- China

- /

- Communications

- /

- SZSE:002465

Exploring 3 High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and shifting economic indicators, smaller-cap indexes have shown resilience despite lagging behind larger counterparts. In such a dynamic environment, identifying high-growth tech stocks in Asia requires a keen understanding of market trends and the ability to pinpoint companies with strong fundamentals and innovative potential that can thrive amid evolving conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.68% | 30.37% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Auras Technology | 21.79% | 25.47% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

NCSOFT (KOSE:A036570)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCSOFT Corporation is a global developer and publisher of online games with a market capitalization of ₩3.35 trillion.

Operations: The company generates revenue primarily from online games and game services, amounting to approximately ₩1.54 trillion.

Despite a challenging year with earnings declining by 51.9%, NCSOFT's outlook appears promising with an expected annual earnings growth of 31%. This growth rate notably surpasses the broader Korean market's forecast of 21%. The company, which recently reported a dip in quarterly sales from KRW 397.91 billion to KRW 360.28 billion, also faces shrinking profit margins, now at 4.9% compared to last year's 9.2%. However, its commitment to innovation is evident from substantial R&D investments and a strategic presence at major industry conferences, suggesting resilience and adaptability in its operations. With revenue growth projected at a steady rate of 10.5% annually—faster than the market average—NCSOFT is positioning itself for recovery and sustained growth in the competitive tech landscape of Asia.

- Delve into the full analysis health report here for a deeper understanding of NCSOFT.

Understand NCSOFT's track record by examining our Past report.

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. specializes in producing and distributing quantum information technology-based security products and services for the information and communication technology sector in China, with a market cap of CN¥27.38 billion.

Operations: The company focuses on the development and sale of quantum information technology solutions tailored for security in the ICT sector within China. Its operations generate revenue primarily through these specialized products and services, with a market capitalization of CN¥27.38 billion.

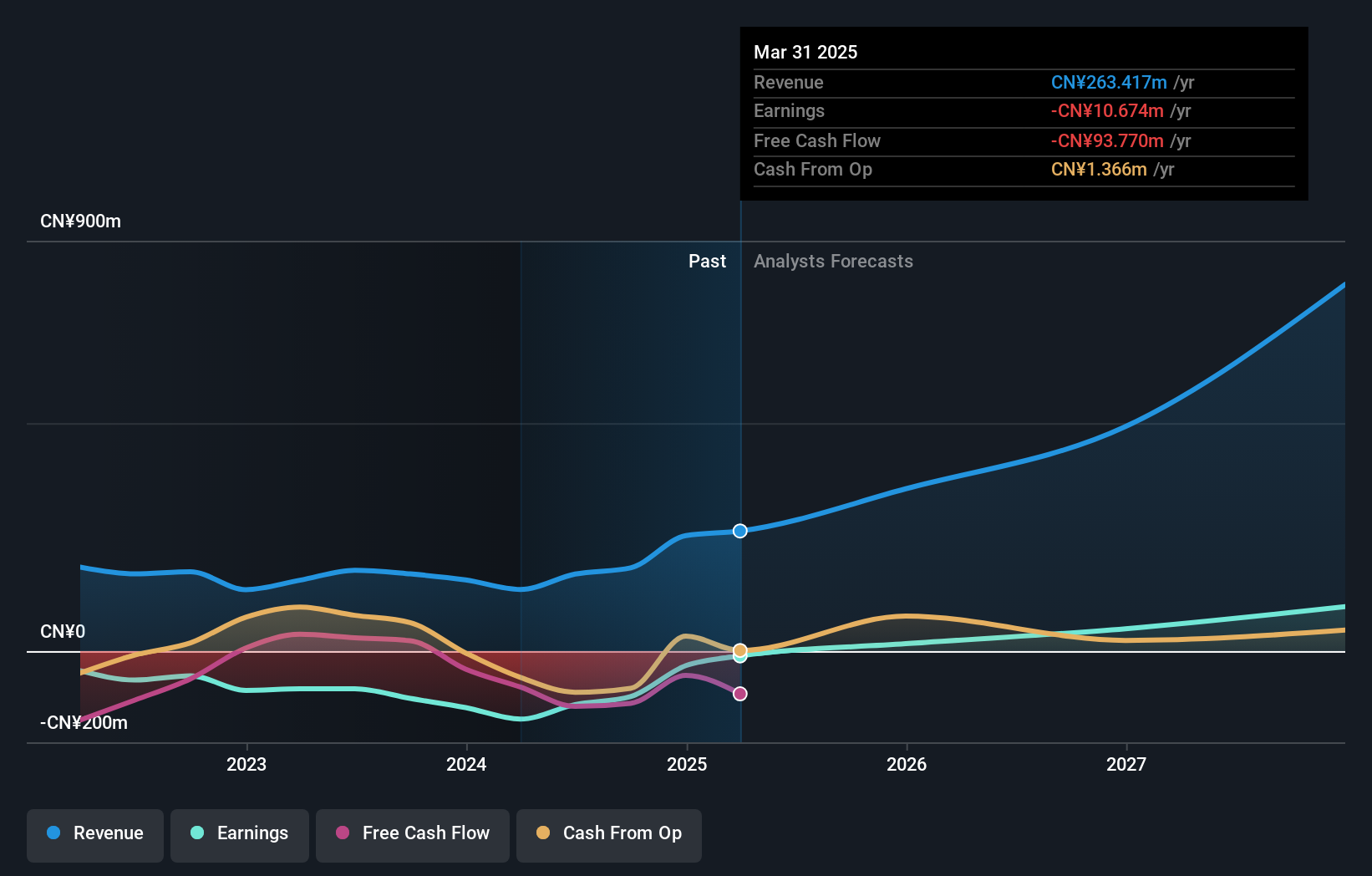

QuantumCTek, amidst a robust Asian tech sector, showcases an impressive revenue surge of 40.1% annually, outpacing the CN market's growth rate of 12.4%. Despite current unprofitability, the company is on a trajectory to profitability within three years with an anticipated earnings increase of 89.36% per year. This growth is supported by significant R&D investment, aligning with industry trends towards enhanced security solutions in digital communications—a sector where QuantumCTek is gaining notable traction. Recent events like their extraordinary shareholders meeting and positive Q1 earnings report underline their proactive approach in navigating market challenges and capitalizing on emerging tech opportunities.

- Dive into the specifics of QuantumCTek here with our thorough health report.

Assess QuantumCTek's past performance with our detailed historical performance reports.

Guangzhou Haige Communications Group (SZSE:002465)

Simply Wall St Growth Rating: ★★★★★☆

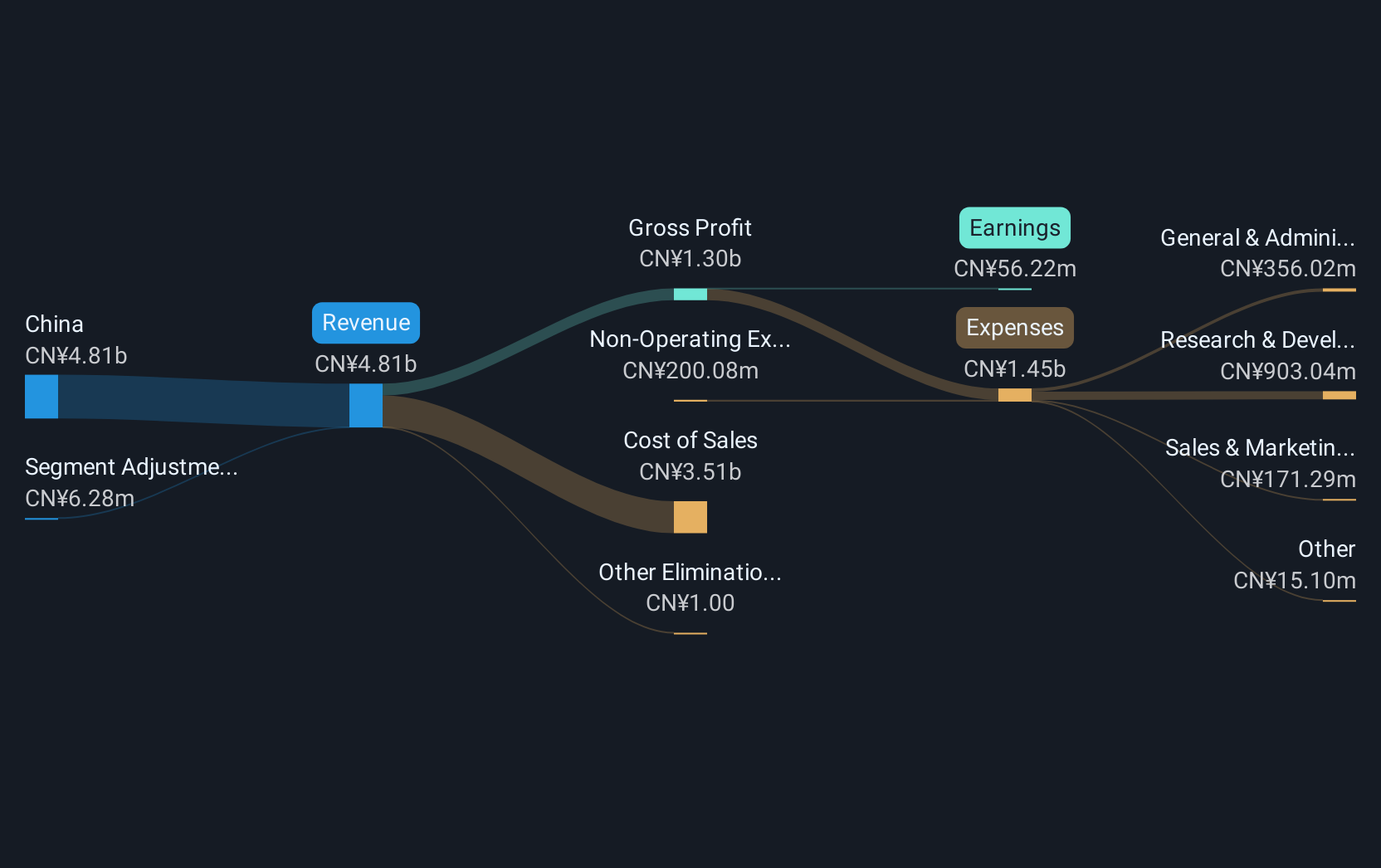

Overview: Guangzhou Haige Communications Group Incorporated Company operates in wireless communications, Beidou navigation, aerospace, and digital intelligence ecology sectors in China with a market capitalization of approximately CN¥32.98 billion.

Operations: The company generates revenue through its operations in wireless communications, Beidou navigation, aerospace, and digital intelligence ecology sectors within China. It has a market capitalization of approximately CN¥32.98 billion.

Guangzhou Haige Communications Group, amid a challenging market, reported a substantial revenue dip to CNY 4.92 billion from CNY 6.45 billion year-over-year, reflecting intensified competition and market saturation in the communications sector. Despite this downturn, the company's commitment to innovation is evident with its recent share repurchase plan aimed at boosting shareholder value and investing in equity incentives for employees. This strategic move underscores their adaptation strategy, focusing on long-term growth through internal reinvestment and talent retention amidst a forecasted significant earnings growth of 59.1% annually.

Summing It All Up

- Access the full spectrum of 488 Asian High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002465

Guangzhou Haige Communications Group

Engages in the wireless communications, Beidou navigation, aerospace, and digital intelligence ecology businesses in China.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.