- South Korea

- /

- Entertainment

- /

- KOSE:A181710

Improved Revenues Required Before NHN Corporation (KRX:181710) Shares Find Their Feet

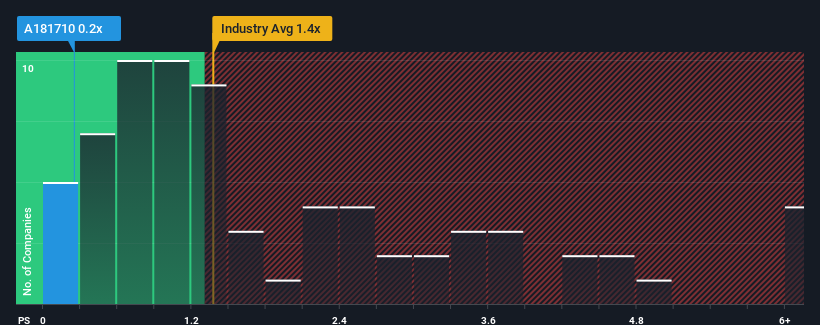

When close to half the companies operating in the Entertainment industry in Korea have price-to-sales ratios (or "P/S") above 1.4x, you may consider NHN Corporation (KRX:181710) as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for NHN

What Does NHN's Recent Performance Look Like?

Recent revenue growth for NHN has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on NHN will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on NHN will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For NHN?

There's an inherent assumption that a company should underperform the industry for P/S ratios like NHN's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.7%. The latest three year period has also seen an excellent 35% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 10% over the next year. Meanwhile, the rest of the industry is forecast to expand by 17%, which is noticeably more attractive.

With this in consideration, its clear as to why NHN's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From NHN's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of NHN's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for NHN that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if NHN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A181710

NHN

An IT company, provides gaming, payment, entertainment, IT, and advertisement solutions in South Korea and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.