sinsin Pharmaceutical (at least 2 which are potentially serious) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Sinsin Pharmaceutical or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Sinsin Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A002800

Sinsin Pharmaceutical

Manufactures and sells pharmaceutical products in South Korea.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives