- China

- /

- Electronic Equipment and Components

- /

- SHSE:688188

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate the early days of President Trump's administration, U.S. stocks are reaching new highs, buoyed by optimism around potential tariff relaxations and enthusiasm for artificial intelligence investments. In this environment, high-growth tech stocks that demonstrate strong innovation and adaptability to emerging technologies may capture investor attention as they align with current market trends and economic developments.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1224 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

CJ CGV (KOSE:A079160)

Simply Wall St Growth Rating: ★★★★☆☆

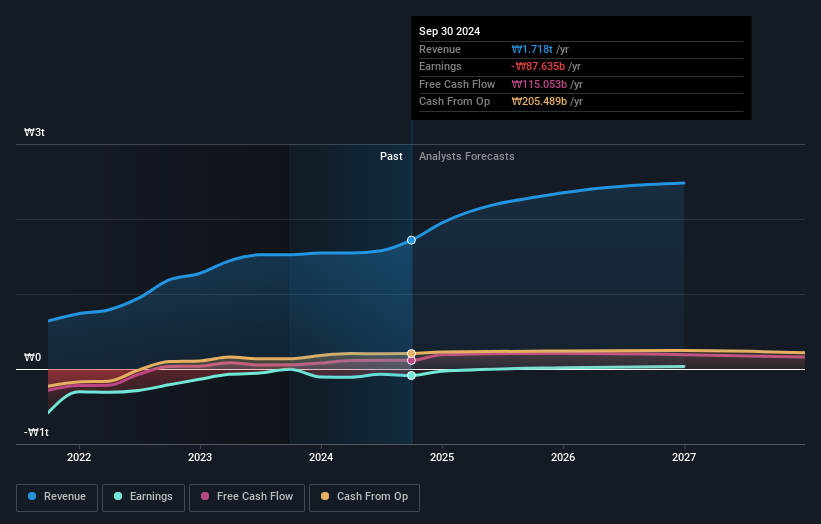

Overview: CJ CGV Co., Ltd. operates theaters under the CJ CGV brand in South Korea and has a market capitalization of approximately ₩844.46 billion.

Operations: CJ CGV generates revenue primarily from its multiplex operations, amounting to approximately ₩1.48 trillion, and also earns from technology special formats and equipment sales totaling around ₩108.28 billion. The company's financials include segment adjustments of ₩249.13 million and consolidation adjustments of -₩118.72 million, impacting overall figures.

CJ CGV, navigating through a challenging phase, reported a significant dip in quarterly earnings with net income plunging to KRW 4.2 billion from KRW 19.4 billion year-over-year, alongside a sales decrease to KRW 296.9 billion. Despite these setbacks, the company is poised for recovery with an expected revenue growth of 15.4% annually and an impressive forecast of earnings growth at 120.7% per year. This potential turnaround is underpinned by CJ CGV's strategic focus on enhancing viewer experiences and expanding its market presence, which could redefine its trajectory in the entertainment industry.

- Delve into the full analysis health report here for a deeper understanding of CJ CGV.

Gain insights into CJ CGV's past trends and performance with our Past report.

Shanghai BOCHU Electronic Technology (SHSE:688188)

Simply Wall St Growth Rating: ★★★★★★

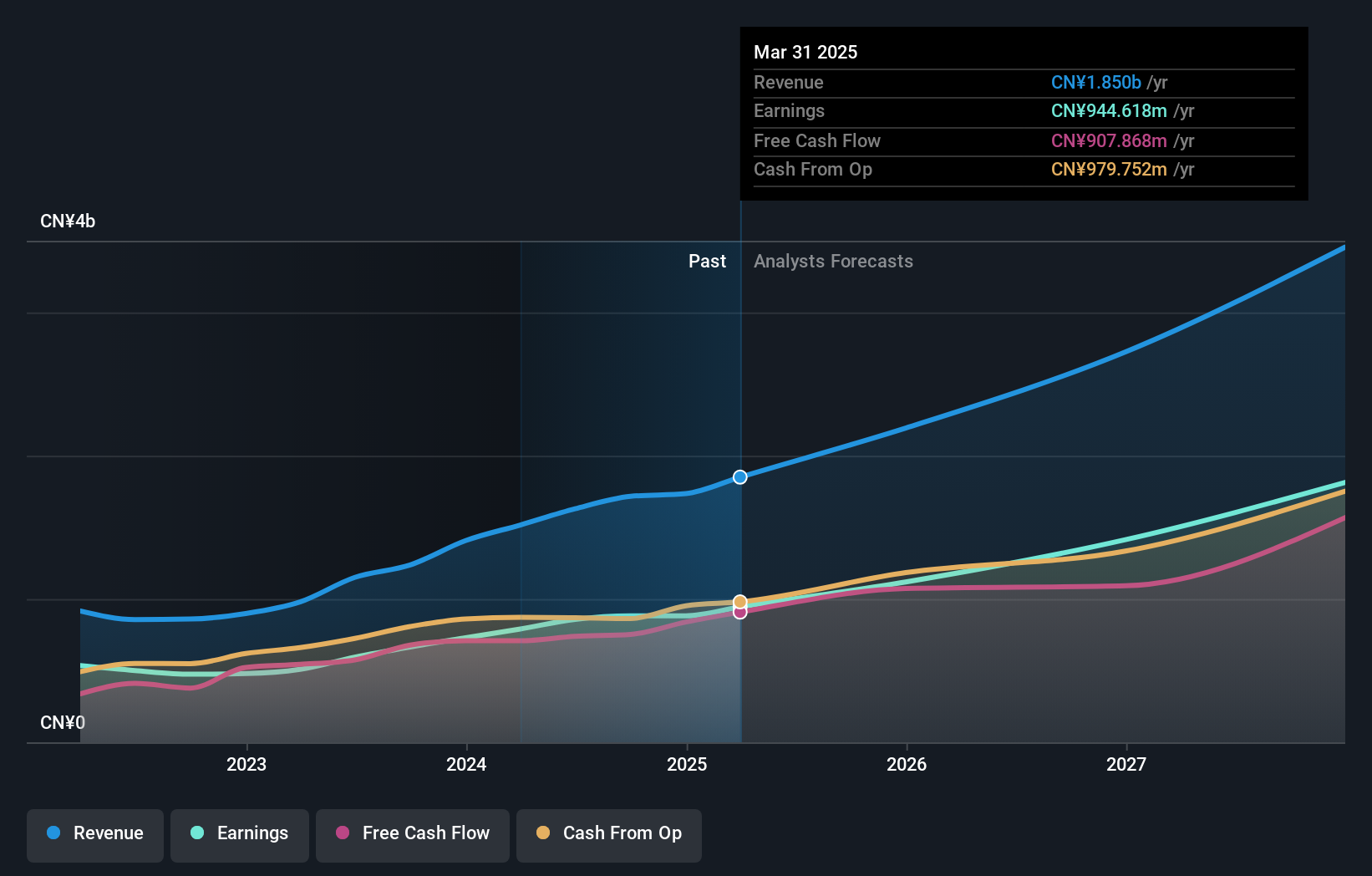

Overview: Shanghai BOCHU Electronic Technology Corporation Limited operates in the electronic technology sector and has a market capitalization of CN¥40.91 billion.

Operations: Shanghai BOCHU Electronic Technology focuses on the electronic technology sector, generating revenue primarily through its diverse range of electronic products and solutions. The company emphasizes cost efficiency in its operations, contributing to a notable gross profit margin trend.

Shanghai BOCHU Electronic Technology has been outpacing its sector, with earnings surging by 32.7% over the past year, significantly above the electronic industry's growth of 2.3%. This robust performance is set to continue, with projected annual revenue and earnings growth rates at 28.1% and 29.8%, respectively, both well ahead of broader market expectations. The company's commitment to innovation is evident from its R&D investments which are crucial for sustaining long-term competitiveness in the fast-evolving tech landscape. With a forecasted high return on equity of 22.2% in three years, Shanghai BOCHU is not just keeping pace but setting benchmarks within its industry.

Digiwin (SZSE:300378)

Simply Wall St Growth Rating: ★★★★☆☆

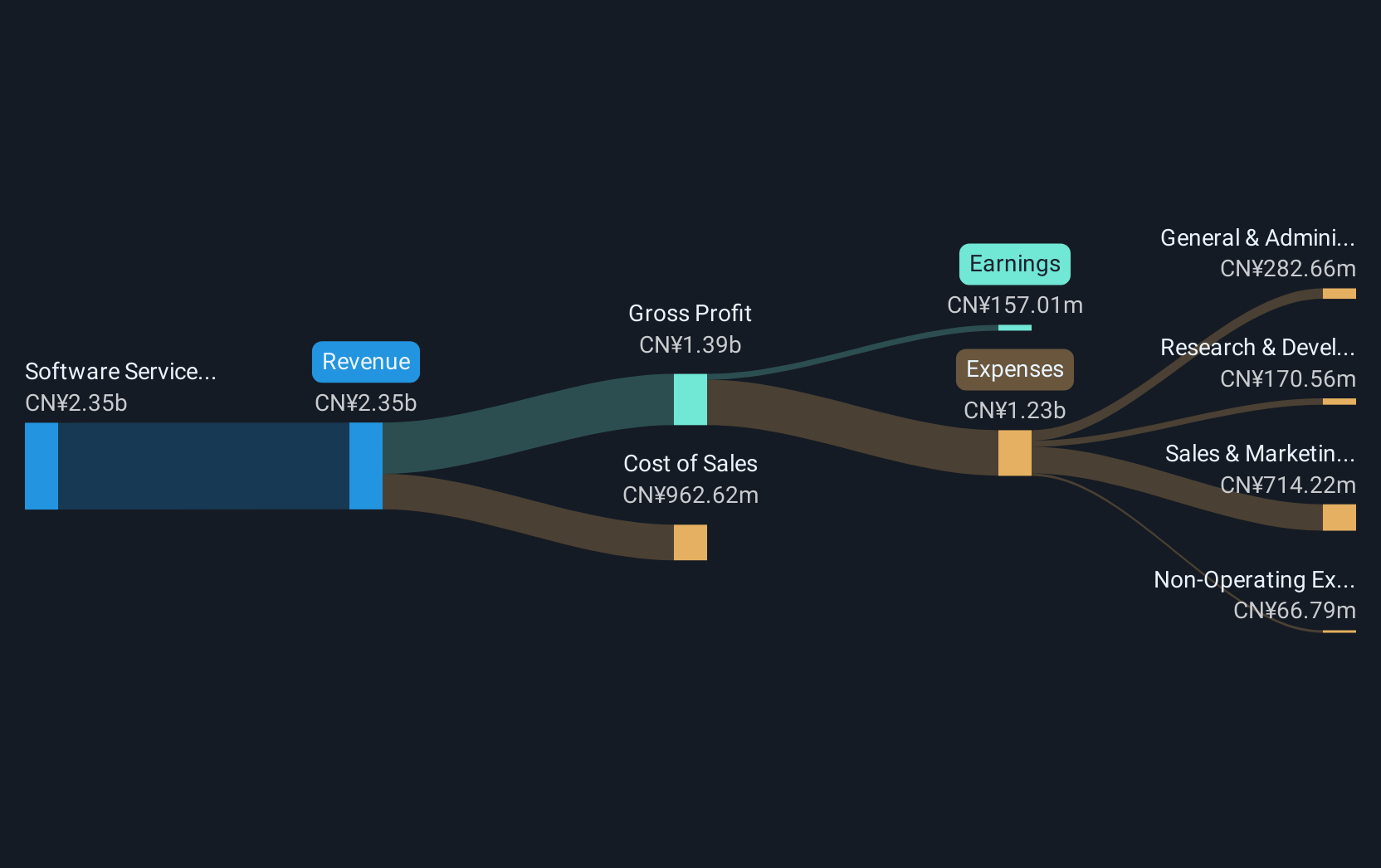

Overview: Digiwin Co., Ltd. offers industry-specific software solutions both in Mainland China and internationally, with a market cap of CN¥8.88 billion.

Operations: Digiwin Co., Ltd. generates revenue primarily from its software services segment, which accounts for CN¥2.39 billion.

Digiwin, a player in the high-growth tech sector, has shown notable performance with its earnings growth of 12.1% over the past year, outpacing the software industry's decline of 11.2%. This momentum is underpinned by a robust annual revenue forecast of 16.8%, which surpasses the Chinese market average growth rate of 13.3%. Moreover, Digiwin's commitment to innovation is reflected in its R&D expenditures, crucial for maintaining competitive edge; however, it faces challenges with a projected low return on equity (ROE) of just 9.5% in three years' time. While navigating market volatility and enhancing shareholder value through strategic investments could bolster future prospects, careful navigation will be essential given these mixed financial indicators.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1224 High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688188

Shanghai BOCHU Electronic Technology

Shanghai BOCHU Electronic Technology Corporation Limited.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives