- South Korea

- /

- Interactive Media and Services

- /

- KOSDAQ:A376300

High Growth Tech Stocks In Asia To Watch December 2025

Reviewed by Simply Wall St

As global markets experience fluctuations, with small-cap stocks outperforming their larger counterparts and technology indices rebounding from recent sell-offs, the Asian tech sector is drawing significant attention from investors. In this dynamic environment, identifying high-growth tech stocks requires a keen understanding of market trends and economic indicators that can impact performance, such as consumer spending patterns and inflation rates.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

DEAR U (KOSDAQ:A376300)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DEAR U Co., LTD. is a communication platform company operating in South Korea and internationally, with a market cap of ₩773.87 billion.

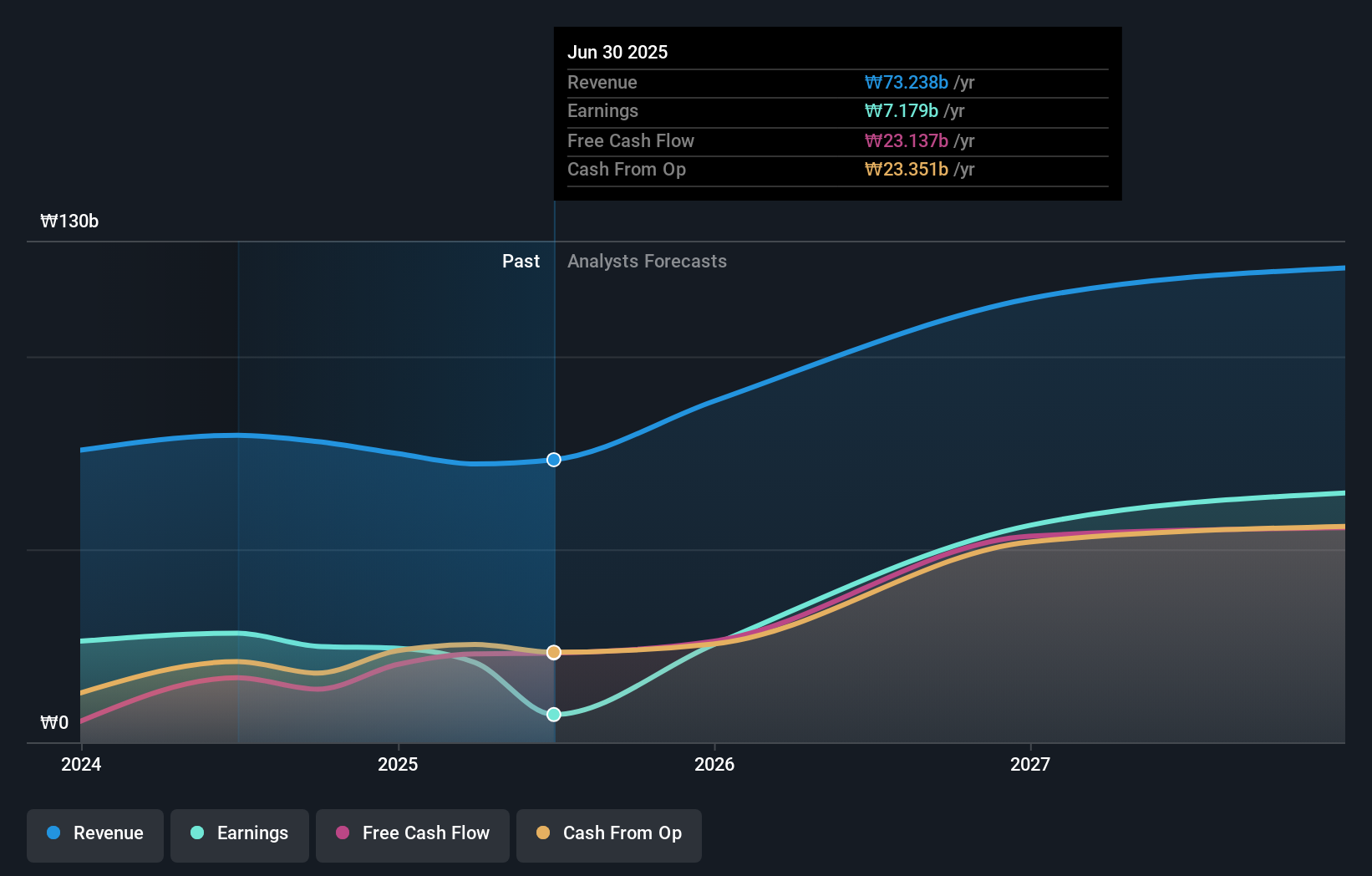

Operations: The company generates revenue primarily through its Bubble platform, with reported earnings of ₩77.80 billion.

DEAR U, a player in the Interactive Media and Services sector, is navigating a challenging landscape with its earnings having dipped by 44.5% over the past year, contrasting sharply with an industry average growth of 17.8%. Despite this downturn, forecasts are robust with expected revenue growth at 16.7% annually, outpacing the broader KR market's 10.4%. The company's commitment to innovation is evident from its R&D investments which have strategically focused on enhancing product offerings and expanding market reach. Looking ahead, DEAR U’s projected annual earnings growth of 55.2% signals a promising rebound, supported by a solid profit margin recovery plan aiming to surpass last year's high of 31.9%.

- Unlock comprehensive insights into our analysis of DEAR U stock in this health report.

Explore historical data to track DEAR U's performance over time in our Past section.

Queclink Wireless Solutions (SZSE:300590)

Simply Wall St Growth Rating: ★★★★☆☆

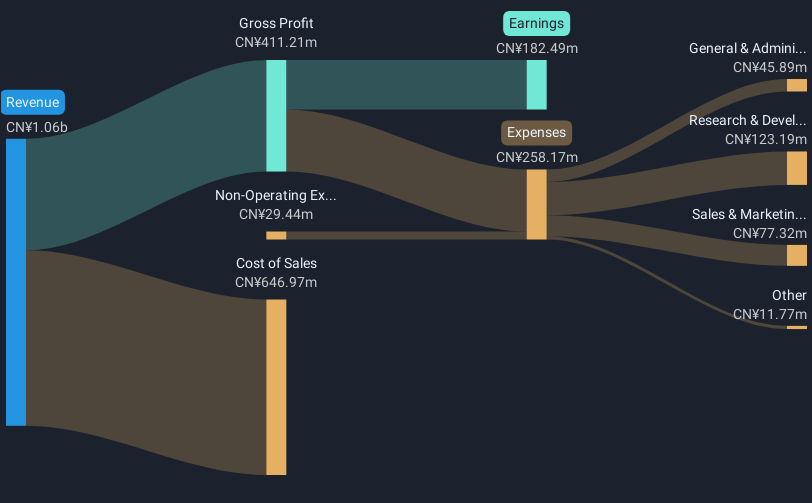

Overview: Queclink Wireless Solutions Co., Ltd. is engaged in the research, development, manufacturing, and sale of wireless IoT equipment and solutions both in China and globally, with a market cap of CN¥5.64 billion.

Operations: Queclink focuses on the development and sale of wireless IoT equipment and solutions, serving both domestic and international markets. The company operates through various revenue streams tied to its IoT product offerings.

Queclink Wireless Solutions, despite a challenging year with a net income drop to CNY 61.63 million from CNY 133.94 million, continues to innovate in the tech industry. The company's R&D dedication is reflected in its substantial investment, aligning with an aggressive growth strategy marked by a projected annual earnings increase of 42.1%. This strategic focus on innovation could drive future performance, especially as it adapts to market demands and technological advancements within Asia’s competitive tech landscape.

Digital Arts (TSE:2326)

Simply Wall St Growth Rating: ★★★★★★

Overview: Digital Arts Inc. is a company that develops and markets internet security software and appliances across Japan, the United States, Europe, and the Asia Pacific with a market capitalization of ¥93.85 billion.

Operations: The primary revenue stream for Digital Arts Inc. is its Security Business, generating ¥10.14 billion. The company operates in the internet security sector across multiple regions including Japan, the United States, Europe, and the Asia Pacific.

Digital Arts is distinguishing itself in the high-growth tech sector in Asia, notably through its strategic R&D investments which have consistently aligned with its robust annual revenue growth of 21.2%. The company's recent share repurchase program, where it bought back shares worth ¥482.55 million, underscores a commitment to shareholder value and capital efficiency. Moreover, Digital Arts' focus on cloud services as part of the GIGA School Concept projects underpins future growth prospects by expanding its sustainable revenue base, despite a recent earnings revision due to prorated sales recognition practices in cloud products. This approach not only reflects adaptability but also positions the company well for leveraging emerging tech trends within Asia’s dynamic market landscape.

- Click here and access our complete health analysis report to understand the dynamics of Digital Arts.

Understand Digital Arts' track record by examining our Past report.

Key Takeaways

- Click here to access our complete index of 185 Asian High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A376300

DEAR U

Operates as a communication platform company in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026