- South Korea

- /

- Entertainment

- /

- KOSDAQ:A035900

High Growth Tech Stocks To Watch For Potential Portfolio Boost

Reviewed by Simply Wall St

As global markets navigate a landscape marked by central banks adjusting interest rates and economic indicators reflecting mixed signals, the technology-heavy Nasdaq Composite has reached record highs, highlighting investor interest in growth sectors despite broader market declines. In this context, identifying high-growth tech stocks can be pivotal for investors looking to potentially enhance their portfolios, particularly those that demonstrate resilience and innovation amidst fluctuating economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1269 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

JYP Entertainment (KOSDAQ:A035900)

Simply Wall St Growth Rating: ★★★★☆☆

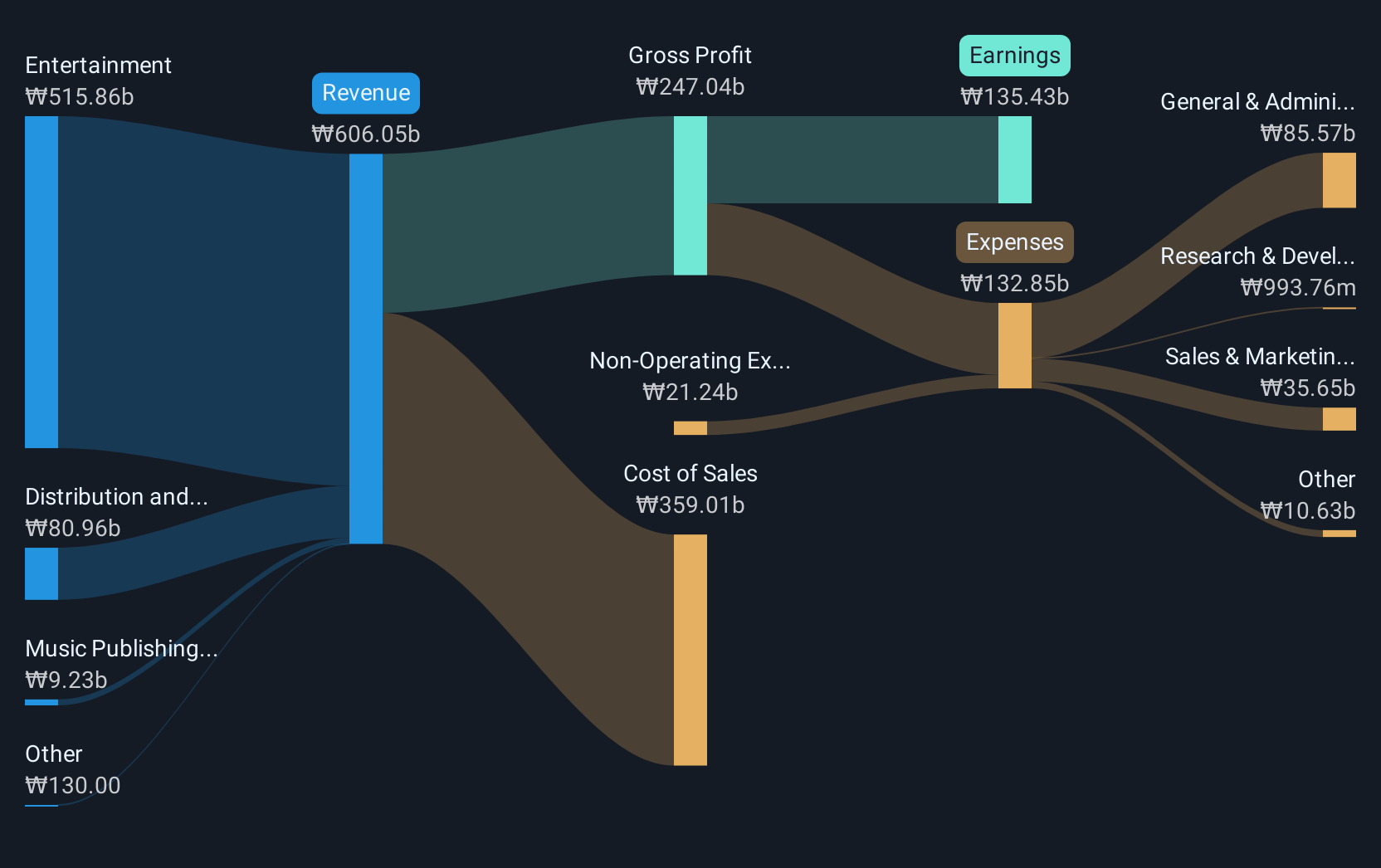

Overview: JYP Entertainment Corporation operates as an entertainment company in South Korea and internationally, with a market cap of ₩2.42 trillion.

Operations: The company generates revenue primarily from its Entertainment segment, which accounts for ₩470.40 billion, followed by Distribution and Sales at ₩78.85 billion, and Music Publishing contributing ₩10.51 billion.

JYP Entertainment, amidst a challenging tech landscape, demonstrates resilience with a projected 19% annual earnings growth and an 11.2% revenue increase annually, outpacing the South Korean market's averages of 12.3% and 5.3%, respectively. Despite a setback in profit margins from last year’s 21.9% to this year's 13.5%, the company continues to innovate, as evidenced by its substantial investment in R&D—allocating funds consistently above industry norms to foster growth in entertainment technologies and artist management platforms. These strategic moves could potentially stabilize future revenue streams and enhance market positioning despite current volatility in net earnings growth rates.

- Dive into the specifics of JYP Entertainment here with our thorough health report.

Evaluate JYP Entertainment's historical performance by accessing our past performance report.

NHN (KOSE:A181710)

Simply Wall St Growth Rating: ★★★★☆☆

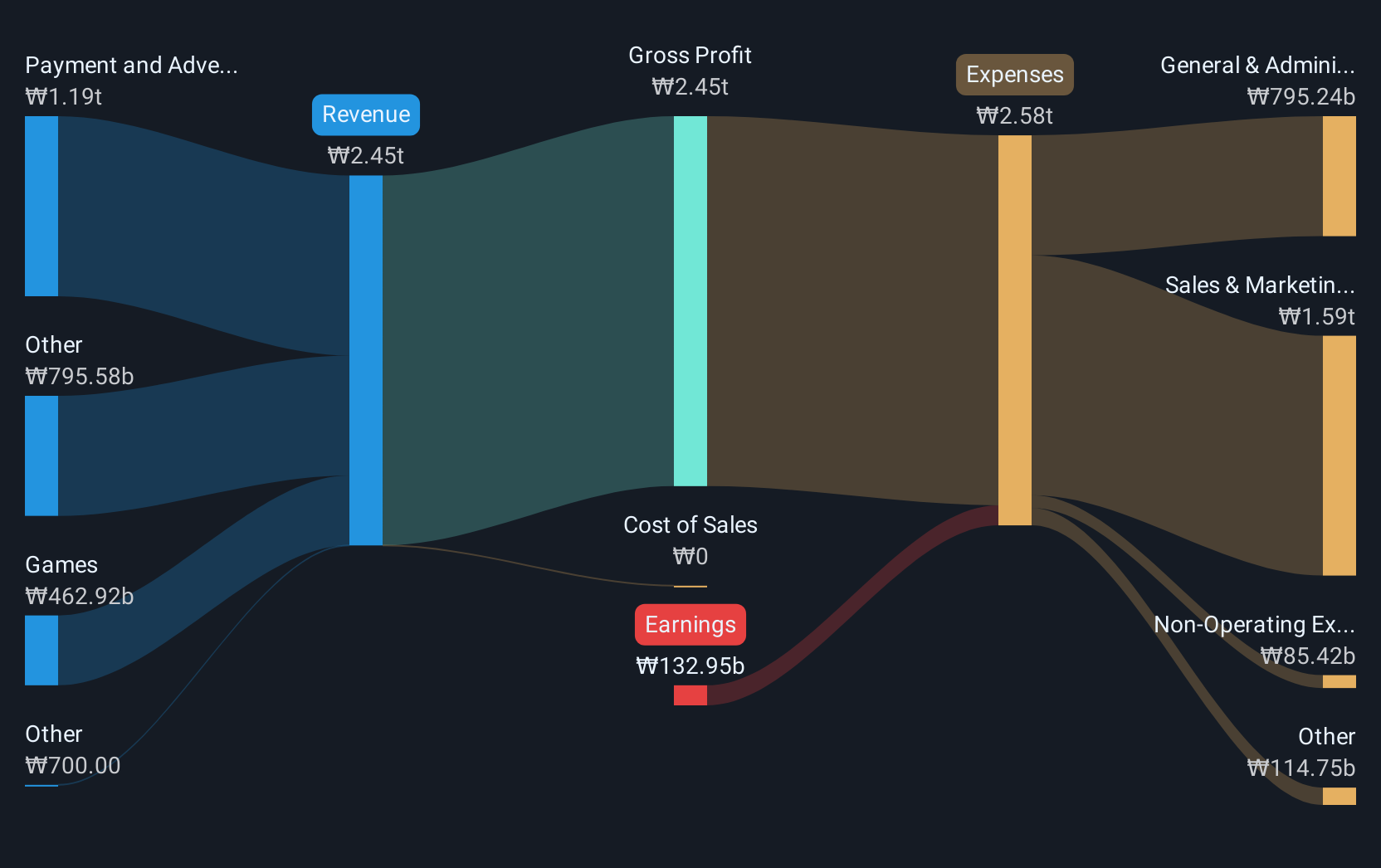

Overview: NHN Corporation is an IT company offering gaming, payment, entertainment, IT, and advertisement solutions both in South Korea and internationally, with a market cap of ₩611.93 billion.

Operations: NHN generates revenue primarily from its gaming and payment and advertising segments, with the latter contributing ₩1.16 trillion. The company focuses on diverse IT solutions across various sectors, including entertainment and advertisement services.

NHN's trajectory in the tech sector is marked by robust revenue growth of 8.2% annually, signaling a strong market presence despite recent financial setbacks, including a shift from net income to a net loss this past quarter. The company's commitment to innovation and shareholder value is underscored by its aggressive share repurchase program, buying back 524,000 shares recently. This strategy, coupled with an annual earnings forecast growth of 84.65%, positions NHN to potentially stabilize and grow amidst industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of NHN.

Gain insights into NHN's historical performance by reviewing our past performance report.

Zyxel Group (TWSE:3704)

Simply Wall St Growth Rating: ★★★★☆☆

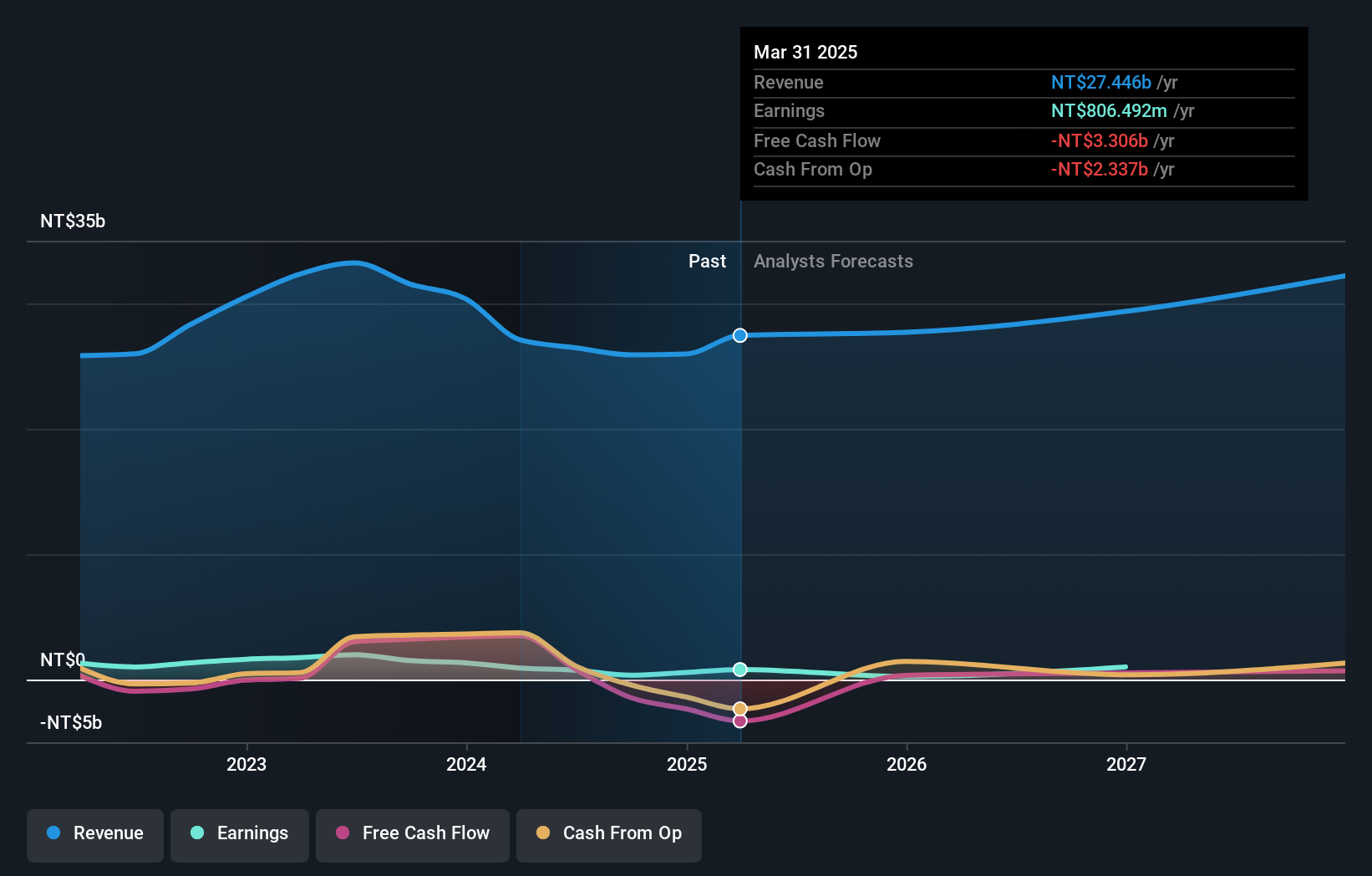

Overview: Zyxel Group Corporation, along with its subsidiaries, provides networking solutions for telecommunications companies, small and medium-sized enterprises, and digital homes across the United States, France, and globally, with a market capitalization of NT$15.49 billion.

Operations: The company generates revenue by offering networking solutions tailored for telecommunications companies, small and medium-sized enterprises, and digital homes across various regions including the United States and France. With a market capitalization of NT$15.49 billion, Zyxel Group focuses on providing innovative products to enhance connectivity in both business and residential settings globally.

Zyxel Group's recent financial performance highlights challenges, with a significant drop in sales to TWD 18.47 billion from TWD 22.95 billion year-over-year and a drastic decline in net income from TWD 1.06 billion to just TWD 61.77 million. Despite these setbacks, the company is positioned for recovery with projected revenue growth at an annual rate of 11.4% and earnings expected to surge by approximately 119.3% per year, outpacing the broader Taiwanese market's projections significantly. This optimistic outlook is tempered by current volatility in its share price and a recent shift from profitability to losses, underscoring the need for strategic adjustments moving forward.

- Get an in-depth perspective on Zyxel Group's performance by reading our health report here.

Assess Zyxel Group's past performance with our detailed historical performance reports.

Key Takeaways

- Explore the 1269 names from our High Growth Tech and AI Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A035900

JYP Entertainment

Operates as an entertainment company in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives