3 Asian Stocks Estimated To Be Up To 41.2% Below Their Intrinsic Value

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a cautious optimism that could influence investment opportunities in the region. In this environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential market corrections or shifts, as these stocks may offer significant upside if their intrinsic values are realized amidst improving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥74.29 | CN¥144.77 | 48.7% |

| BYD Electronic (International) (SEHK:285) | HK$31.80 | HK$63.03 | 49.5% |

| Alexander Marine (TWSE:8478) | NT$142.50 | NT$280.32 | 49.2% |

| Zhende Medical (SHSE:603301) | CN¥19.33 | CN¥37.64 | 48.6% |

| Members (TSE:2130) | ¥1137.00 | ¥2211.77 | 48.6% |

| Rakus (TSE:3923) | ¥2194.50 | ¥4296.95 | 48.9% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.51 | CN¥20.78 | 49.4% |

| BalnibarbiLtd (TSE:3418) | ¥1152.00 | ¥2223.40 | 48.2% |

| Swire Properties (SEHK:1972) | HK$16.82 | HK$32.75 | 48.6% |

| Yuhan (KOSE:A000100) | ₩113000.00 | ₩219128.89 | 48.4% |

Let's review some notable picks from our screened stocks.

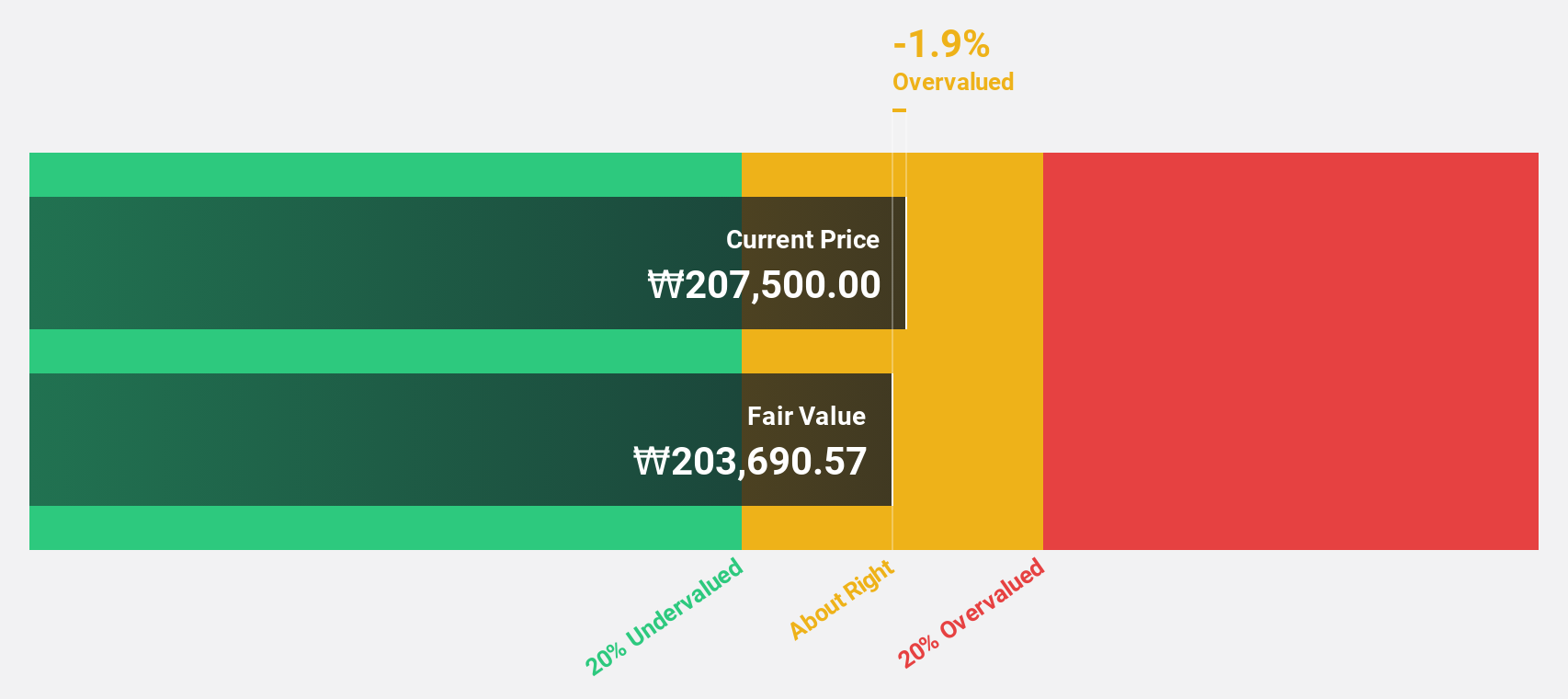

NCSOFT (KOSE:A036570)

Overview: NCSOFT Corporation develops and publishes online games worldwide, with a market cap of ₩2.86 trillion.

Operations: The company generates revenue of ₩1.58 trillion from its online games and game services segment.

Estimated Discount To Fair Value: 41.2%

NCSOFT is trading at ₩150,700, significantly below its estimated fair value of ₩256,089.25, suggesting it may be undervalued based on cash flows. Despite a challenging year with declining sales and net income from KRW 1.78 trillion to KRW 1.58 trillion and KRW 212 billion to KRW 94 billion respectively, earnings are forecasted to grow significantly at 24.86% annually over the next three years, outpacing the Korean market's growth rate of 21.5%.

- According our earnings growth report, there's an indication that NCSOFT might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of NCSOFT.

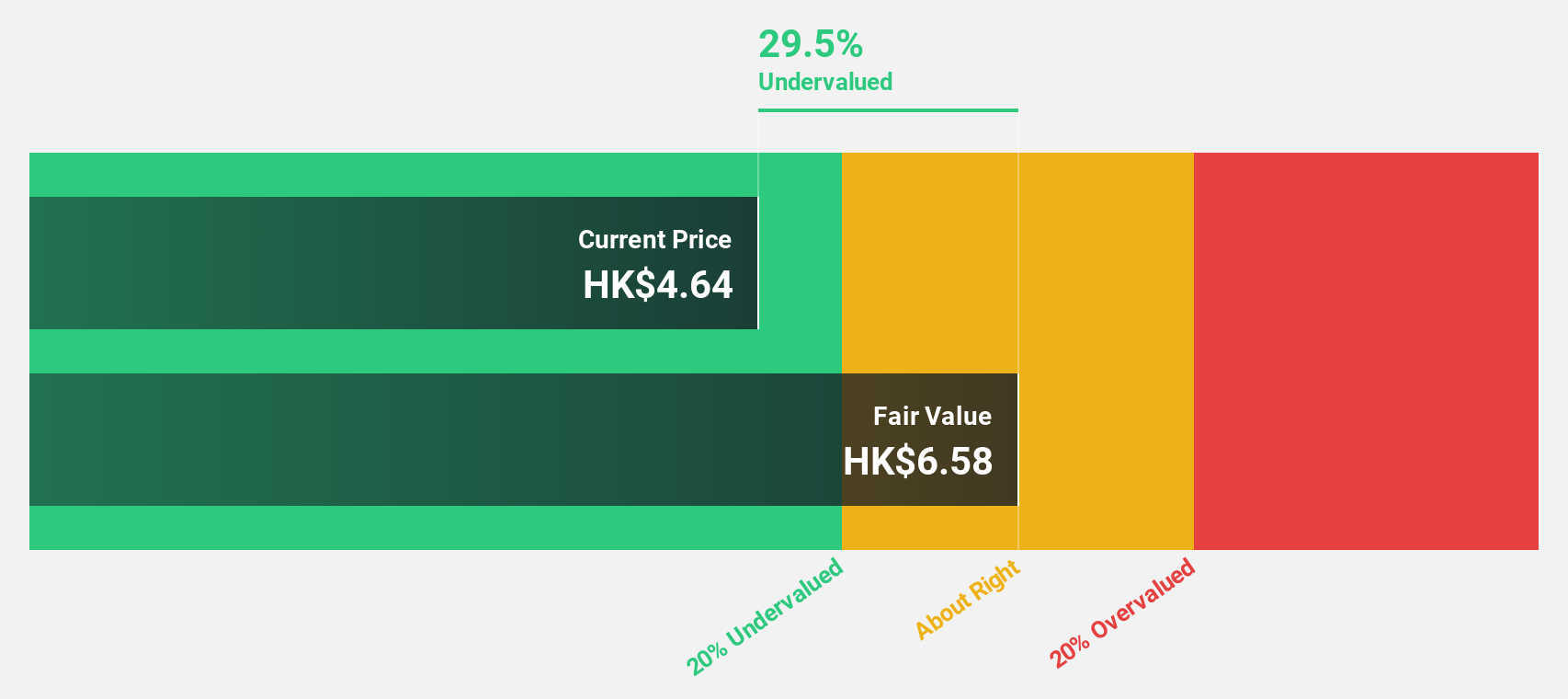

Bosideng International Holdings (SEHK:3998)

Overview: Bosideng International Holdings Limited operates in the apparel industry in the People’s Republic of China with a market cap of HK$47.05 billion.

Operations: The company's revenue segments include Down Apparels at CN¥20.66 billion, Ladieswear Apparels at CN¥735.22 million, Diversified Apparels at CN¥254.12 million, and Original Equipment Manufacturing (OEM) Management at CN¥2.97 billion.

Estimated Discount To Fair Value: 30.6%

Bosideng International Holdings is trading at HK$4.11, well below its estimated fair value of HK$5.92, indicating potential undervaluation based on cash flows. Despite an unstable dividend history, the company's earnings are projected to grow at 13.21% annually, surpassing the Hong Kong market's growth rate of 10.6%. Recent shareholder meetings focused on future transaction renewals and annual caps could impact strategic directions and financial outlooks positively in the long term.

- Our earnings growth report unveils the potential for significant increases in Bosideng International Holdings' future results.

- Get an in-depth perspective on Bosideng International Holdings' balance sheet by reading our health report here.

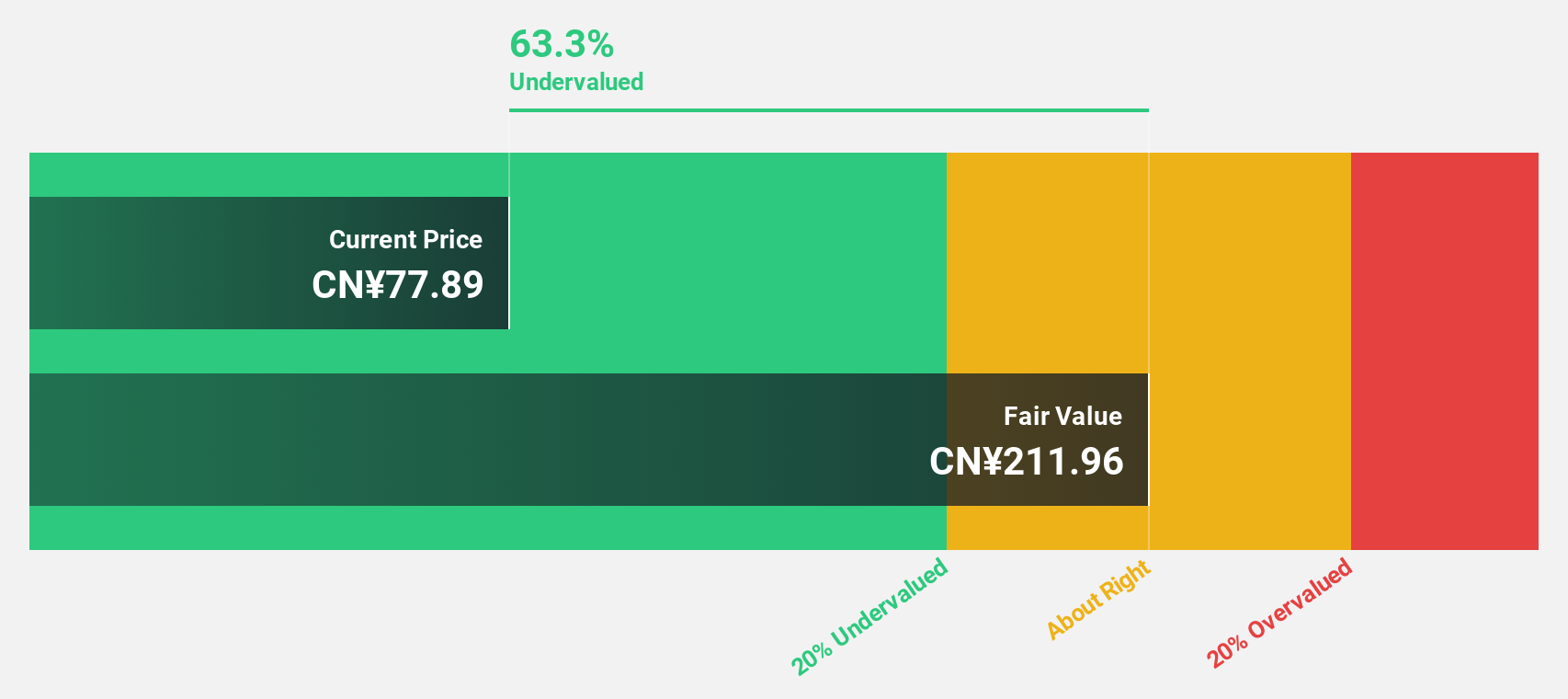

YanKer shop FoodLtd (SZSE:002847)

Overview: YanKer shop Food Co., Ltd is involved in the research, development, production, and sale of leisure food products both in China and internationally, with a market cap of CN¥24.24 billion.

Operations: YanKer shop Food Co., Ltd generates revenue through its core activities of researching, developing, producing, and selling leisure food products domestically and abroad.

Estimated Discount To Fair Value: 10.1%

YanKer shop Food Ltd is trading at CNY 88.88, slightly below its estimated fair value of CNY 98.9, suggesting potential undervaluation based on cash flows. The company reported significant earnings growth of 18.9% last year and forecasts a further increase of 22.69% annually over the next three years, although this lags behind the Chinese market's average growth rate. Recent earnings reports show robust revenue increases, yet dividends remain inadequately supported by free cash flows.

- The growth report we've compiled suggests that YanKer shop FoodLtd's future prospects could be on the up.

- Dive into the specifics of YanKer shop FoodLtd here with our thorough financial health report.

Taking Advantage

- Investigate our full lineup of 263 Undervalued Asian Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade YanKer shop FoodLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002847

YanKer shop FoodLtd

Researches and develops, produces, and sells leisure food products in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives